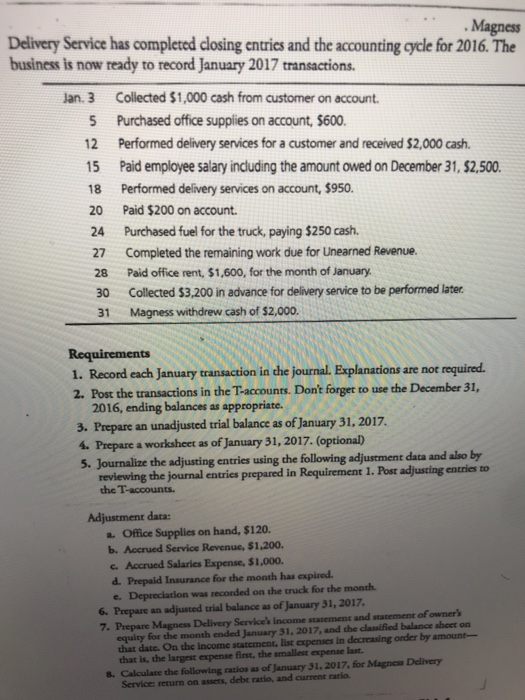

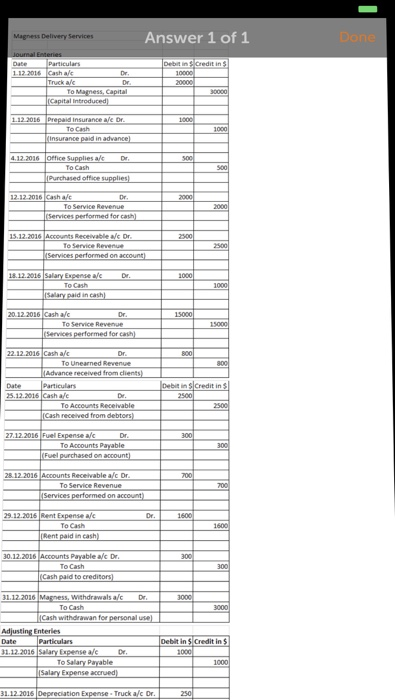

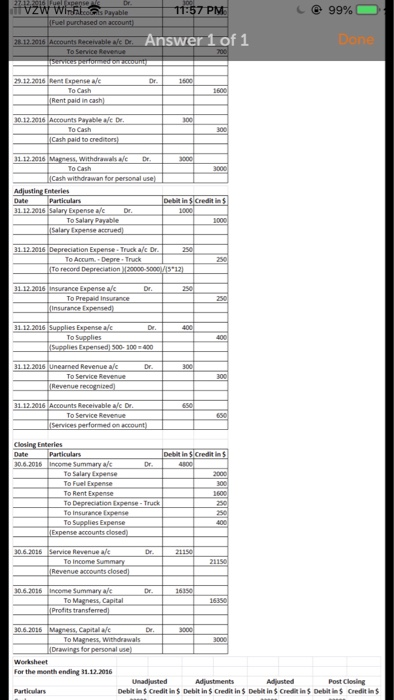

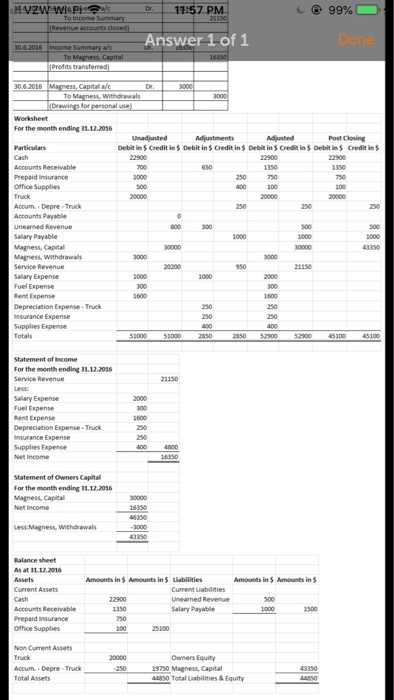

Magness Delivery Service has completed closing entries and the accounting cycle for 2016. The business is now ready to record January 2017 transactions. Jan. 3 Collected $1,000 cash from customer on account 5 Purchased office supplies on account, $600 12 Performed delivery services for a customer and received $2,000 cash. 15 Paid employee salary including the amount owed on December 31, $2,500. 18 Performed delivery services on account, $950. 20 Paid $200 on account. 24 Purchased fuel for the truck, paying $250 cash 27 Completed the remaining work due for Unearned Revenue. 28 Paid office rent, $1,600, for the month of January 30 Collected $3,200 in advance for delivery service to be performed later 31 Magness withdrew cash of $2,000 Requirements 1. Record each January transaction in che journal. Explanations are not required. 2. Post the transactions in the T-accounts. Don't forget to use the December 31, 2016, ending balances as appropriate. 3. Prepare an unadjusted trial balance as of January 31, 2017. 4. Prepare a worksheet as of January 31, 2017. (optional) 5. Journalize the adjusting entries using the following adjustment data and aso by reviewing the journal entries prepared in Requirement 1. Post adjusting entries to the T-accounts. Adjustment data: a. Office Supplies on hand, $120. b. Accrued Service Revenue, $1,200. c. Accrued Salaries Expense, $1,000. d. Prepaid Insurance for the month has expired e. Depreciation was recorded on the truck for the month. 6. Prepare an adjusted rial balance as of January 31, 2017 7. Prepare Magness Delivery Service's income statement and statement of owners equity for the month ended January 31, 2017, and the classified balance sheet on that date. On de income statement. Ilst expenses in decreasing order by amount- - that is, the largest expense first, the smallest expense last 2017. fer Magces Delivery Service: return on assets, debt ratio, and current ratio Answer 1 of 1 Magness Delivery Services Service Revenue Receivable a/c Dr 2012 2016 22.12.2016 To Unearned Revenue dvance received from recelived from 28. 12 2016 Receivable alc Dr To Cash Rent paid in 30.12.2016 Cash withdrawan in S Credit in 31.12 2016 Truck a/c D c @ 99% CO Answer 1 of 1 1 12.2016 1 12.201 1.12.2016 12. 2016 s Receivable a/e D Clesing Enteries To Rent 0.6.2016 To Magness, Withdrawals for the month ending 31.12.036 Post Closing Unadjnsted Debit in $ Credit in $ Debit in $ Credit in $ Debit in $ Credit in $ Debit in$ Credit in 1157 PM c @ 99% CO Answer 1 of 1 0.6.2016 For the month ending 31.12.2016 Post Closing Debit in $ Credit in $ Debit in $ Credit in $ Debit in 5 Credn in $ Debit in5 Cedit in Accounts Recelvable Prepaid Insurance Office Supplies Accum Depre Truck Accounts Payable Salary Payable Magness, Capital Sallary Expense Fuel Expense Rent Expense Depreciation Expense-Truck insurance Expense Supplies Expense 850 52300 20045300 45100 For the month ending 3312.2036 Salary Expense Fuel Expense Rent Expense Depreciation Expense- Truck insurance Expense Supplies Expense Statement of Owners Capital For the month ending 3312.2036 Magness, Capital Amounts in $ Amounts in $ Liabilities Amounts in $ Amounts in $ Unearned Revenue Salary Payable Prepaid insurance Office Supplies Owners Equity Accum Depre Truck 19750 Magness, Capital 400 Total uabilities & Equity