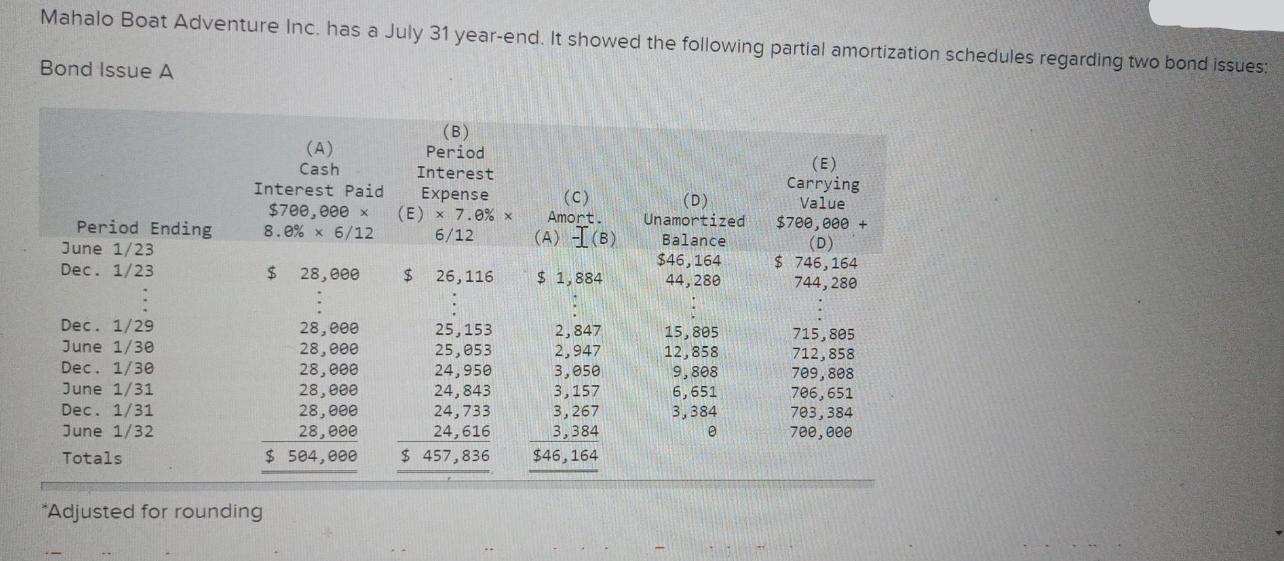

Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A Period

Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A Period Ending June 1/23 Dec. 1/23 Dec. 1/29 June 1/30 Dec. 1/30 June 1/31 Dec. 1/31 June 1/32 Totals (A) Cash Interest Paid $700,000 x 8.0% 6/12 *Adjusted for rounding $ 28,000 28,000 28,000 28,000 28,000 28,000 28,000 $ 504,000 (B) Period Interest Expense (E) x 7.0% x 6/12 $ 26,116 25,153 25,053 24,950 24,843 24,733 24,616 $ 457,836 (C) Amort. (A) I(B) $ 1,884 2,847 2,947 3,050 3,157 3,267 3,384 $46,164 (D) Unamortized Balance $46,164 44,280 15,805 12,858 9,808 6,651 3,384 0 (E) Carrying Value $700,000 + (D) $ 746,164 744,280 715,805 712,858 709,808 706,651 703,384 700,000 Required: 1. Bond Issue A a. Were the bond A issued at a premium and/or discount? b. Journalize the issuance of bond A on June 1, 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Bond Issue A a Were the bond A issued at a premium andor discount To determine if the bond was iss...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started