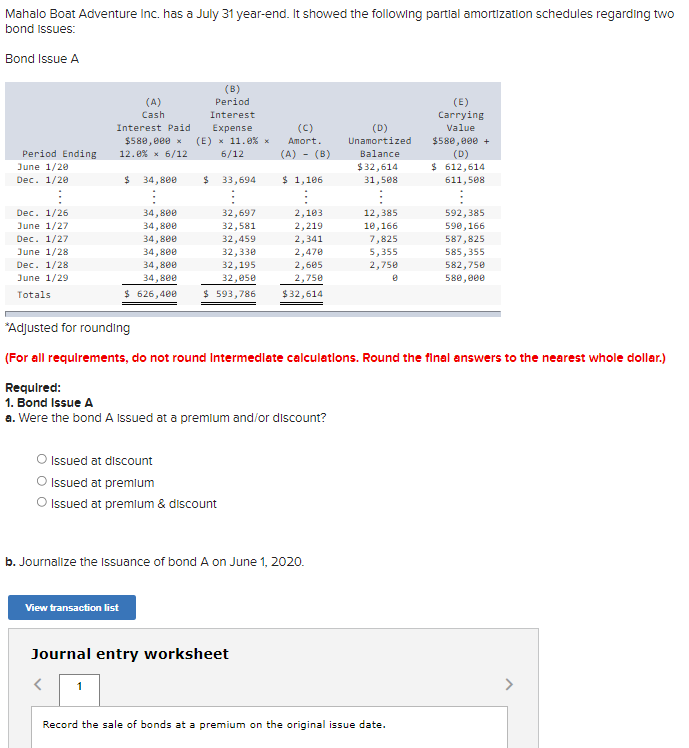

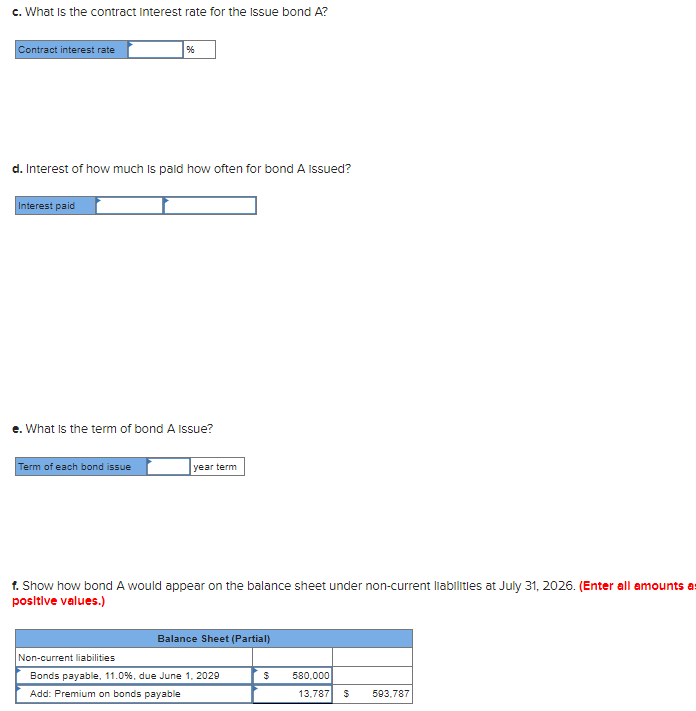

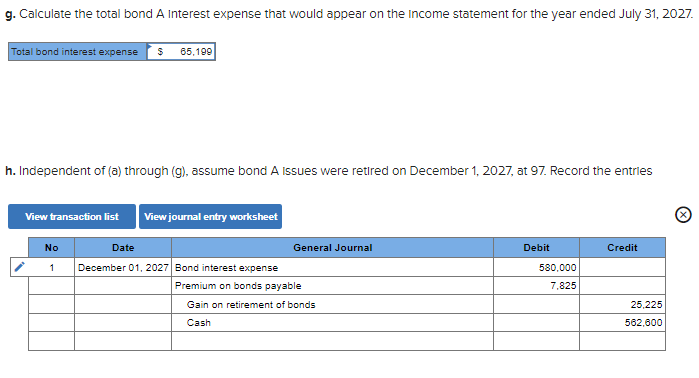

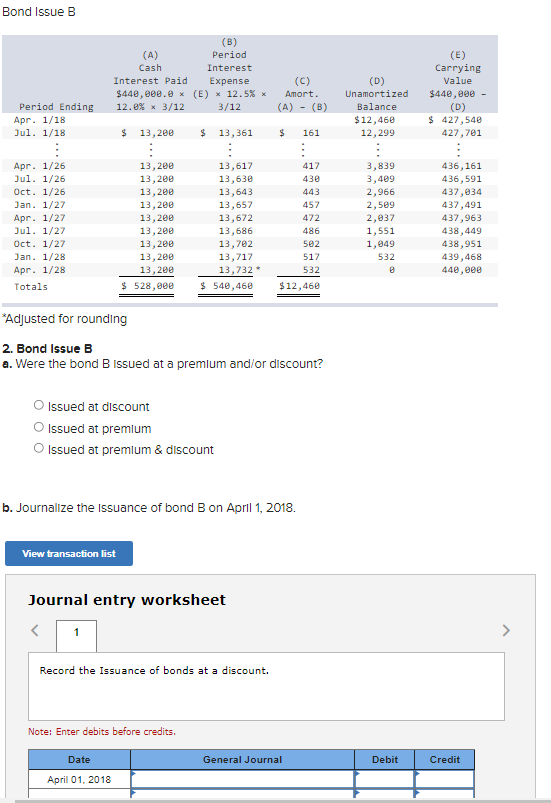

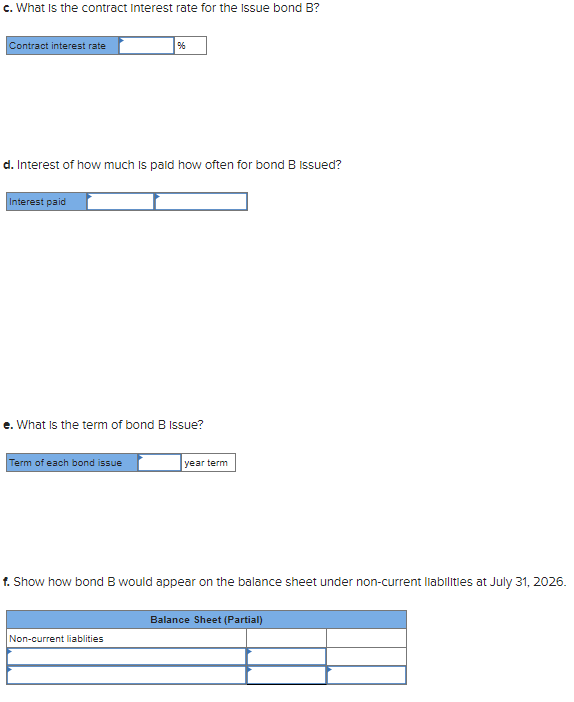

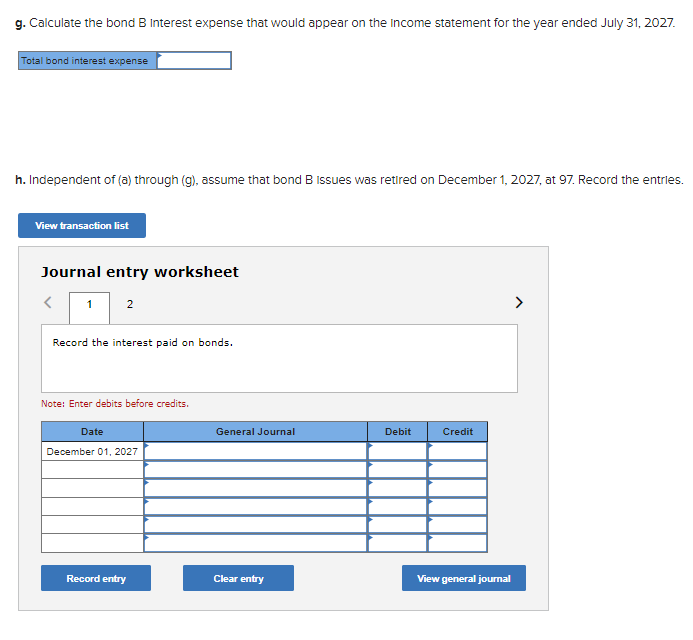

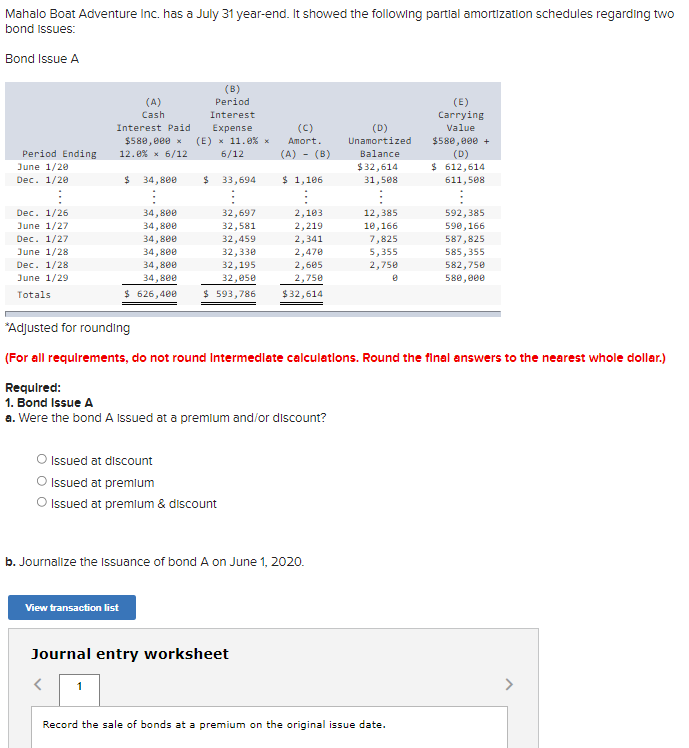

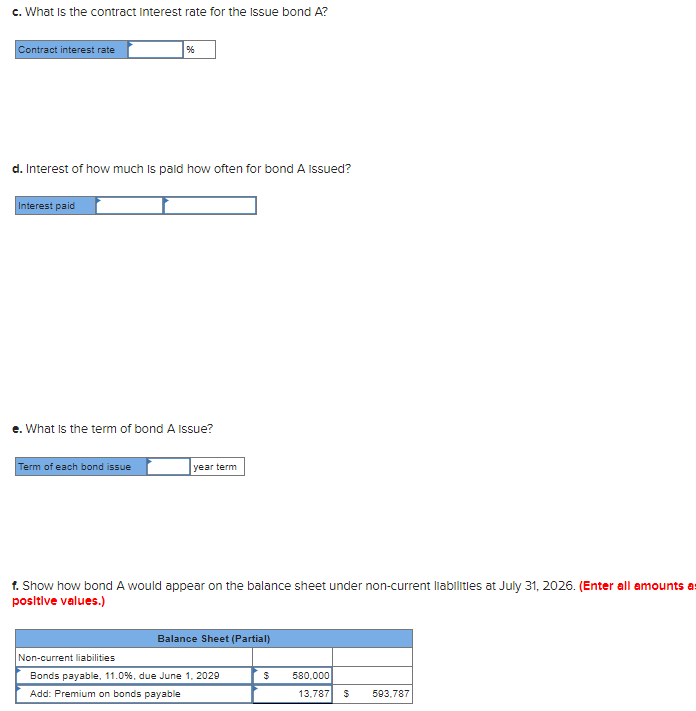

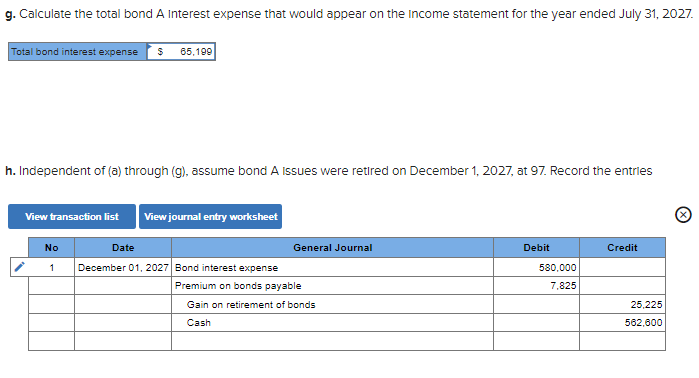

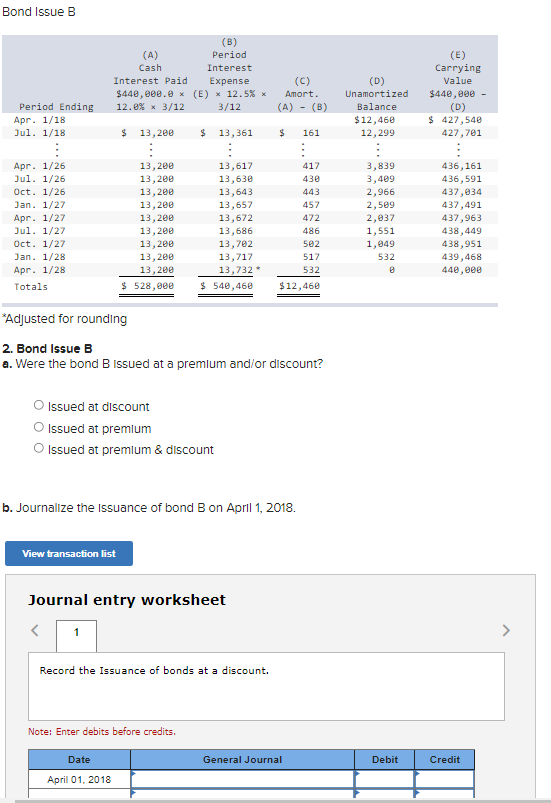

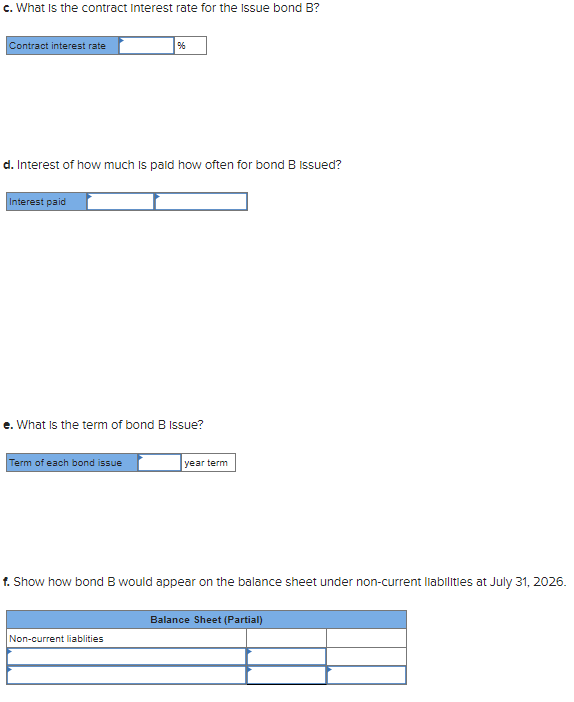

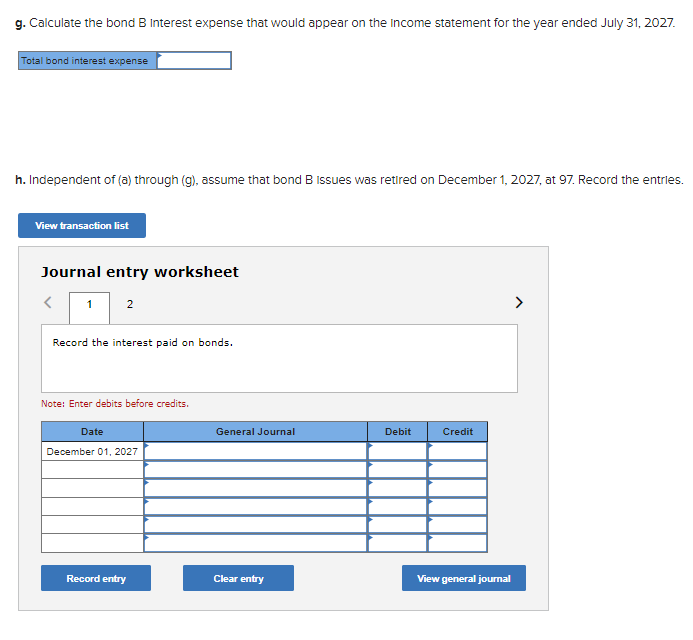

Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond Issues: Bond Issue A (A) Cash Interest Paid $589,80 x 12.0% * 6/12 (B) Period Interest Expense (E) * 11.0% x 6/12 (C) Amort. (A) - (B) (E) Carrying Value $589,880 + (D) $ 612,614 611,508 (D) Unamortized Balance $32,614 31,508 Period Ending June 1/20 Dec. 1/20 $ 34,800 $ 33,694 $ 1,106 Dec. 1/26 June 1/27 Dec. 1/27 June 1/28 Dec. 1/28 June 1/29 Totals 34,800 34,800 34,800 34,800 34,800 34,800 $ 626,400 32,697 32,581 32,459 32,330 32,195 32,050 $ 593,786 2,103 2,219 2,341 2,479 2,685 2,750 $32,614 12,385 10,166 7,825 5,355 2,750 592,385 590,166 587,825 585,355 582,750 580,000 *Adjusted for rounding (For all requirements, do not round Intermediate calculations. Round the final answers to the nearest whole dollar.) Required: 1. Bond Issue A a. Were the bond A issued at a premium and/or discount? Issued at discount Issued at premium Issued at premium & discount b. Journalize the issuance of bond A on June 1, 2020. View transaction list Journal entry worksheet Record the sale of bonds at a premium on the original issue date. c. What is the contract Interest rate for the issue bond A? Contract interest rate % d. Interest of how much is paid how often for bond A issued? Interest paid e. What is the term of bond A issue? Term of each bond issue year term t. Show how bond A would appear on the balance sheet under non-current liabilities at July 31, 2026. (Enter all amounts a positive values.) Balance Sheet (Partial) Non-current liabilities Bonds payable, 11.0%, due June 1, 2029 $ Add: Premium on bonds payable 580.000 13.787 $ 503.787 g. Calculate the total bond A Interest expense that would appear on the Income statement for the year ended July 31, 2027. Total bond interest expense $ 65,199 h. Independent of (a) through (g), assume bond A issues were retired on December 1, 2027, at 97. Record the entries View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 December 01, 2027 Bond interest expense Premium on bonds payable 580,000 7,825 25,225 Gain on retirement of bonds Cash 562,600 Bond Issue B (B) (A) Period Cash Interest Interest Paid Expense $440,000. * (E) X 12.5% x 12.0% x 3/12 3/12 (C) Amort. (A) - (B) $ Period Ending Apr. 1/18 Jul. 1/18 : Apr. 1/26 Jul. 1/26 Oct. 1/26 Jan. 1/27 Apr. 1/27 Jul. 1/27 Oct. 1/27 Jan. 1/28 Apr. 1/28 Totals $ 13,200 : 13, 2ee 13,200 13,200 13,200 13,200 13,200 13, 2ee 13,200 13,200 $ 528,000 $ 13,361 : 13,617 13,630 13,643 13,657 13,672 13,686 13,702 13,717 13,732 $ 540,460 161 : 417 430 443 457 472 486 502 517 532 (D) Unamortized Balance $12,460 12,299 : 3,839 3,409 2,966 2,509 2,037 551 1,849 532 (E) Carrying Value $440,890 - (D) $ 427,540 427,701 : 436,161 436,591 437,234 437,491 437,963 49 438,951 439,468 440,000 $12,460 *Adjusted for rounding 2. Bond Issue B a. Were the bond B issued at a premlum and/or discount? Issued at discount Issued at premlum Issued at premlum & discount b. Journalize the issuance of bond B on April 1, 2018. View transaction list Journal entry worksheet