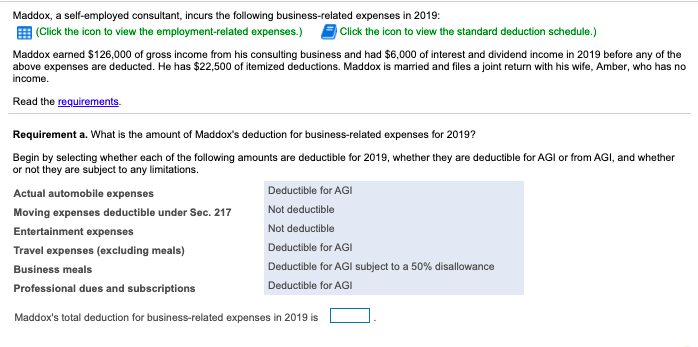

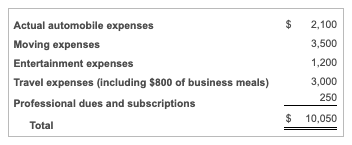

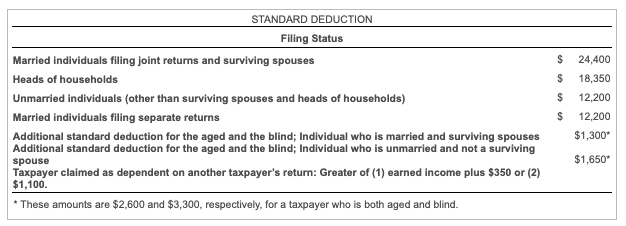

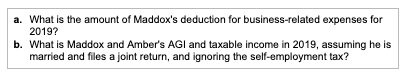

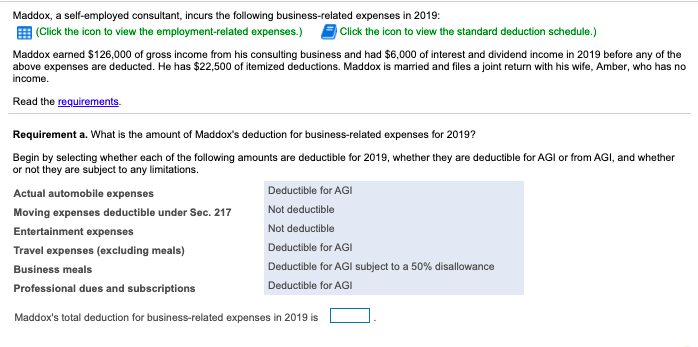

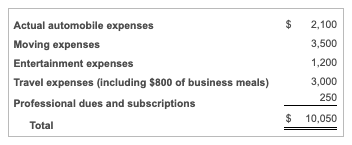

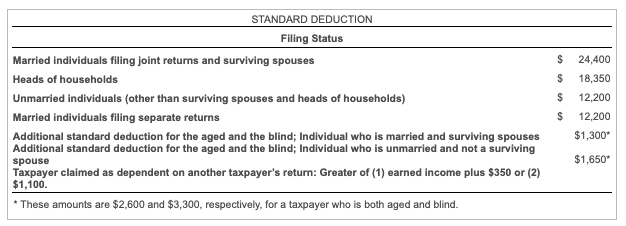

Maddox, a self-employed consultant, incurs the following business-related expenses in 2019: (Click the icon to view the employment-related expenses.) Click the icon to view the standard deduction schedule.) Maddox earned $126,000 of gross income from his consulting business and had $6,000 of interest and dividend income in 2019 before any of the above expenses are deducted. He has $22,500 of itemized deductions. Maddox is married and files a joint return with his wife, Amber, who has no income. Read the requirements. Requirement a. What is the amount of Maddox's deduction for business-related expenses for 2019? Begin by selecting whether each of the following amounts are deductible for 2019, whether they are deductible for AGI or from AGI, and whether or not they are subject to any limitations. Actual automobile expenses Deductible for AGI Moving expenses deductible under Sec. 217 Not deductible Entertainment expenses Not deductible Travel expenses (excluding meals) Deductible for AGI Business meals Deductible for AGI subject to a 50% disallowance Professional dues and subscriptions Deductible for AGI Maddox's total deduction for business-related expenses in 2019 is $ 2,100 3,500 Actual automobile expenses Moving expenses Entertainment expenses Travel expenses (including $800 of business meals) Professional dues and subscriptions 1,200 3,000 250 $ 10,050 Total STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. * These amounts are $2,600 and $3,300, respectively, for a taxpayer who is both aged and blind. $ 24,400 $ 18,350 $ 12,200 $ 12,200 $1,300* $1,650* a. What is the amount of Maddox's deduction for business-related expenses for 2019? b. What is Maddox and Amber's AGI and taxable income in 2019, assuming he is married and files a joint return, and ignoring the self-employment tax? Maddox, a self-employed consultant, incurs the following business-related expenses in 2019: (Click the icon to view the employment-related expenses.) Click the icon to view the standard deduction schedule.) Maddox earned $126,000 of gross income from his consulting business and had $6,000 of interest and dividend income in 2019 before any of the above expenses are deducted. He has $22,500 of itemized deductions. Maddox is married and files a joint return with his wife, Amber, who has no income. Read the requirements. Requirement a. What is the amount of Maddox's deduction for business-related expenses for 2019? Begin by selecting whether each of the following amounts are deductible for 2019, whether they are deductible for AGI or from AGI, and whether or not they are subject to any limitations. Actual automobile expenses Deductible for AGI Moving expenses deductible under Sec. 217 Not deductible Entertainment expenses Not deductible Travel expenses (excluding meals) Deductible for AGI Business meals Deductible for AGI subject to a 50% disallowance Professional dues and subscriptions Deductible for AGI Maddox's total deduction for business-related expenses in 2019 is $ 2,100 3,500 Actual automobile expenses Moving expenses Entertainment expenses Travel expenses (including $800 of business meals) Professional dues and subscriptions 1,200 3,000 250 $ 10,050 Total STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. * These amounts are $2,600 and $3,300, respectively, for a taxpayer who is both aged and blind. $ 24,400 $ 18,350 $ 12,200 $ 12,200 $1,300* $1,650* a. What is the amount of Maddox's deduction for business-related expenses for 2019? b. What is Maddox and Amber's AGI and taxable income in 2019, assuming he is married and files a joint return, and ignoring the self-employment tax