Question

Magnum Company manufactures two different products, A and B. In the past, the company has allocated its plant wide manufacturing overhead costs based on direct

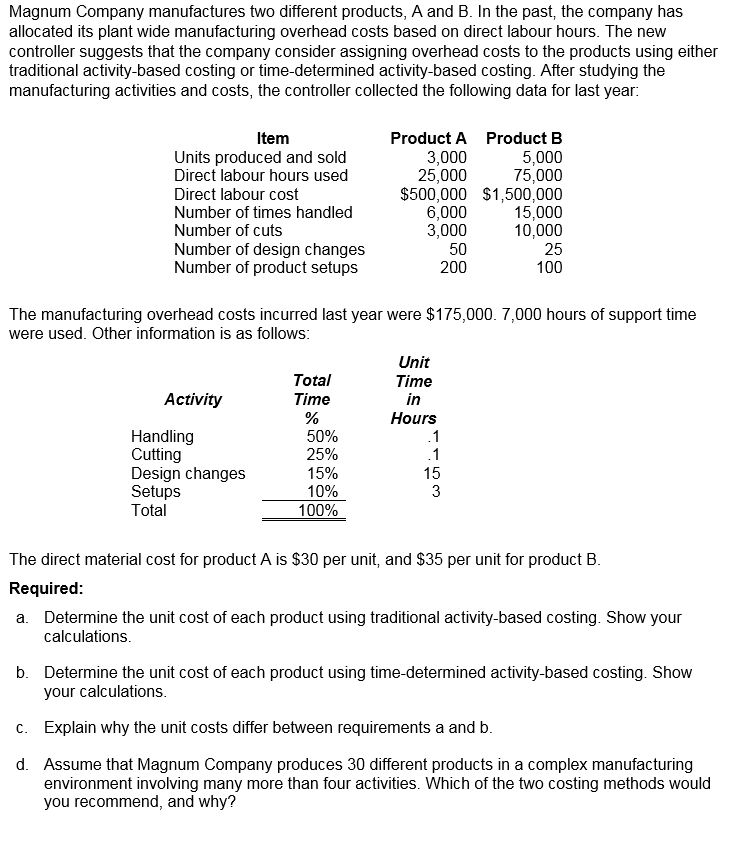

Magnum Company manufactures two different products, A and B. In the past, the company has allocated its plant wide manufacturing overhead costs based on direct labour hours. The new controller suggests that the company consider assigning overhead costs to the products using either traditional activity-based costing or time-determined activity-based costing. After studying the manufacturing activities and costs, the controller collected the following data for last year:

| Item | Product A | Product B |

| Units produced and sold | 3,000 | 5,000 |

| Direct labour hours used | 25,000 | 75,000 |

| Direct labour cost | $500,000 | $1,500,000 |

| Number of times handled | 6,000 | 15,000 |

| Number of cuts | 3,000 | 10,000 |

| Number of design changes | 50 | 25 |

| Number of product setups | 200 | 100 |

The manufacturing overhead costs incurred last year were $175,000. 7,000 hours of support time were used. Other information is as follows:

|

Activity |

Total Time % |

| Unit Time in Hours |

| Handling | 50% |

| .1 |

| Cutting | 25% |

| .1 |

| Design changes | 15% |

| 15 |

| Setups | 10% |

| 3 |

| Total | 100% |

|

|

The direct material cost for product A is $30 per unit, and $35 per unit for product B.

Required:

| a. | Determine the unit cost of each product using traditional activity-based costing. Show your calculations.

|

| b. | Determine the unit cost of each product using time-determined activity-based costing. Show your calculations.

|

| c. | Explain why the unit costs differ between requirements a and b.

|

| d. | Assume that Magnum Company produces 30 different products in a complex manufacturing environment involving many more than four activities. Which of the two costing methods would you recommend, and why?

|

Magnum Company manufactures two different products, A and B. In the past, the company has allocated its plant wide manufacturing overhead costs based on direct labour hours. The new controller suggests that the company consider assigning overhead costs to the products using either traditional activity-based costing or time-determined activity-based costing. After studying the manufacturing activities and costs, the controller collected the following data for last year: Item Product A Product B 5,000 75,000 $500,000 $1,500,000 15,000 10,000 25 100 3,000 25,000 Units produced and sold Direct labour hours used Direct labour cost Number of times handled Number of cuts Number of design changes Number of product setups 6,000 3,000 50 200 The manufacturing overhead costs incurred last year were $175,000. 7,000 hours of support time were used. Other information is as follows Unit Time in Hours Total Time Activity Handling Cutting Design changes Setups Total 25% 15% 10% 100% 15 The direct material cost for product A is $30 per unit, and $35 per unit for product B Required Determine the unit cost of each product using traditional activity-based costing. Show your calculations a. b. Determine the unit cost of each product using time-determined activity-based costing. Show your calculations C. Explain why the unit costs differ between requirements a and b d. Assume that Magnum Company produces 30 different products in a complex manufacturing environment involving many more than four activities. Which of the two costing methods would you recommend, and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started