"Made up problem fake characters

Jaunito A. Orlando (SSN 909-22-8545) lives at 432 Dakota ave, Yorba Linda, California 90102. Jaunito, a single taxpayer, age 67. He lives with his dependent elderly mother whom he completely supports. Jaunito is a self-employed accountant who sees and consults his clients exclusively at his home office. Other relevant information includes: Earnings from his consulting business: $95,000 Rents collected from properties Jaunito owns, including $1,000 rent deposit $22,000 Interest income (treasury bonds) $500 Interest income (municipal bonds) $450 Life insurance payment to Jaunito $50,000 (Jaunito was a beneficiary on his fathers life insurance policy and received a lump sum payment equal to the policy face value) Personal Deductible Expenses (Itemized Deductions) $16,300 Tax Withholdings (prepayments) $7,000 John receives monthly $1,000 pension plan distributions from his former employers qualified pension plan; Jaunito contributed $84,000 to the plan. In addition, Jaunito was in a car accident and received the following settlement from an insurance company: $12,000 for the physical injury that he sustained, $3,000 for the relating emotional distress, and $4,000 in punitive damages

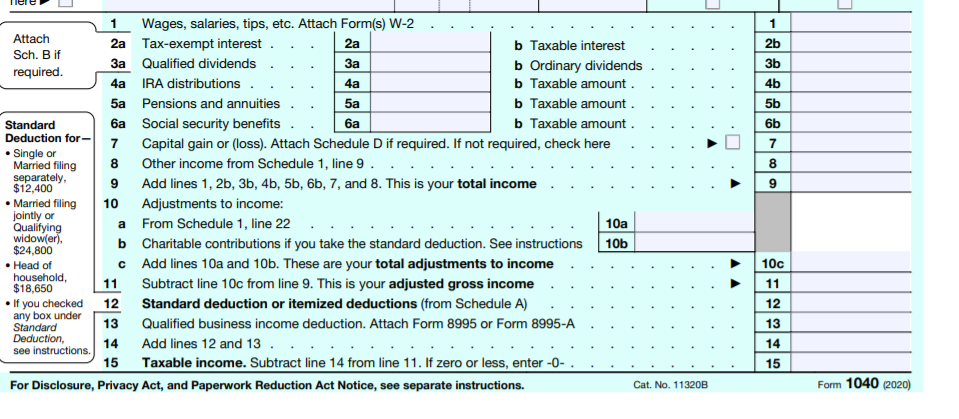

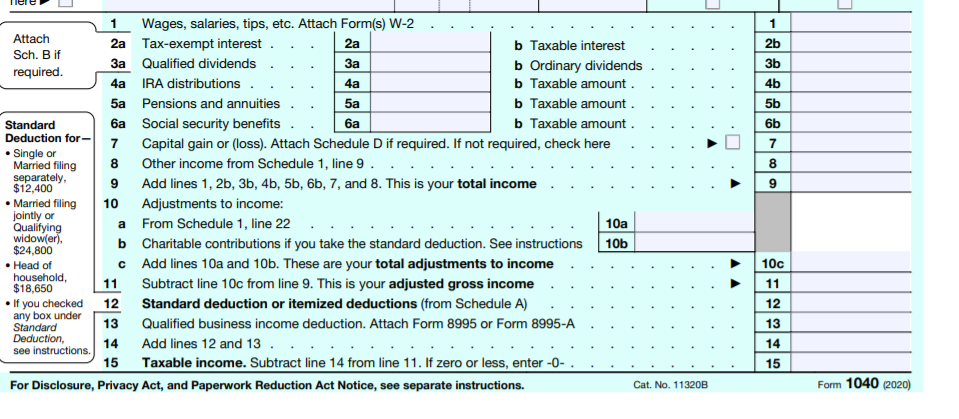

What would go in the boxes below? Please answer what ever is allowed. What ever you can is helpful.

"" What information is needed?

"" What information is needed?

1 1 2b 3b 4b 5b 6b 7 8 9 Wages, salaries, tips, etc. Attach Form(s) W-2 Attach 2a Tax-exempt interest . 2a b Taxable interest Sch. B if 3a Qualified dividends required. b Ordinary dividends 4a IRA distributions. 4a b Taxable amount 5a Pensions and annuities 5a b Taxable amount Standard 6a Social security benefits b Taxable amount Deduction for 7 Capital gain or (loss). Attach Schedule Dif required. If not required, check here Single or Married filing 8 Other income from Schedule 1, line 9. separately, $12,400 9 Add lines 1, 2b, 3b, 45, 56, 6b, 7, and 8. This is your total income Married filing 10 Adjustments to income: jointly or Qualifying a From Schedule 1, line 22 10a b Charitable contributions if you take the standard deduction. See instructions 10b $24,800 Head of c Add lines 10a and 10b. These are your total adjustments to income 11 $18,650 Subtract line 10c from line 9. This is your adjusted gross income If you checked 12 Standard deduction or itemized deductions (from Schedule A) Standard 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A Deduction, 14 Add lines 12 and 13. see instructions. 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter -- . For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B widow(er), household, 10c 11 12 13 14 any box under 15 Form 1040 (2020) 1 1 2b 3b 4b 5b 6b 7 8 9 Wages, salaries, tips, etc. Attach Form(s) W-2 Attach 2a Tax-exempt interest . 2a b Taxable interest Sch. B if 3a Qualified dividends required. b Ordinary dividends 4a IRA distributions. 4a b Taxable amount 5a Pensions and annuities 5a b Taxable amount Standard 6a Social security benefits b Taxable amount Deduction for 7 Capital gain or (loss). Attach Schedule Dif required. If not required, check here Single or Married filing 8 Other income from Schedule 1, line 9. separately, $12,400 9 Add lines 1, 2b, 3b, 45, 56, 6b, 7, and 8. This is your total income Married filing 10 Adjustments to income: jointly or Qualifying a From Schedule 1, line 22 10a b Charitable contributions if you take the standard deduction. See instructions 10b $24,800 Head of c Add lines 10a and 10b. These are your total adjustments to income 11 $18,650 Subtract line 10c from line 9. This is your adjusted gross income If you checked 12 Standard deduction or itemized deductions (from Schedule A) Standard 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A Deduction, 14 Add lines 12 and 13. see instructions. 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter -- . For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B widow(er), household, 10c 11 12 13 14 any box under 15 Form 1040 (2020)

"" What information is needed?

"" What information is needed?