Macroeconomics homework help. Attached are photos with the multi-choice answers below.

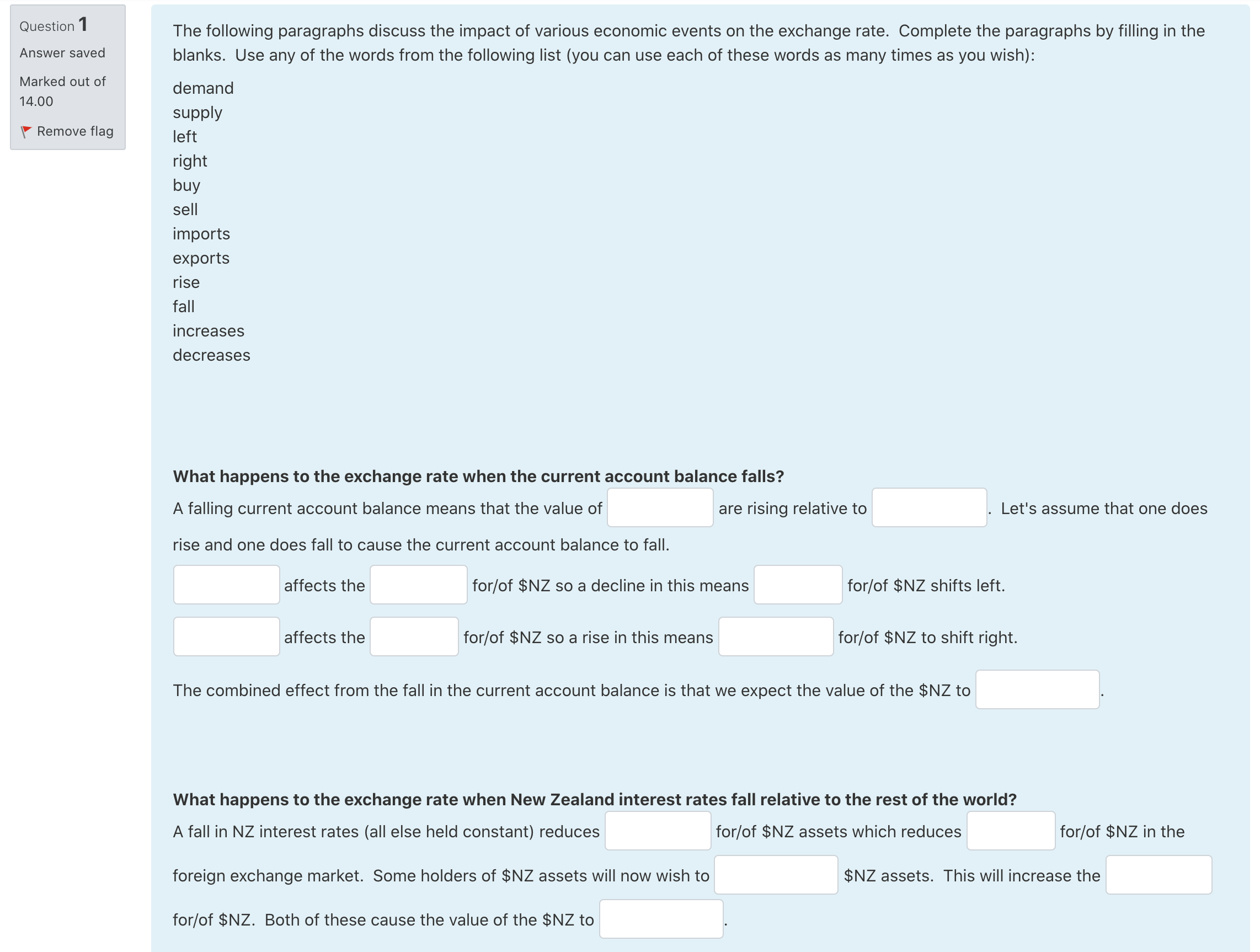

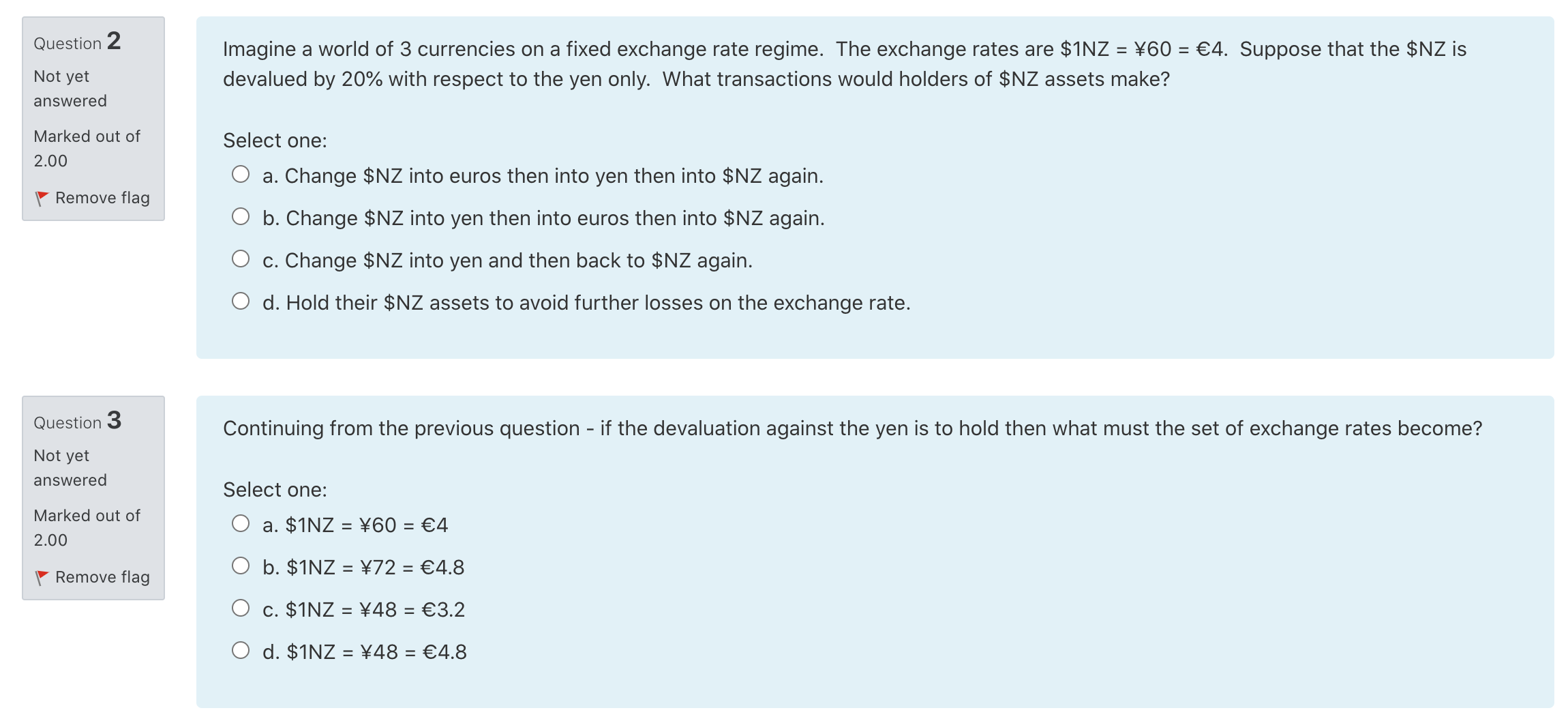

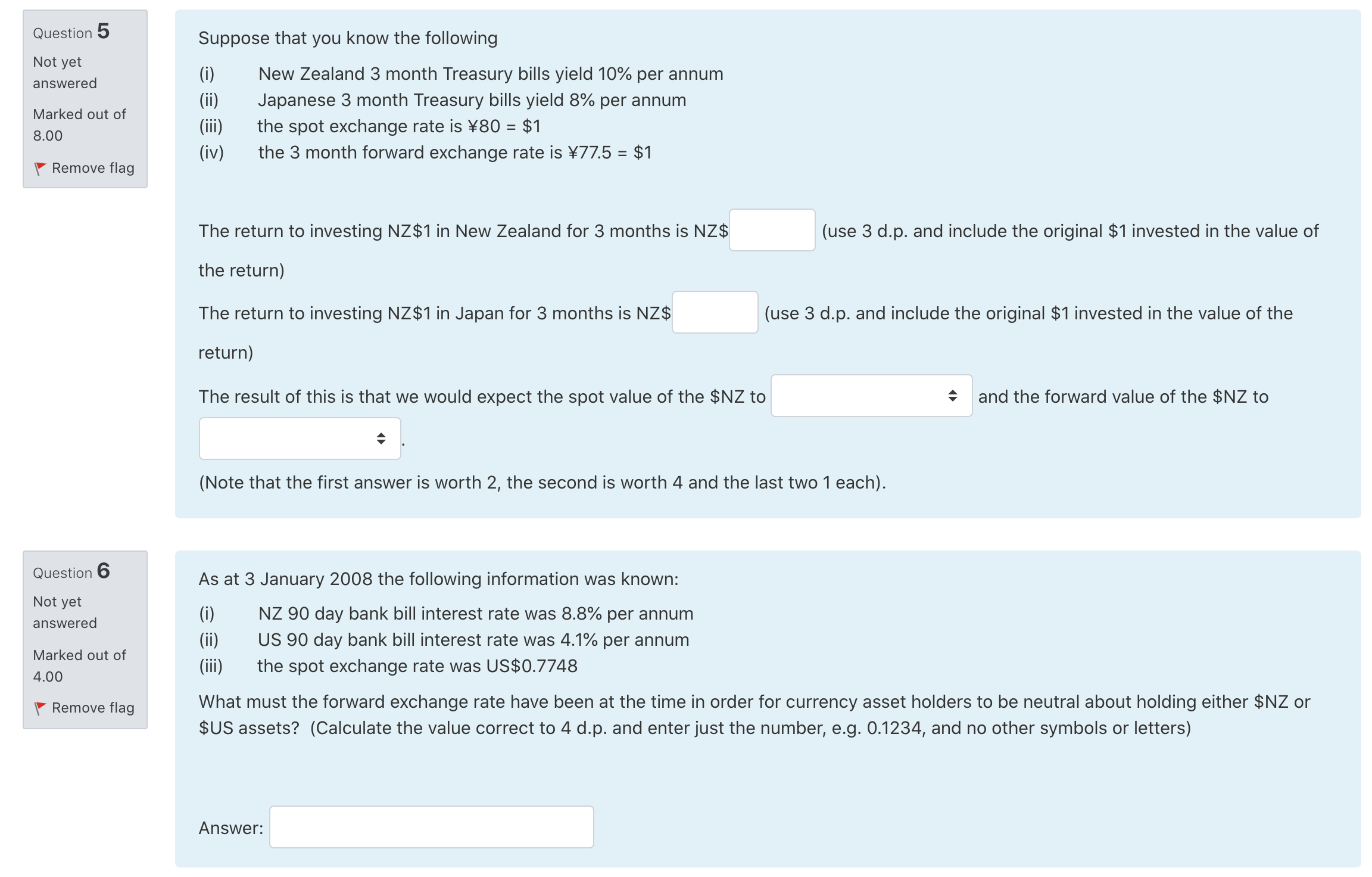

QUESM\" The following paragraphs discuss the impact of various economic events on the exchange rate. Complete the paragraphs by filling in the Answer saved blanks. Use any of the words from the following list (you can use each of these words as many times as you wish): Marked out of 14.00 demand supply V Remove flag left right buy sell imports exports rise fall increases decreases What happens to the exchange rate when the current account balance falls? A falling current account balance means that the value of are rising relative to . Let's assume that one does rise and one does fall to cause the current account balance to fall. affects the for/of $NZ so a decline in this means for/of $NZ shifts left. affects the for/of $NZ so a rise in this means for/of $NZ to shift right. The combined effect from the fall in the current account balance is that we expect the value of the $NZ to What happens to the exchange rate when New Zealand interest rates fall relative to the rest of the world? A fall in NZ interest rates (all else held constant) reduces for/of $NZ assets which reduces for/of $NZ in the foreign exchange market. Some holders of $NZ assets will now wish to $NZ assets. This will increase the for/of $NZ. Both of these cause the value of the $NZ to Question 2 Imagine a world of 3 currencies on a fixed exchange rate regime. The exchange rates are $1NZ = *60 = 4. Suppose that the $NZ is Not yet devalued by 20% with respect to the yen only. What transactions would holders of $NZ assets make? answered Marked out of Select one: 2.00 O a. Change $NZ into euros then into yen then into $NZ again. Remove flag O b. Change $NZ into yen then into euros then into $NZ again. O c. Change $NZ into yen and then back to $NZ again. O d. Hold their $NZ assets to avoid further losses on the exchange rate. Question 3 Continuing from the previous question - if the devaluation against the yen is to hold then what must the set of exchange rates become? Not yet answered Select one: Marked out of 2.00 O a. $1NZ = 460 = E4 Remove flag O b. $1NZ = 472 = E4.8 O c. $1NZ = 148 = E3.2 O d. $1NZ = 148 = E4.8Question 5 Not yet answered Marked out of 8.00 V Remove flag Question 6 Not yet answered Marked out of 4100 Y Remove flag Suppose that you know the following (i) New Zealand 3 month Treasury bills yield 10% per annum (ii) Japanese 3 month Treasury bills yield 8% per annum (iii) the spot exchange rate is 80 = $1 (iv) the 3 month forward exchange rate is 77.5 = $1 The return to investing NZ$1 in New Zealand for 3 months is NZ$ (use 3 d.p. and include the original $1 invested in the value of the return) The return to investing NZ$1 in Japan for 3 months is NZ$ (use 3 clip. and include the original $1 invested in the value of the return) The result of this is that we would expect the spot value of the $NZ to and the forward value of the $NZ to A v (Note that the first answer is worth 2, the second is worth 4 and the last two 1 each). As at 3 January 2008 the following information was known: (i) N2 90 day bank bill interest rate was 8.8% per annum (ii) US 90 day bank bill interest rate was 4.1% per annum (iii) the spot exchange rate was US$0.7748 What must the forward exchange rate have been at the time in order for currency asset holders to be neutral about holding either $NZ or $US assets? (Calculate the value correct to 4 d.p. and enter just the number, e.g. 0.1234, and no other symbols or letters)