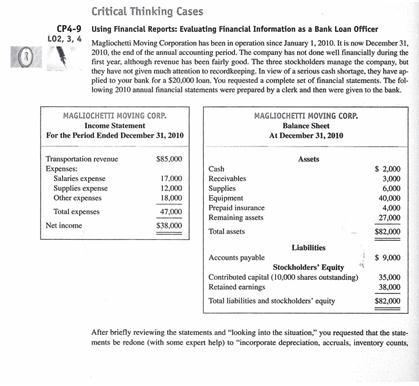

Magliochetti Moving Corporation has been in operation since January 1, 2010. It is now December 31, 2010. the end of the annual accounting period. The company has not done well financially during the first year. although revenue has been fairly good. The three stock holders manage the company. But they have not given much attention to recordkeeping. In view of a serious cash shortage. they have applied to your bank for a $ 20, 000 loan. You requested a complete set of financial statement. The following 2010 annual financial statements were prepared by a cleric and then were given to the bank After briefly reviewing the statements and "looking into the situation". you requested that the statement be reduce (with some expert help) to "incorporate depreciation. accruals. inventory accounts. income taxes, and so on." As a result of a review of the records and supporting documents, the following additional information was developed: The Supplies of $6,000 shown on the balance sheet has not been adjusted for supplies used during 2010. A count of the supplies on hand on December 31. 2010. showed $1,800. The insurance premium paid in 2010 was for years 2010 and 2011. The total insurance premium was debited in full to Prepaid Insurance when paid in 2010 and no adjustment has been made. The equipment cost $40,000 when purchased January 1, 2010. It had an estimated annual depreciation of $8,000. No depreciation has been recorded for 2010. Unpaid (and unrecorded) salaries at December 31. 2010. amounted to $2,200. At December 31. 2010, transportation revenue collected in advance amounted to $7,000. This amount was credited in full to Transportation Revenue when the cash was collected earlier during 2010. Income tax expense was $3,650 (the tax rate is 25 percent). Magliochetti Moving Corporation has been in operation since January 1, 2010. It is now December 31, 2010. the end of the annual accounting period. The company has not done well financially during the first year. although revenue has been fairly good. The three stock holders manage the company. But they have not given much attention to recordkeeping. In view of a serious cash shortage. they have applied to your bank for a $ 20, 000 loan. You requested a complete set of financial statement. The following 2010 annual financial statements were prepared by a cleric and then were given to the bank After briefly reviewing the statements and "looking into the situation". you requested that the statement be reduce (with some expert help) to "incorporate depreciation. accruals. inventory accounts. income taxes, and so on." As a result of a review of the records and supporting documents, the following additional information was developed: The Supplies of $6,000 shown on the balance sheet has not been adjusted for supplies used during 2010. A count of the supplies on hand on December 31. 2010. showed $1,800. The insurance premium paid in 2010 was for years 2010 and 2011. The total insurance premium was debited in full to Prepaid Insurance when paid in 2010 and no adjustment has been made. The equipment cost $40,000 when purchased January 1, 2010. It had an estimated annual depreciation of $8,000. No depreciation has been recorded for 2010. Unpaid (and unrecorded) salaries at December 31. 2010. amounted to $2,200. At December 31. 2010, transportation revenue collected in advance amounted to $7,000. This amount was credited in full to Transportation Revenue when the cash was collected earlier during 2010. Income tax expense was $3,650 (the tax rate is 25 percent)