Answered step by step

Verified Expert Solution

Question

1 Approved Answer

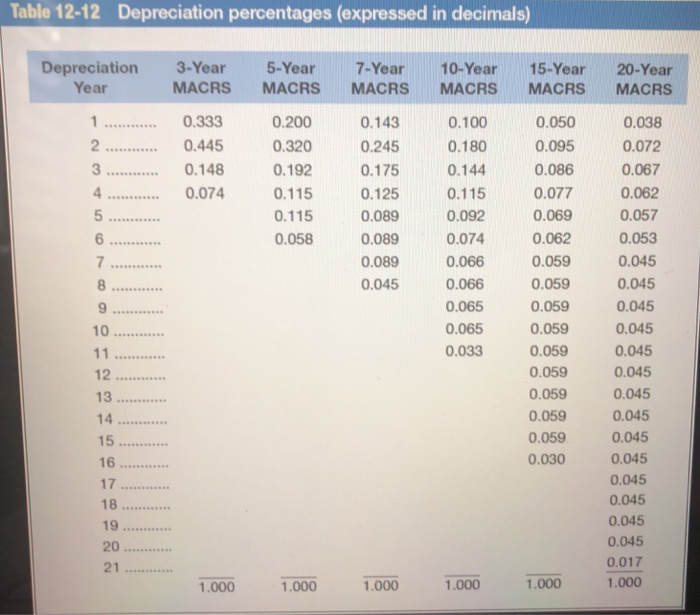

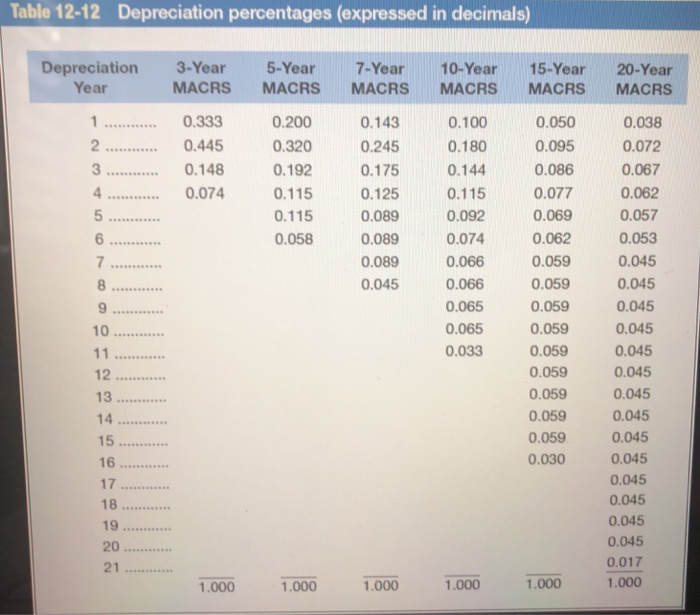

MACRS depreciation and net present value Table 12-12 Depreciation percentages (expressed in decimals) Depreciation Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year MACRS MACRS MACRS MACRS

MACRS depreciation and net present value

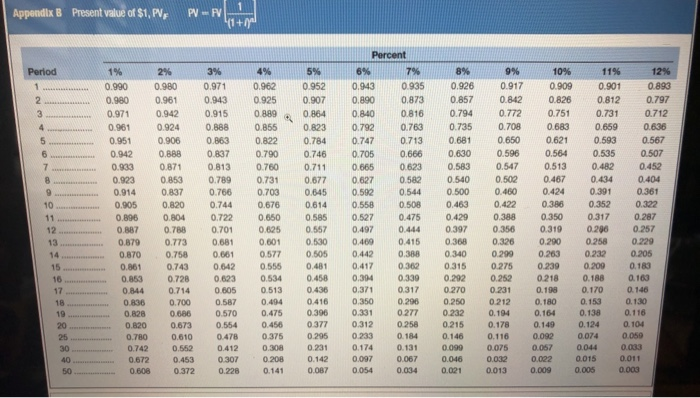

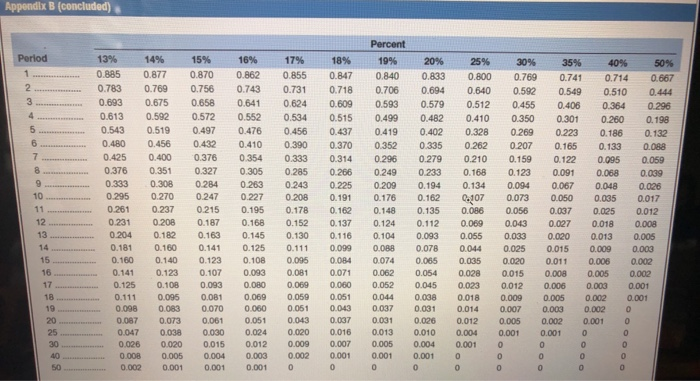

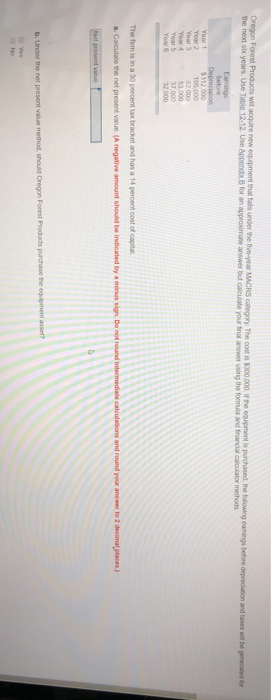

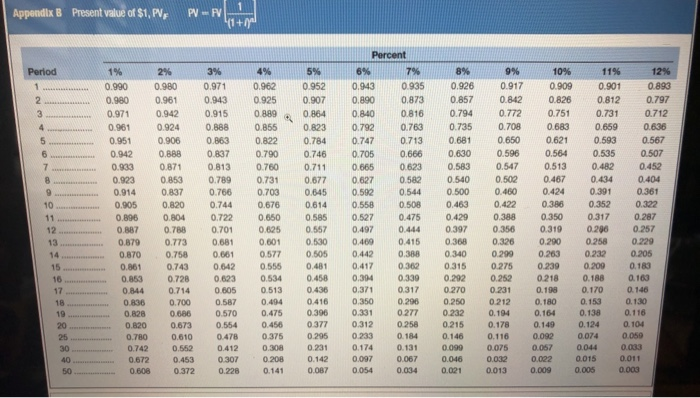

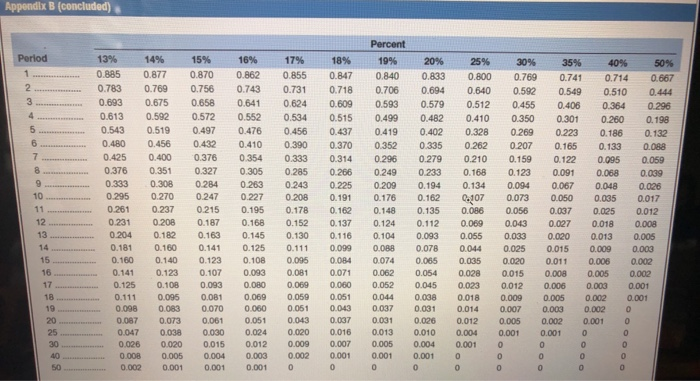

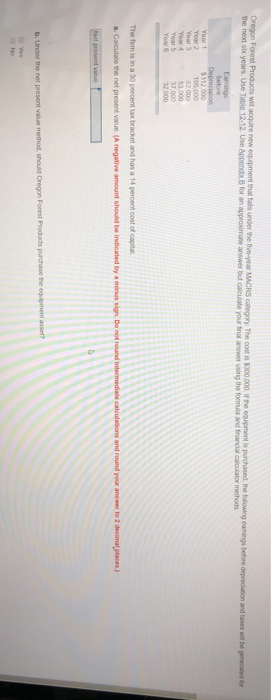

Table 12-12 Depreciation percentages (expressed in decimals) Depreciation Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year MACRS MACRS MACRS MACRS MACRS MACRS 0.333 0.445 0.148 0.074 0.200 0.320 0.192 0.115 0.115 0.058 0.143 0.245 0.175 0.125 0.089 0.089 0.100 0.180 0.144 0.115 0.092 0.074 0.066 0.066 0.065 0.065 0.033 0.089 0.045 0.050 0.095 0.086 0.077 0.069 0.062 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.059 0.030 0.038 0.072 0.067 0.062 0.057 0.053 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.045 0.017 1.000 1.000 1.000 1.000 1.000 1.000 Appendix B Present value of $1, PV, PV - FV Percent 8% 0.94 9. Period 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.93 0.923 0.914 10... 0.905 0.896 O BB7 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 0.780 0.742 40 .................. 0.672 50 ................ 0.608 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 0.478 0.412 0.307 0.228 4% 0.962 0.952 0.925 0.907 0.889 0.864 0.855 0.823 0.822 0.784 0.790 0.746 0.760 0.711 0.731 0.677 0.703 0.645 0.6760.614 0.650 0.585 0.625 0.557 0.601 0.530 0.577 0.505 0.555 0.481 0.534 0.458 0.513 0.436 0.494 0416 0.475 0.396 0.456 0377 0.375 0.295 0.308 0.231 0208 0.142 0.141 0.087 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.233 0.174 0.097 0.054 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.3.8 0.362 0.339 0.317 0.296 0277 0.258 0.184 0.131 0.067 0.034 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.046 0.021 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0212 0.194 0.178 0.116 0.075 0.032 0.013 10% 11% 12% 0.909 0.901 0.893 0.826 0.812 0.797 0.751 0.731 0.712 0.683 0.659 0.636 0.621 0.593 0.567 0.564 0.535 0.507 0.513 0.482 0.452 0.467 0.434 0.404 0.424 0.391 0.361 0.386 0.352 0.322 0.350 0.317 0.287 0.319 0.296 0.257 0.290 0.258 0.229 0.263 0.232 0.205 0.239 0 209 0.183 0218 0.188 0.163 0.108 0.170 0.146 0.180 0.153 0.130 0.164 0.134 0.116 0.149 0.124 0.104 0.092 0.074 0.059 0.057 0.033 0.022 0.015 0.011 0.009 0.005 0.003 30 0044 Appendix B (concluded) Period 0.833 0.694 0.579 0.482 0 8888888 13% 14% 15% 16% 17% 0.885 0.877 0.870 0.862 0.855 0.783 0.769 0.756 0.743 0.731 0.693 0.6750.658 0.641 0.624 0.613 0.592 0.572 0.552 0534 0.543 0.519 0.497 0.476 0.456 0.480 0.456 0.432 0.410 0.390 0.425 0.400 0.376 0.354 0.333 0.376 0.351 0.327 0.305 0.285 0.333 0.308 0.284 0.263 0.243 0.295 0.270 0.247 0.227 0.208 0.261 0.237 0.215 0.195 0.178 0.231 0.208 0.187 0.168 0.152 0.204 0.182 0.163 0.145 0.130 0.181 0.160 0.141 0.125 0.111 0.160 0.140 0.123 0.108 0.095 0.141 0.123 0.107 0.093 0.081 0.125 0.108 0.093 OOO 0069 0.111 0.095 01 0.00 0.059 0.008 0 083 0.07000600051 0.087 0.073 0.061 0.051 0.043 0.047 0.038 0.030 0.024 0.020 0.026 0.020 0,015 0.012 0.009 0.008 0.005 0.004 0.003 0.002 0.002 0.001 0.001 0.001 0 18% 0.847 0.718 0.609 0.515 0.437 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.116 0.099 0.084 0.071 0.060 0.051 0.043 0.037 0.016 0 .007 0.001 Percent 19% 0.840 0.706 0.593 0.499 0.419 0.352 0.296 0.249 0.209 0.176 0.148 0.124 0.104 0.088 0.074 0.062 0,052 0.044 0.037 0.031 0.013 0.005 0.001 0 0.335 0.279 .233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.008 0.031 0.026 0.010 0.004 0.001 0 0.800 0.640 0.512 0.410 0.328 0.262 0.210 0.168 0.134 0.107 0.086 0.069 0.055 0.044 0.035 0.028 .023 0.018 0.014 0.012 0,004 0.001 0 0 30% 35% 40% 50% 0.769 0.741 0.714 0.667 0.5920.549 0.510 0.444 0.455 0.406 0.364 0.296 0.350 0.30 0.250 0.198 0.269 0.223 0.186 0.132 0.207 0.165 0.133 0.088 0.159 0.122 0.095 0.059 0.123 0.091 0.068 0.039 0.094 0.067 0.048 0.026 0.073 0.050 0.035 0.017 0.056 0.037 0.025 0.012 0.043 0.027 0.027 0.018 0.008 0.033 0.020 0.013 0.005 0.025 0.015 0.0090.000 0.020 0.0110.000 0.002 0.015 0.008 0.005 0.002 0.012 0.006 0.003 0.001 0.009 0 .005 0.002 0.001 0.007 0.003 0.002 0.005 0.002 0.001 0 0.001 0.001 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Oregon Forest Products will acquire new equipment that als under the fiveyear MACRS category. The cost is $300.000 e u ment is purchased the following earrings before depredanon and faces will be generated for the next six years. Use Table 12.12. Use open for an approximane answer but calculate your finalwwer using the formula and financial calculator methods Engs The Timis in a 30 percentax bracket and has a 14 percent cost of capital a. Calculate the net present value. A negative a nd shoubenced try Donotron intermediate calculations and b. Under the represent value method thoud Oregon Forest Products purchase thee

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started