Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maddy is the founder and CEO of Sauerbreit Manufacturing Global (SMG). The firm is introducing a new product line of high-end wireless computer mice.

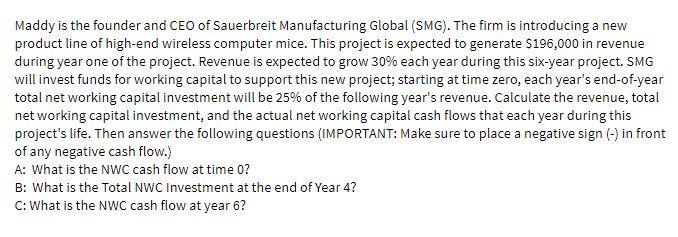

Maddy is the founder and CEO of Sauerbreit Manufacturing Global (SMG). The firm is introducing a new product line of high-end wireless computer mice. This project is expected to generate $196,000 in revenue during year one of the project. Revenue is expected to grow 30% each year during this six-year project. SMG will invest funds for working capital to support this new project; starting at time zero, each year's end-of-year total net working capital investment will be 25% of the following year's revenue. Calculate the revenue, total net working capital investment, and the actual net working capital cash flows that each year during this project's life. Then answer the following questions (IMPORTANT: Make sure to place a negative sign (-) in front of any negative cash flow.) A: What is the NWC cash flow at time 0? B: What is the Total NWC Investment at the end of Year 4? C: What is the NWC cash flow at year 6?

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

0 1 2 3 4 5 6 Revenues 130x next year revenue 196000 254800 331240 430612 5597956 7277343 total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started