Question

Madawaska Timber Inc. had the following transactions: Feb. 14 The board of directors for Madawaska Timber Inc. approved a bonus payout to employees in the

Madawaska Timber Inc. had the following transactions:

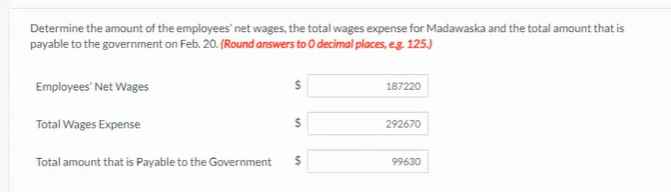

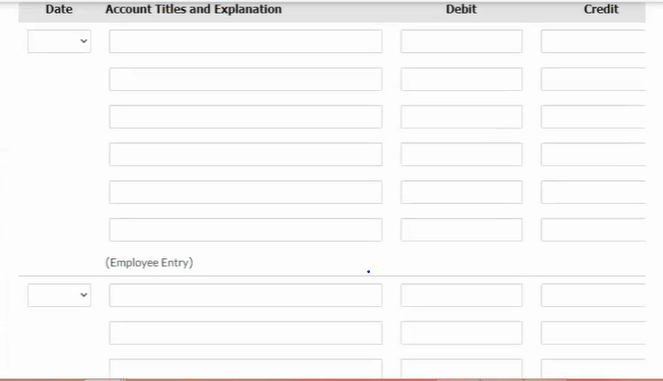

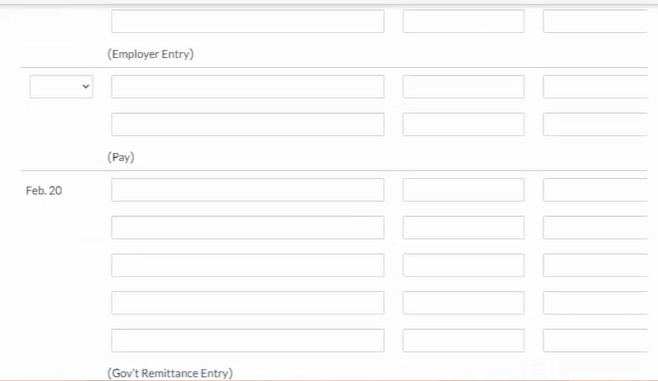

Feb. 14 The board of directors for Madawaska Timber Inc. approved a bonus payout to employees in the amount of $255,000. The source deductions on the bonus earned were CPP of $12,623, which Madawaska matched; EI of $4,157, which it matched at 1.4 times; and income taxes of $51,000 and finally, $2,550 to the Union of Forest Workers (UFW) to cover union dues. In addition, Madawaska was required to pay Workers Compensation Board (WCB) of British Columbia premiums of 6.54% based on the bonus costs. Feb. 15 Paid the bonus approved by the board of directors on February 14. Feb. 20 Made the remittance to the government related to the February 14 bonus. Feb. 21 Made the remittance to UFW related to the February 14 bonus.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started