Question

Macroeconomics - McConnell Brue Flynn Problems Pg 322 (Picture attached) I'm not good with math and equations, I just want to make sure I am

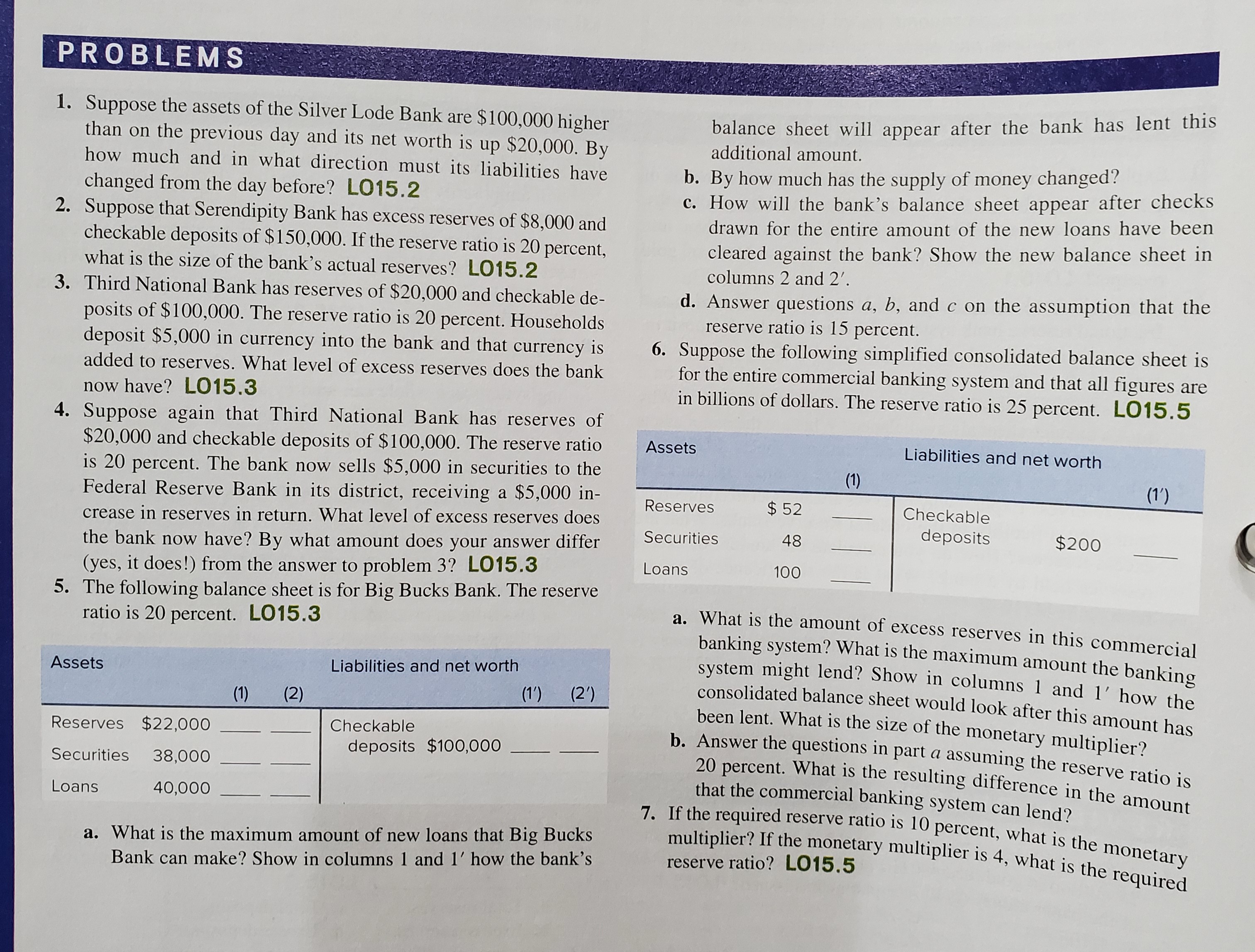

Macroeconomics - McConnell Brue Flynn

Problems Pg 322 (Picture attached)

I'm not good with math and equations, I just want to make sure I am answering these correctly, thank you!

2.

Required reserve20% of $150,000 (checkable deposits)=30,000

Actual Reserve$30,000 + $8,000 (excess reserve)= $38,000

Excess Reserve$38,000 (actual reserve) - $30,000 (required reserve) = $8,000

3.

Checkable deposits = 100,000 + 5,000 = $105,000

Required reserves = 105,000 x 20% = $21,000

Excess reserves = actual reserves - required reserves

= (20,000 + 5,000) -21,000 = 25,000 - 21,000 = $4,000

Excess reserves = 4,000

4.

$20,000 (reserves) + 5,000 (new deposit) = 25,000

No change in checkable deposits due to sale in securities, so required reserves don't change still equaling $20,000.

Excess reserves = actual-required

25,000 - 20,000 = 5,000

The difference between the amount in question three and four is $1,000.

5.

A.

Required reserves = 0.20 x $100,000 = $20,000

Excess reserves = actual reserves - required reserves

$22,000 - $20,000 = $2,000

Loans will increase by $2,000

No change in reserves due to no checks having been drawn against the loan yet or securities.When the bank makes the loan, crediting the borrowers account (checkable deposits)for the amount ofthe loan,checkable deposits increase by $2,000.

B. The money supply has changed by $2,000

C.

Reserves$22,000$22,000$20,000

Securities$38,000$38,000$38,000

Loans$40,000$42,000$42,000

Checkable Deposits$100,000$102,000$100,000

D.

Required reserves = 0.15 $100,000 = $15,000

Excess reserves = actual reserves - required reserves

$22,000 - $15,000 = $7,000

Maximum amount of new loans bank can make $7,000

No change in reserves due to no checks having been drawn against the loan yet or securities. When the bank makes the loan, crediting the borrowers account (checkable deposits)for the amount ofthe loan, checkable deposits increase by $7,000.

Money supply changed by $7,000

Reserves$22,000$22,000$15,000

Securities$38,000$38,000$38,000

Loans$40,000$42,000$42,000

Checkable Deposits$100,000$107,000$100,000

7.

Monetary multiplier =_________1________

Required Reserve Ratio

Required Reserve Ratio is 10% (.1)1=10

.1

If the money multiplier is4,4 = 1

Required Reserve Ratio

Required Reserve Ratio = 1= .25

4

If the monetary multiplier is 4, the required reserve ratio is 25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started