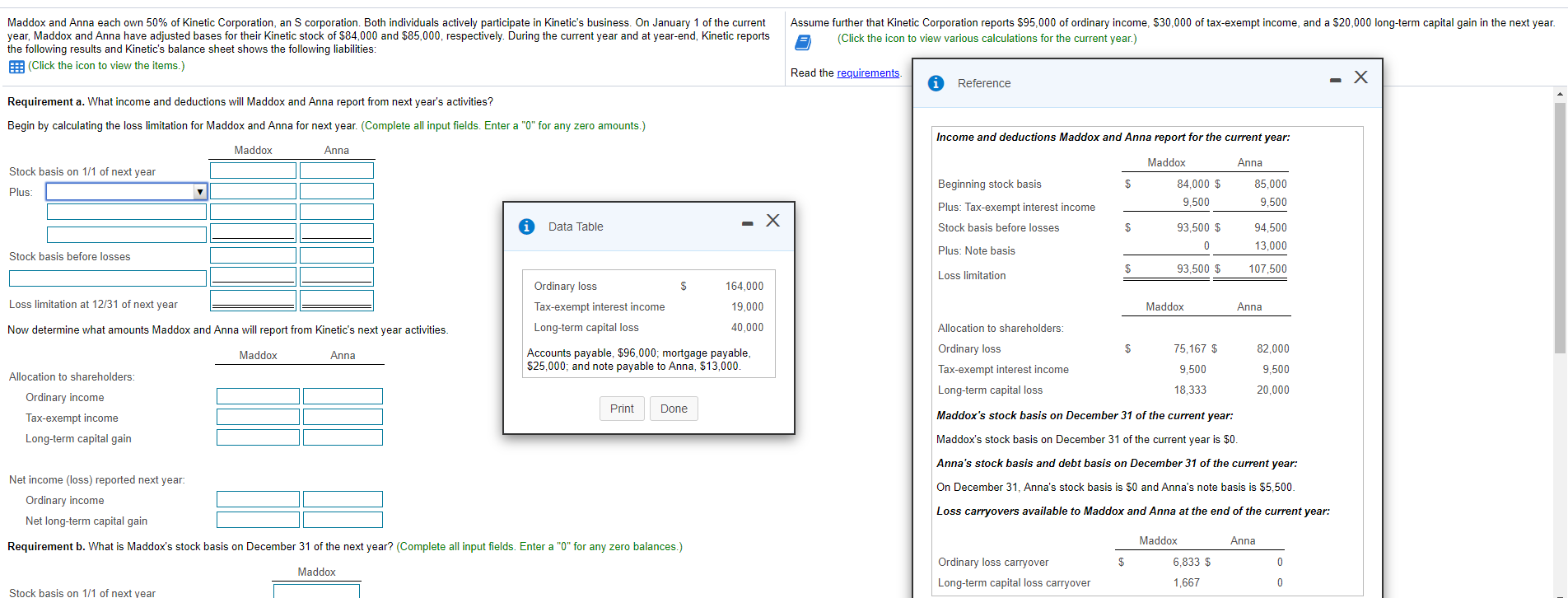

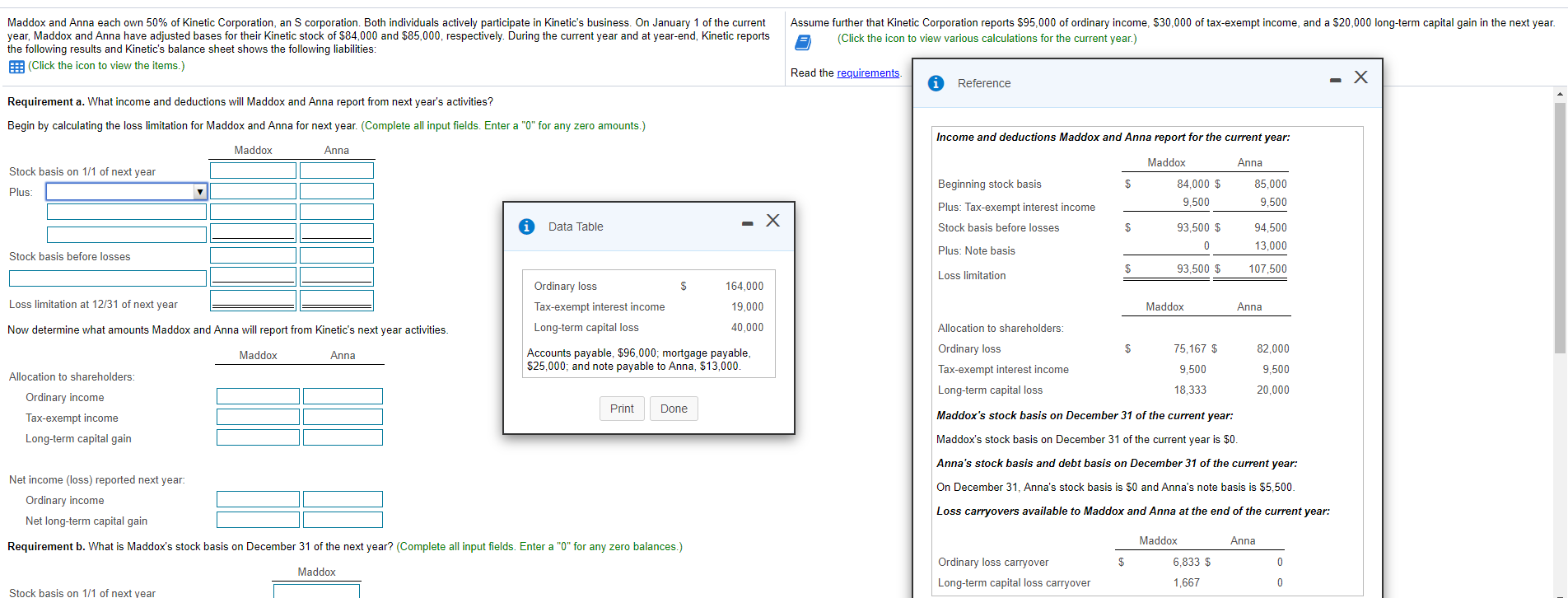

Maddox and Anna each own 50% of Kinetic Corporation, an S corporation. Both individuals actively participate in Kinetic's business. On January 1 of the current year, Maddox and Anna have adjusted bases for their Kinetic stock of $84,000 and $85,000, respectively. During the current year and at year-end, Kinetic reports the following results and Kinetic's balance sheet shows the following liabilities: (Click the icon to view the items.) Assume further that Kinetic Corporation reports $95,000 of ordinary income, $30,000 of tax-exempt income, and a $20,000 long-term capital gain in the next year. (Click the icon to view various calculations for the current year.) Read the requirements. X Reference Requirement a. What income and deductions will Maddox and Anna report from next year's activities? Begin by calculating the loss limitation for Maddox and Anna for next year. (Complete all input fields. Enter a "0" for any zero amounts.) Income and deductions Maddox and Anna report for the current year: Maddox Anna Maddox Anna Stock basis on 1/1 of next year Beginning stock basis $ Plus: 84,000 $ 9,500 85,000 9,500 - X Plus: Tax-exempt interest income Stock basis before losses Data Table $ 93,500 $ 0 94.500 13.000 Plus: Note basis Stock basis before losses $ 93,500 $ 107,500 Loss limitation $ 164.000 Loss limitation at 12/31 of next year Ordinary loss Tax-exempt interest income Long-term capital loss 19,000 Maddox Anna Now determine what amounts Maddox and Anna will report from Kinetic's next year activities. 40,000 Allocation to shareholders: $ Maddox 82.000 75,167 $ Anna Accounts payable, $96,000; mortgage payable, $25,000, and note payable to Anna, $13,000. Ordinary loss Tax-exempt interest income Long-term capital loss 9,500 9,500 20,000 18,333 Allocation to shareholders: Ordinary income Tax-exempt income Long-term capital gain Print Done Maddox's stock basis on December 31 of the current year: Maddox's stock basis on December 31 of the current year is $0. Anna's stock basis and debt basis on December 31 of the current year: On December 31, Anna's stock basis is SO and Anna's note basis is $5,500 Net income (loss) reported next year: Ordinary income Net long-term capital gain Loss carryovers available to Maddox and Anna at the end of the current year: Maddox Anna Requirement b. What is Maddox's stock basis on December 31 of the next year? (Complete all input fields. Enter a "0" for any zero balances.) $ 6.833 $ 0 Maddox Ordinary loss carryover Long-term capital loss carryover 1,667 0 Stock basis on 1/1 of next year Maddox and Anna each own 50% of Kinetic Corporation, an S corporation. Both individuals actively participate in Kinetic's business. On January 1 of the current year, Maddox and Anna have adjusted bases for their Kinetic stock of $84,000 and $85,000, respectively. During the current year and at year-end, Kinetic reports the following results and Kinetic's balance sheet shows the following liabilities: (Click the icon to view the items.) Assume further that Kinetic Corporation reports $95,000 of ordinary income, $30,000 of tax-exempt income, and a $20,000 long-term capital gain in the next year. (Click the icon to view various calculations for the current year.) Read the requirements. X Reference Requirement a. What income and deductions will Maddox and Anna report from next year's activities? Begin by calculating the loss limitation for Maddox and Anna for next year. (Complete all input fields. Enter a "0" for any zero amounts.) Income and deductions Maddox and Anna report for the current year: Maddox Anna Maddox Anna Stock basis on 1/1 of next year Beginning stock basis $ Plus: 84,000 $ 9,500 85,000 9,500 - X Plus: Tax-exempt interest income Stock basis before losses Data Table $ 93,500 $ 0 94.500 13.000 Plus: Note basis Stock basis before losses $ 93,500 $ 107,500 Loss limitation $ 164.000 Loss limitation at 12/31 of next year Ordinary loss Tax-exempt interest income Long-term capital loss 19,000 Maddox Anna Now determine what amounts Maddox and Anna will report from Kinetic's next year activities. 40,000 Allocation to shareholders: $ Maddox 82.000 75,167 $ Anna Accounts payable, $96,000; mortgage payable, $25,000, and note payable to Anna, $13,000. Ordinary loss Tax-exempt interest income Long-term capital loss 9,500 9,500 20,000 18,333 Allocation to shareholders: Ordinary income Tax-exempt income Long-term capital gain Print Done Maddox's stock basis on December 31 of the current year: Maddox's stock basis on December 31 of the current year is $0. Anna's stock basis and debt basis on December 31 of the current year: On December 31, Anna's stock basis is SO and Anna's note basis is $5,500 Net income (loss) reported next year: Ordinary income Net long-term capital gain Loss carryovers available to Maddox and Anna at the end of the current year: Maddox Anna Requirement b. What is Maddox's stock basis on December 31 of the next year? (Complete all input fields. Enter a "0" for any zero balances.) $ 6.833 $ 0 Maddox Ordinary loss carryover Long-term capital loss carryover 1,667 0 Stock basis on 1/1 of next year