Mail - Rugeethaan Asol X Mock FNCE 3P93 Final Ex M MHE Reader (41) FIN 401 - Net Adva x Messenger x G NPV

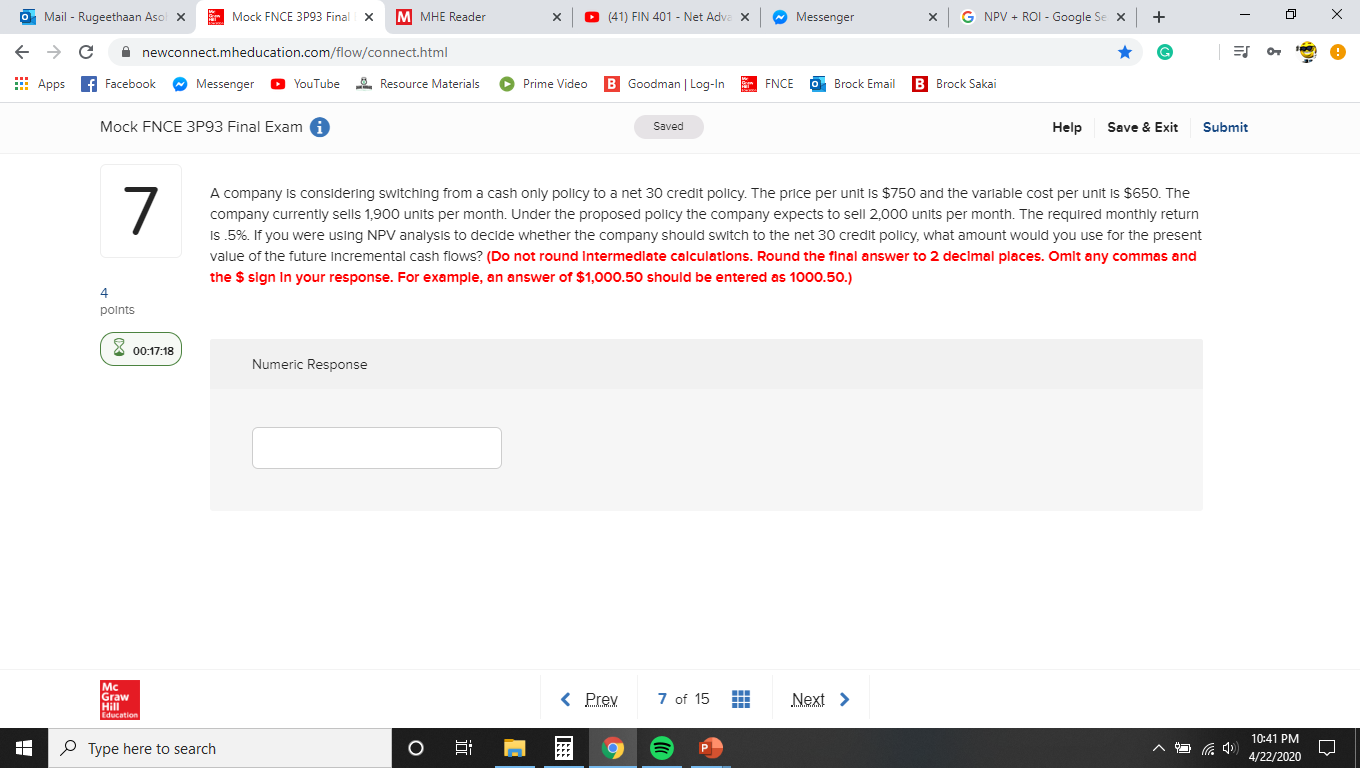

Mail - Rugeethaan Asol X Mock FNCE 3P93 Final Ex M MHE Reader (41) FIN 401 - Net Adva x Messenger x G NPV + ROI - Google Sex + C newconnect.mheducation.com/flow/connect.html YouTube Resource Materials Prime Video B Goodman | Log-In FNCE Brock Email B Brock Sakai Saved Apps f Facebook Messenger Mock FNCE 3P93 Final Exam EJ Help Save & Exit Submit 7 A company is considering switching from a cash only policy to a net 30 credit policy. The price per unit is $750 and the variable cost per unit is $650. The company currently sells 1,900 units per month. Under the proposed policy the company expects to sell 2,000 units per month. The required monthly return Is .5%. If you were using NPV analysis to decide whether the company should switch to the net 30 credit policy, what amount would you use for the present value of the future incremental cash flows? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commas and the $ sign in your response. For example, an answer of $1,000.50 should be entered as 1000.50.) 4 points 00:17:18 Numeric Response Mc Graw Hill Education Type here to search O < Prev 7 of 15 Next > 10:41 PM 4/22/2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Current monthly sales 1900 units Expected monthly sales with credit policy 2000 units Pr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started