Answered step by step

Verified Expert Solution

Question

1 Approved Answer

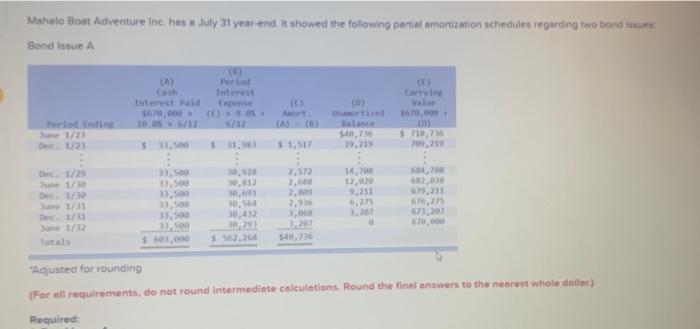

Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A Period Ending

Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A Period Ending June 1/23 Dec. 1/23 Dec. 1/29 June 1/30 Dec. 1/30 June 1/31 Dec. 1/31 June 1/32 Totals (A) Cash Interest Paid $670,000 * 10.0% 6/12 $ 33,500 33,500 33,500 33,500 33,500 33,500 33,500 $ 603,000 (B) Period Interest Expense (E) * 9.0% * 6/12 $ 31,983 30,928 30,812 30,691 30,564 30,432 30,293 $ 562,264 Amort. (A) - (B) $ 1,517 2,572 2,688 2,809 2,936 3,068 3,207 $40,736 (D) Unamortized Balance $40,736 39,219 14,708 12,020 9,211 6,275 3,207 Carrying Value $670,000+ (D) $ 710,736 709,219 684,708 682,020 679,211 676,275 673,207 670,000 "Adjusted for rounding (For all requirements, do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Required:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started