Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maddy agrees to pay Millie the sum of $100,000 at the end of 25 years in return for a yearly payment for 25 years

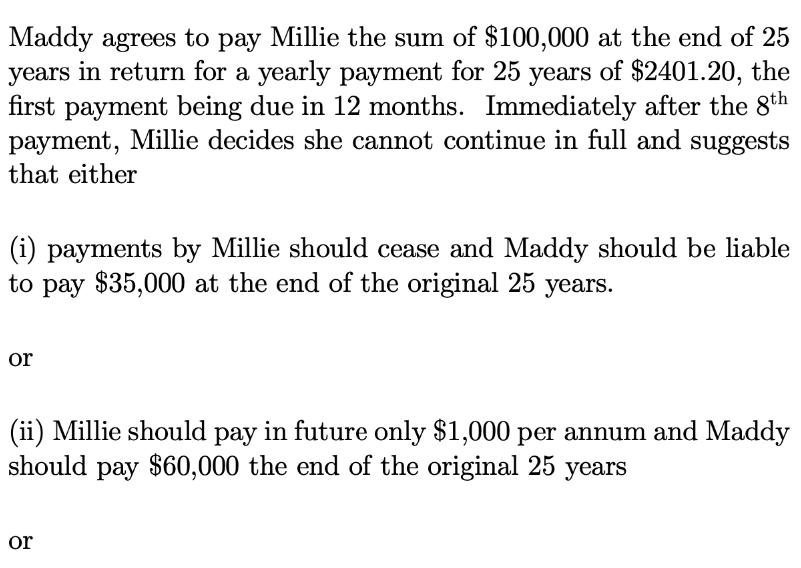

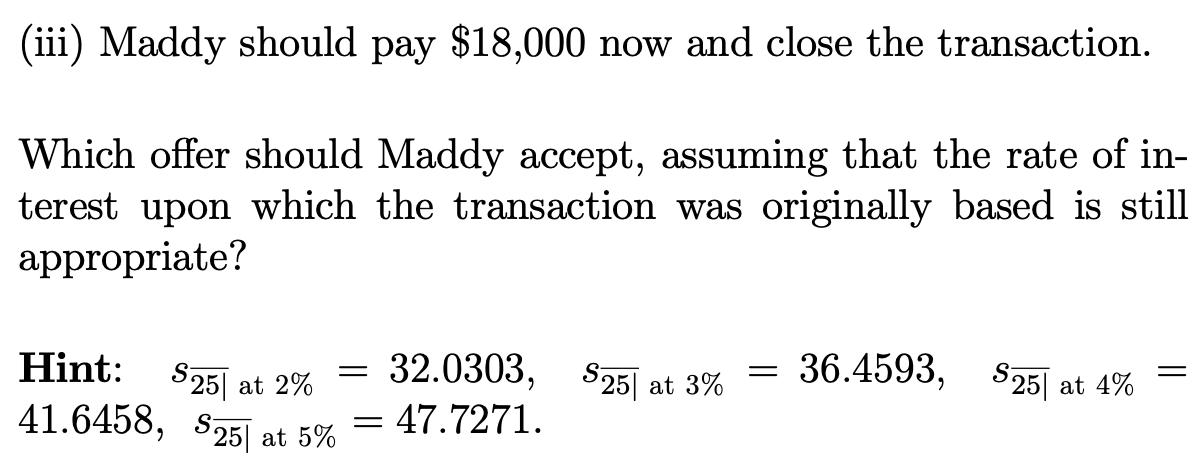

Maddy agrees to pay Millie the sum of $100,000 at the end of 25 years in return for a yearly payment for 25 years of $2401.20, the first payment being due in 12 months. Immediately after the 8th payment, Millie decides she cannot continue in full and suggests that either (i) payments by Millie should cease and Maddy should be liable to pay $35,000 at the end of the original 25 years. or (ii) Millie should pay in future only $1,000 per annum and Maddy should pay $60,000 the end of the original 25 years or (iii) Maddy should pay $18,000 now and close the transaction. Which offer should Maddy accept, assuming that the rate of in- terest upon which the transaction was originally based is still appropriate? $25 at 2% 32.0303, $25 at 3% = 36.4593, $251 at 4% 47.7271. Hint: 41.6458, $25 at 5% = = =

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Originally Millie agreed to pay Maddy 240120 annually for 25 years in return for 100000 at the end o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started