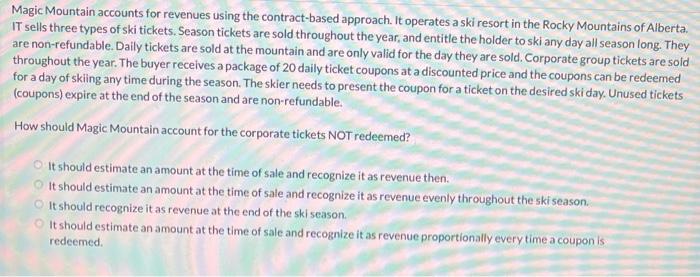

Magic Mountain accounts for revenues using the contract-based approach. It operates a ski resort in the Rocky Mountains of Alberta. IT sells three types of ski tickets. Season tickets are sold throughout the year, and entitle the holder to ski any day all season long. They are non-refundable. Daily tickets are sold at the mountain and are only valid for the day they are sold. Corporate group tickets are sold throughout the year. The buyer receives a package of 20 daily ticket coupons at a discounted price and the coupons can be redeemed for a day of skiing any time during the season. The skier needs to present the coupon for a ticket on the desired ski day. Unused tickets (coupons) expire at the end of the season and are non-refundable. How should Magic Mountain account for the corporate tickets NOT redeemed? It should estimate an amount at the time of sale and recognize it as revenue then. It should estimate an amount at the time of sale and recognize it as revenue evenly throughout the ski season. It should recognize it as revenue at the end of the ski season. It should estimate an amount at the time of sale and recognize it as revenue proportionally every time a coupon is: redeemed. Magic Mountain accounts for revenues using the contract-based approach. It operates a ski resort in the Rocky Mountains of Alberta. IT sells three types of ski tickets. Season tickets are sold throughout the year, and entitle the holder to ski any day all season long. They are non-refundable. Daily tickets are sold at the mountain and are only valid for the day they are sold. Corporate group tickets are sold throughout the year. The buyer receives a package of 20 daily ticket coupons at a discounted price and the coupons can be redeemed for a day of skiing any time during the season. The skier needs to present the coupon for a ticket on the desired ski day. Unused tickets (coupons) expire at the end of the season and are non-refundable. How should Magic Mountain account for the corporate tickets NOT redeemed? It should estimate an amount at the time of sale and recognize it as revenue then. It should estimate an amount at the time of sale and recognize it as revenue evenly throughout the ski season. It should recognize it as revenue at the end of the ski season. It should estimate an amount at the time of sale and recognize it as revenue proportionally every time a coupon is: redeemed