Answered step by step

Verified Expert Solution

Question

1 Approved Answer

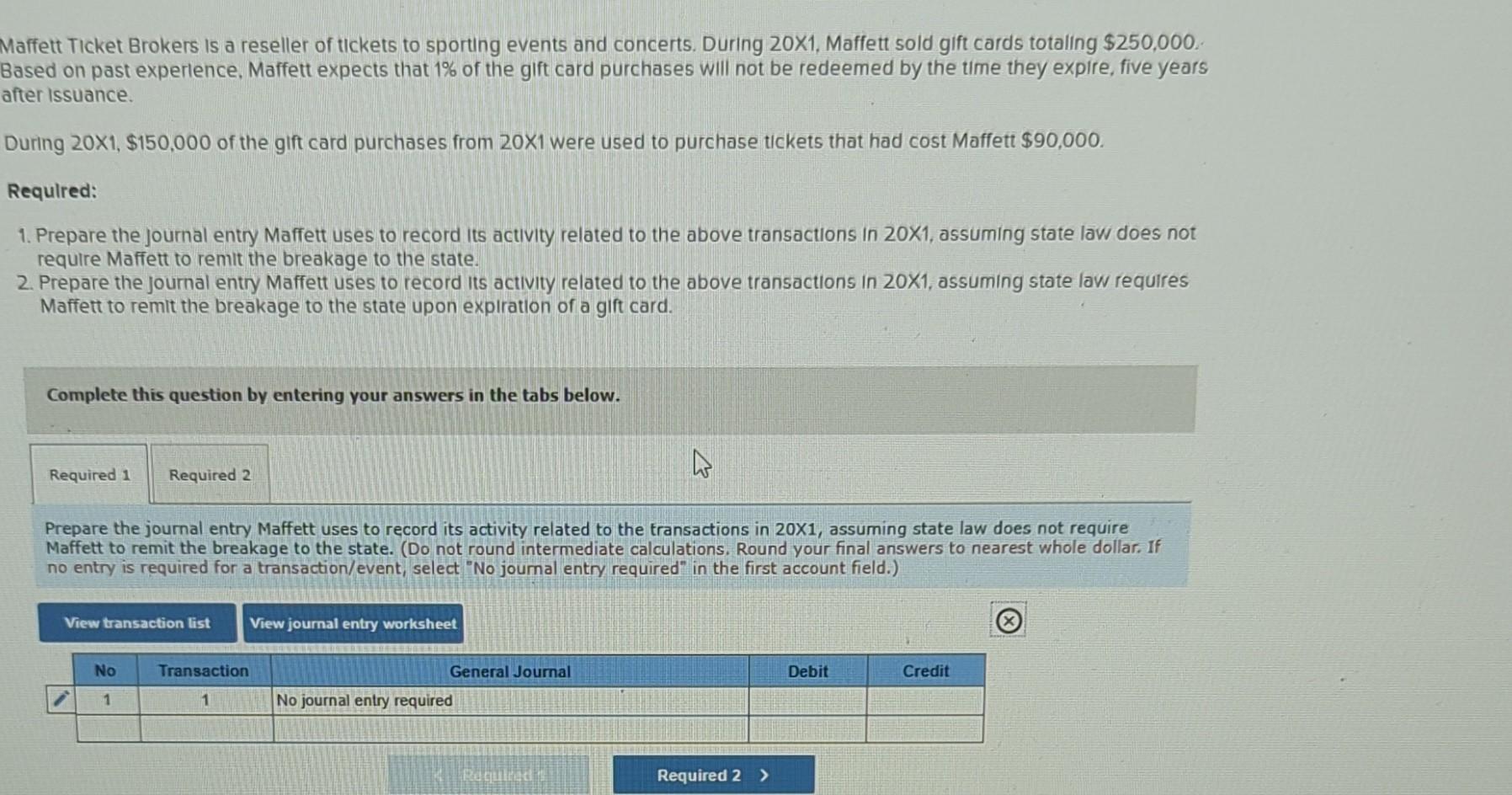

Maffett Ticket Brokers is a reseller of tickets to sporting events and concerts. During 20X1, Maffett sold gift cards totaling $250,000. Based on past experlence,

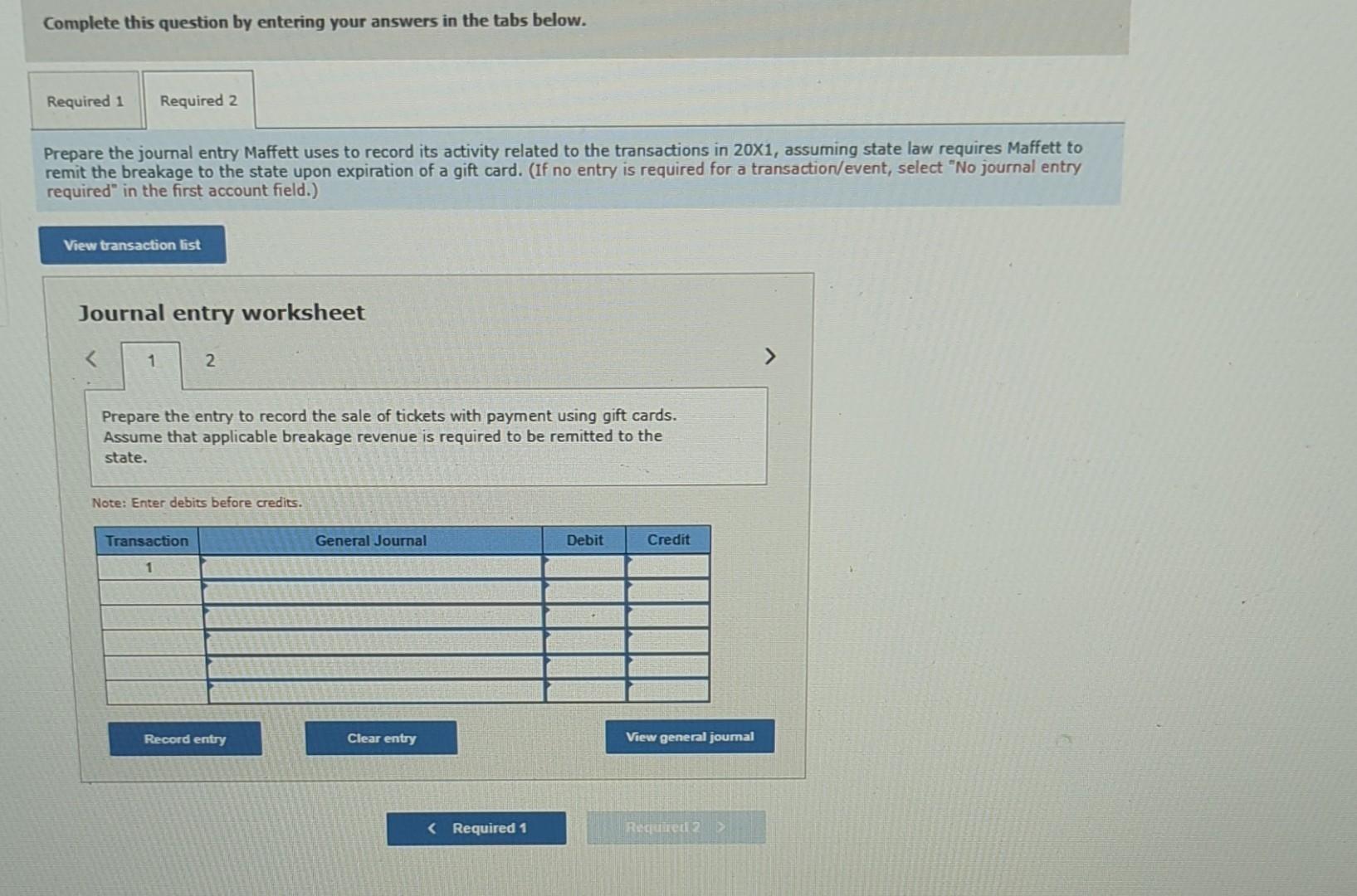

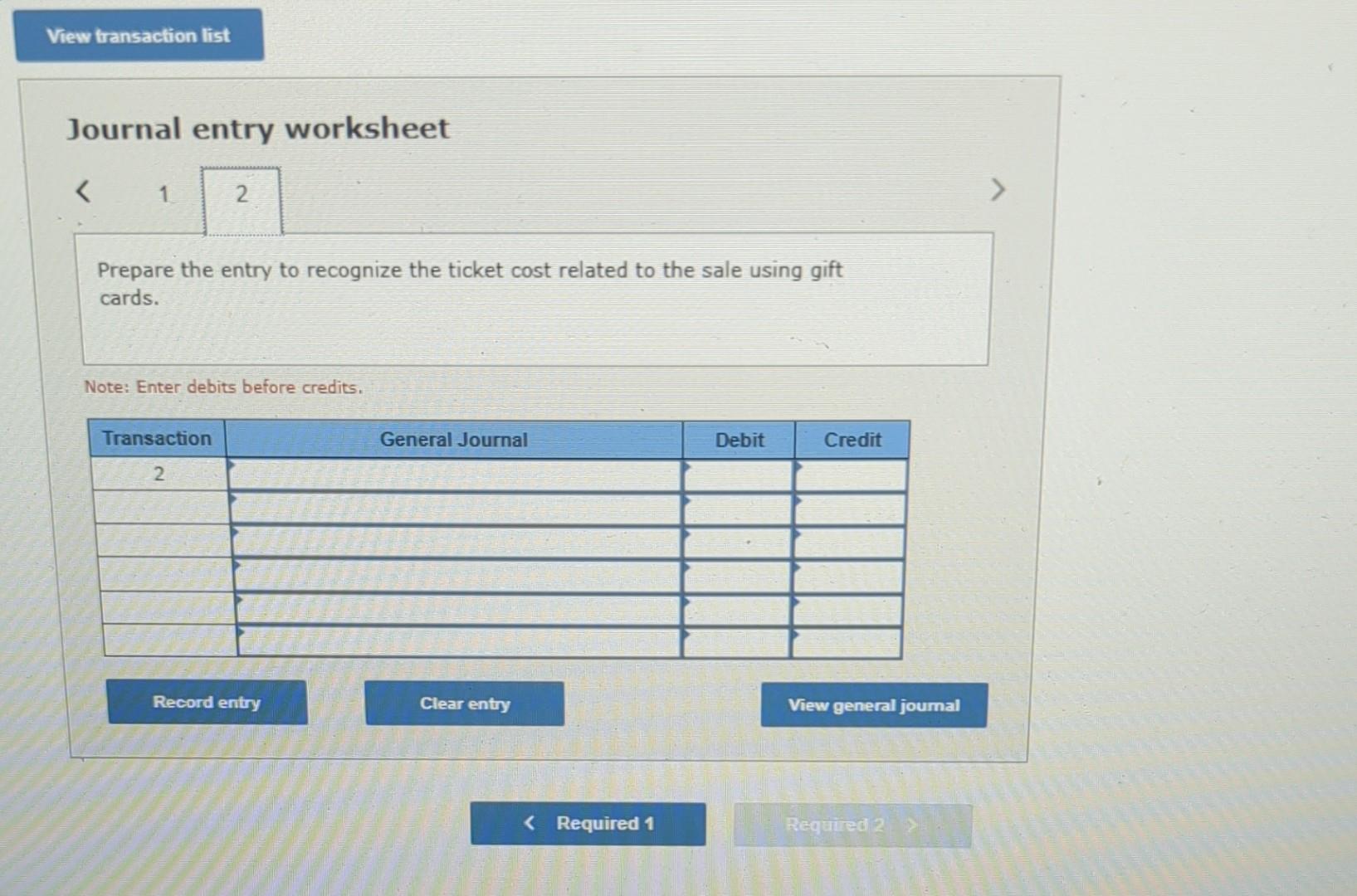

Maffett Ticket Brokers is a reseller of tickets to sporting events and concerts. During 20X1, Maffett sold gift cards totaling $250,000. Based on past experlence, Maffett expects that 1% of the glif card purchases will not be redeemed by the time they explre, five years after issuance. During 201,$150,000 of the gift card purchases from 201 were used to purchase tickets that had cost Maffett $90,000. Requlred: 1. Prepare the Journal entry Maffett uses to record Its activity related to the above transactions in 20X1, assuming state law does not require Maffett to remit the breakage to the state. 2. Prepare the journal entry Maffett uses to record its activity related to the above transactions in 20X1, assuming state law requires Maffett to remit the breakage to the state upon explration of a gift card. Complete this question by entering your answers in the tabs below. Prepare the journal entry Maffett uses to record its activity related to the transactions in 20X1, assuming state law does not require Maffett to remit the breakage to the state. (Do not round intermediate calculations. Round your final answers to nearest whole dollar. If no entry is required for a transaction/event, select "No joumal entry required" in the first account field.) Journal entry worksheet Prepare the entry to recognize the ticket cost related to the sale using gift cards. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare the journal entry Maffett uses to record its activity related to the transactions in 20X1, assuming state law requires Maffett to remit the breakage to the state upon expiration of a gift card. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 2 Prepare the entry to record the sale of tickets with payment using gift cards. Assume that applicable breakage revenue is required to be remitted to the state. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started