MACRS Excel Exercise Steed and Peel, Ltd. (S&P) is a new concept upscale Sandwich Shoppe (deli) in the North Scottsdale/Carefree area.1 In early 2021, the

MACRS Excel Exercise

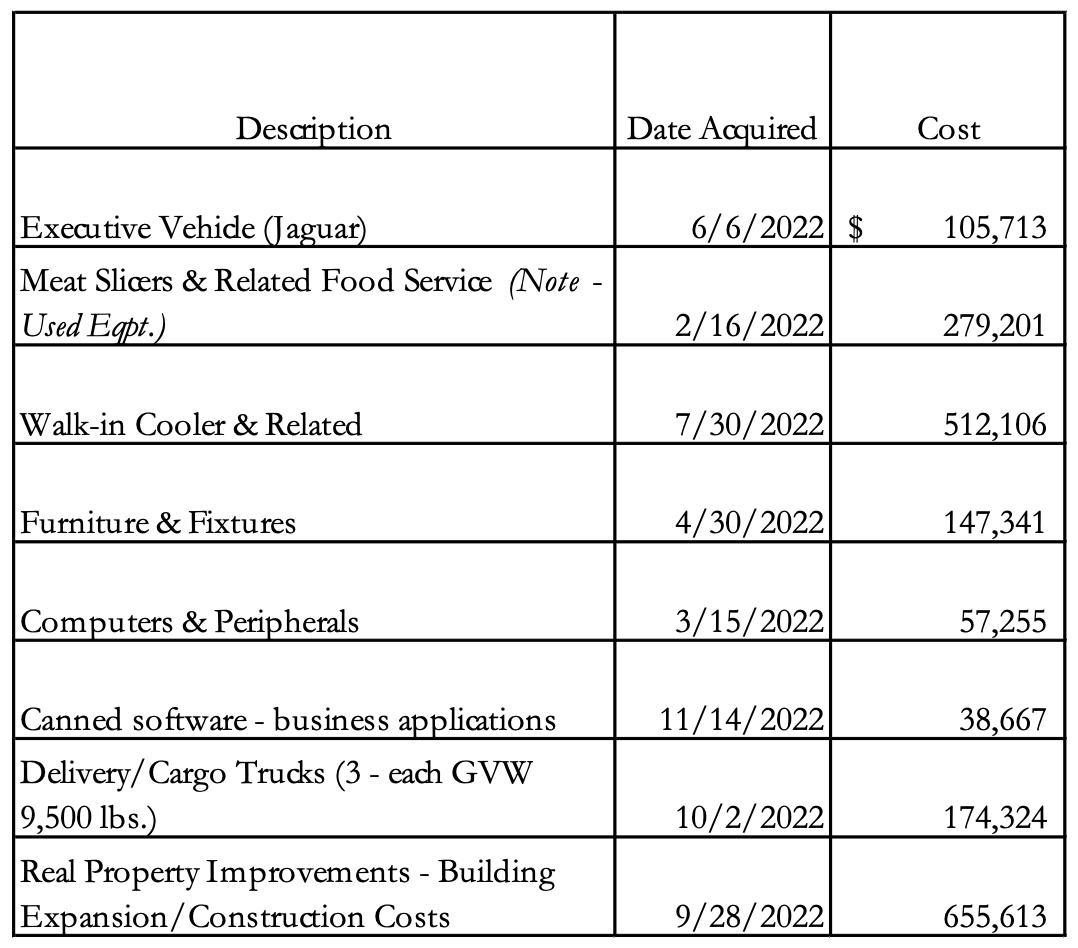

Steed and Peel, Ltd. (S&P) is a new concept upscale “Sandwich Shoppe” (deli) in the North Scottsdale/Carefree area.1 In early 2021, the owners purchased a vacant delicatessen/convenience store, made a few cosmetic renovations (the location was a little shabby by local standards) and opened for business. Catering (no pun intended) mostly to the overly affluent and largely inert, the shop prepares custom gourmet sandwiches, salads and related items, with premium organic and locally sourced ingredients. S&P then promptly delivers these concoctions to the homes and offices of its clientele (with far more cachet than one of the commercial delivery services). In its first tax year (calendar 2021), S&P netted $740,000 in taxable profit - it expects to clear well over $1,380,000 in 2022 (both figures are before any recovery deductions). S&P’s timing was fortuitous as with related to the COVID pandemic, the food delivery business skyrocketed. To help keep up with demand and generally spruce-up the physical facilities in deference to their location, S&P made the following capital expenditures in 2022:

Project Requirements:

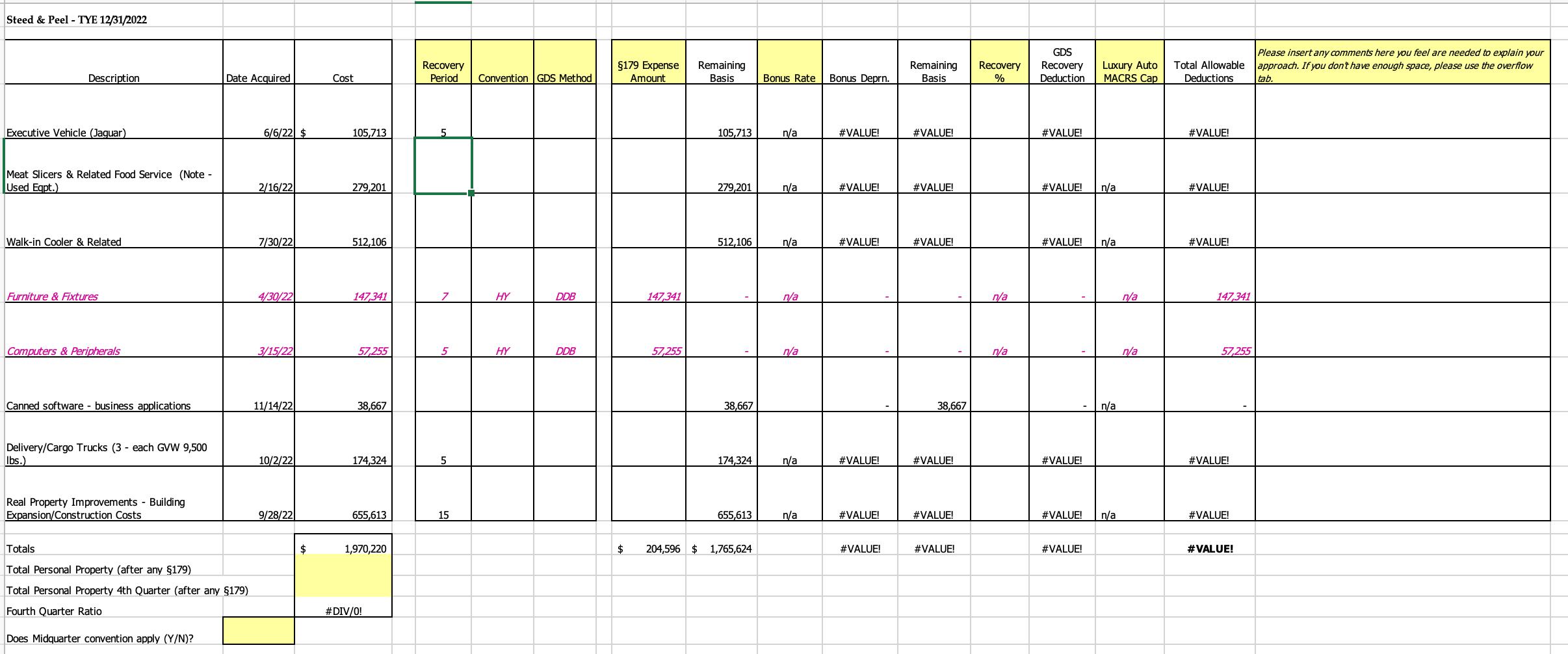

In general, S&P’s owners (it is a “C” corporation) want to maximize first-year tax depreciation and related deductions. In this context, they also hope to avoid keeping annual depreciation records, if possible. However, after conferring with their financial and legal advisors, related to certain financial covenants and regulatory issues (beyond our scope here), S&P will only consider claiming “bonus depreciation” for software acquisitions, if such a bonus allowance is otherwise available. Given the foregoing, your task is to determine how best to achieve S&P’s overall goals relative to depreciation and related deductions. In other words, taking into account the business constraints, how do you apply the federal tax law to maximize their 2022 deductions and minimize the record-keeping burden? Please make sure you consider all these elements when completing the MACRS Template provided as part of this project – you should do your best to compute the maximum deduction. Also, do not forget the deduction ordering rules associated with the various IRC provisions discussed in your text and lecture materials. In addition, along the way, you will likely need to do a little additional research (the template has been partially completed for you/examples provided - see the purple and italicized type font) to determine the appropriate recovery period for certain assets. As discussed in your lecture materials, Revenue Procedure 87-56 is a great place to look for such answers. A copy of that Rev. Proc. is included on Canvas with the other project materials. You can also use CCH AnswerConnect/VitalLaw or RIA Checkpoint to expand or practice your research if desired, or if you have forgotten about MACRS conventions or GDS methods from your lectures. Of course, you can always review the lectures and/or your text as well. Be sure to review the supplement (Video Part 2A pertaining to inflation adjustments) as some of those figures may or may not be incorporated in your text.

This is the empty template we're supposed to use:

Description Executive Vehide (Jaguar) Meat Slicers & Related Food Service (Note - Date Acquired Cost 6/6/2022 $ 105,713 Used Eqpt.) Walk-in Cooler & Related 2/16/2022 279,201 7/30/2022 512,106 Furniture & Fixtures 4/30/2022 147,341 Computers & Peripherals 3/15/2022 57,255 Canned software - business applications 11/14/2022 38,667 Delivery/Cargo Trucks (3 - each GVW 9,500 lbs.) 10/2/2022 174,324 Real Property Improvements - Building Expansion/Construction Costs 9/28/2022 655,613

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To complete the MACRS depreciation schedule for Steed and Peel Ltd youll need to follow these steps 1 Determine the appropriate recovery period for each asset class listed This will depend on the asse...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started