Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Magzter Inc. Magzter, the world's largest digital newsstand, has over 12,000 magazines that can be read anytime and anywhere online. They have an impressive 75

| Magzter Inc. | ||||||

| Magzter, the world's largest digital newsstand, has over 12,000 magazines that can be read anytime and anywhere online. They have an impressive 75 million subscribers worldwide. In Canada, there are 400,000 subscribers who buy the premium package for $90 per year. Ginny Brown, the VP Marketing for Canada, was concerned about the high attrition rate of these Canadian subscribers. | ||||||

| To address this, she developed a retention program with a cost per retained customer of $10 in YEAR 1, $10 in YEAR 2, and $10 in YEAR 3. | ||||||

| Because she was a disciplined marketer, she tested this retention program with 20,000 new customers and set aside an additional 10,000 customers as a control group. The retention rates for the control group and the test group are provided in the tables below. Complete both tables below and calculate the Average LTV per customer for the control group as well as the test group. | ||||||

| The discount rates to be applied are: | ||||||

| Control | Test | Note: The discount rates for the Test are higher than the Control because of the higher risk associated with the Test program. | ||||

| Year 1: | 1.00 | 1.00 | ||||

| Year 2: | 1.05 | 1.07 | ||||

| Year 3: | 1.10 | 1.14 | ||||

| ` | ||||||

| QUESTIONS | ||||||

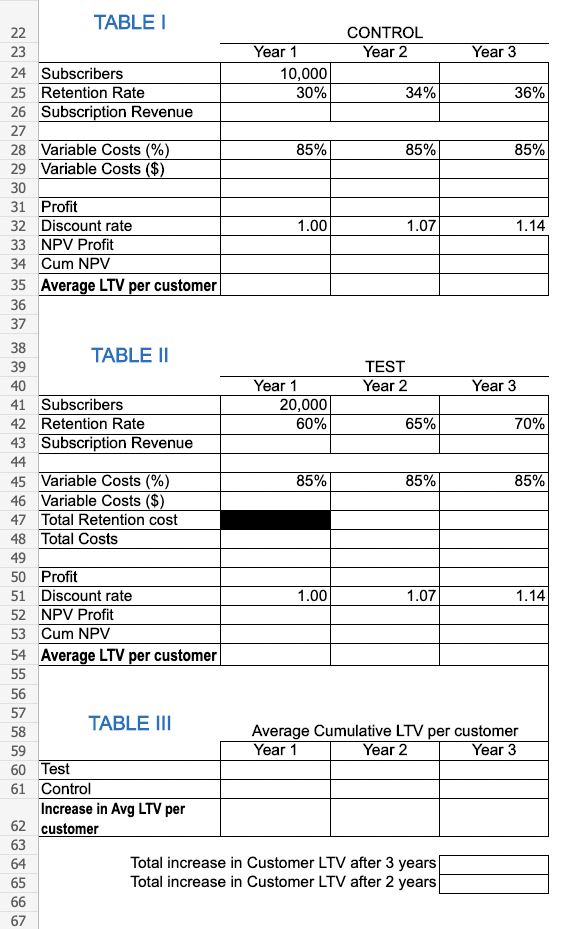

| 1. Please complete TABLE I and TABLE II below to determine the average LTV per customer. | ||||||

| 2. Complete TABLE III. Based on these results, should Ginny: | ||||||

| (a) Roll the program out to all 400,000 subscribers. | ||||||

| (b) Decide not to roll out the program | ||||||

| (c) Other (please provide details) | ||||||

| 3. Based on your recommendation, what would be the total NPV if this program was rolled out to all 400,000 customers? | ||||||

Please follow the same approach for calculating retained subscribers as we did in class. i.e. - The number of subscribers in Year 2 is equal to the number of subscribers in Year 1 times the retention rate that appears below the number of subscribers in Year 1. | ||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started