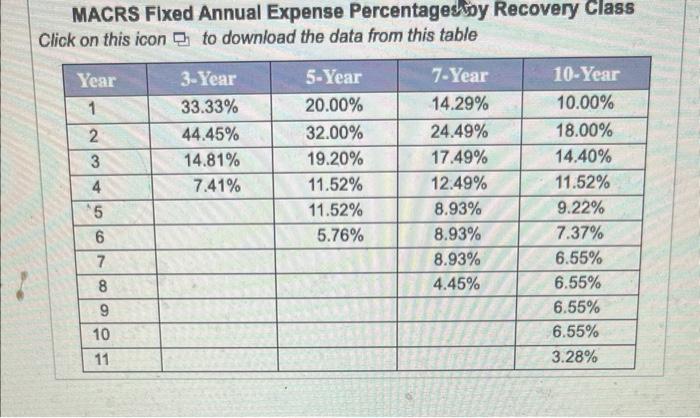

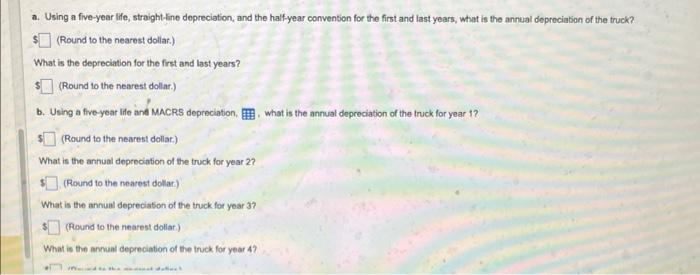

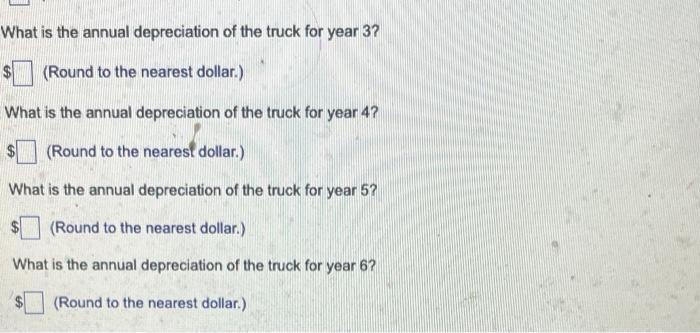

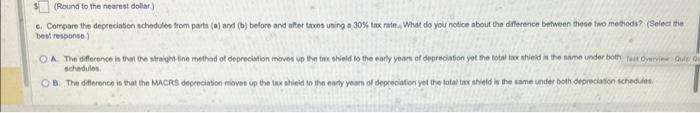

MACRS Fixed Annual Expense Percentagesioy Recovery Class Click on this icon to download the data from this table a. Using a five-year life, straight-line depreciation, and the half-year convention for the first and last years, what is the annual depreciabion of the truck? (Round to the nearest dollar.) What is the depreciation for the first and last years? (Round to the nearest dollar.) b. Using a five-year life ant MACRS depreciation, , what is the annual depreciation of the truck for year 1 ? (Round to the nearest dollar.) What is the annual depreciation of the truck for year 2 ? (Round to the nearest dollar) What is the annual depreciation of the truck for year 3 ? (Found to the nearest dollar) What is the armaal depreciotion of the truck for year 4 ? What is the annual depreciation of the truck for year 3? $ (Round to the nearest dollar.) What is the annual depreciation of the truck for year 4? $ (Round to the nearest dollar.) What is the annual depreciation of the truck for year 5 ? (Round to the nearest dollar.) What is the annual depreciation of the truck for year 6 ? (Round to the nearest dollar.) c. Compare the depreciation schedules from parts (a) and (b) belore and attor toxos using a 30% tax rate . What do you notice about the dfference beriveen these hao metioda? (Seinct the schedules. B. The diflerence is that the Mucres depreciabion mioves up the inx atieid to the narly yean of depreciafon yet the botal tax ahield is the same under both depretalion schediles. MACRS Fixed Annual Expense Percentagesioy Recovery Class Click on this icon to download the data from this table a. Using a five-year life, straight-line depreciation, and the half-year convention for the first and last years, what is the annual depreciabion of the truck? (Round to the nearest dollar.) What is the depreciation for the first and last years? (Round to the nearest dollar.) b. Using a five-year life ant MACRS depreciation, , what is the annual depreciation of the truck for year 1 ? (Round to the nearest dollar.) What is the annual depreciation of the truck for year 2 ? (Round to the nearest dollar) What is the annual depreciation of the truck for year 3 ? (Found to the nearest dollar) What is the armaal depreciotion of the truck for year 4 ? What is the annual depreciation of the truck for year 3? $ (Round to the nearest dollar.) What is the annual depreciation of the truck for year 4? $ (Round to the nearest dollar.) What is the annual depreciation of the truck for year 5 ? (Round to the nearest dollar.) What is the annual depreciation of the truck for year 6 ? (Round to the nearest dollar.) c. Compare the depreciation schedules from parts (a) and (b) belore and attor toxos using a 30% tax rate . What do you notice about the dfference beriveen these hao metioda? (Seinct the schedules. B. The diflerence is that the Mucres depreciabion mioves up the inx atieid to the narly yean of depreciafon yet the botal tax ahield is the same under both depretalion schediles