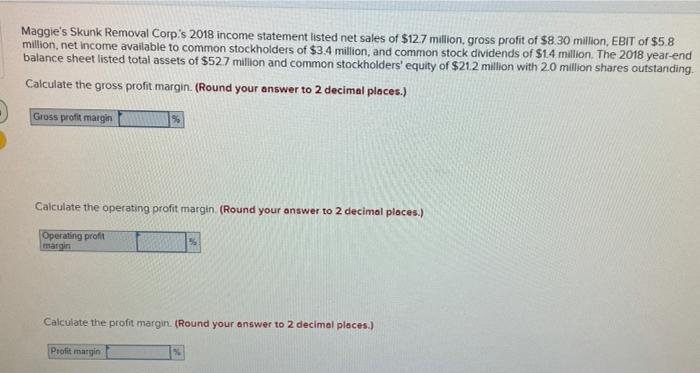

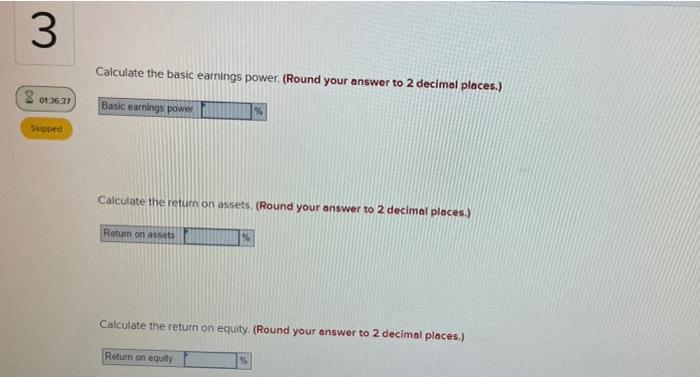

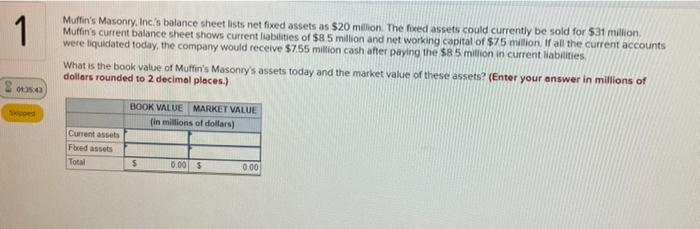

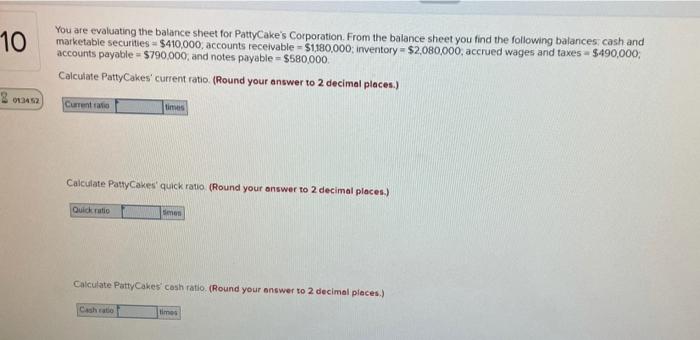

Maggie's Skunk Removal Corp's 2018 income statement listed net sales of $12.7 million, gross profit of $8.30 million, EBIT of $5.8 million, net income available to common stockholders of $3.4 million, and common stock dividends of $14 million. The 2018 year-end balance sheet listed total assets of $527 million and common stockholders' equity of $21.2 million with 20 million shares outstanding. Calculate the gross profit margin(Round your answer to 2 decimal places.) Gross profit margin Calculate the operating profit margin (Round your answer to 2 decimal places.) Operating profit margin Calculate the profit margin (Round your answer to 2 decimal places.) Profit margin 3 Calculate the basic earnings power. (Round your answer to 2 decimal places.) 8 0136.27 Basic earnings power Skipped Calculate the return on assets. (Round your answer to 2 decimal places.) Return on assets Calculate the return on equity (Round your answer to 2 decimal places.) Return on equity SC 1 1 Muffin's Masonry, Inc.'s balance sheet lists net fixed assets as $20 million. The foxed assets could currently be sold for $31 million Muffin's current balance sheet shows current liabilities of $8.5 million and networking capital of $75 million. If all the current accounts were liquidated today, the company would receive $7.55 million cash after paying the $85 million in current liabilities What is the book value of Muffin's Masonry's assets today and the market value of these assets? (Enter your answer in millions of dollars rounded to 2 decimal places.) os BOOK VALUE MARKET VALUE (in millions of dollars) Current asset Fbed assets Total 5 0.005 0.00 10 You are evaluating the balance sheet for PattyCake's Corporation. From the balance sheet you find the following balances cash and marketable securities - $410,000, accounts receivable - $1,180,000 inventory = $2,080,000, accrued wages and taxes - $490,000; accounts payable - $790.000, and notes payable = $580,000. Calculate PattyCakes current ratio (Round your answer to 2 decimal places.) 25.242 Current ratio times Calculate Patty Cakes' quick ratio (Round your answer to 2 decimal places.) Quick ratio Calculate Patty Cakes cash ratio (Round your answer to 2 decimal places.) Cash to