Answered step by step

Verified Expert Solution

Question

1 Approved Answer

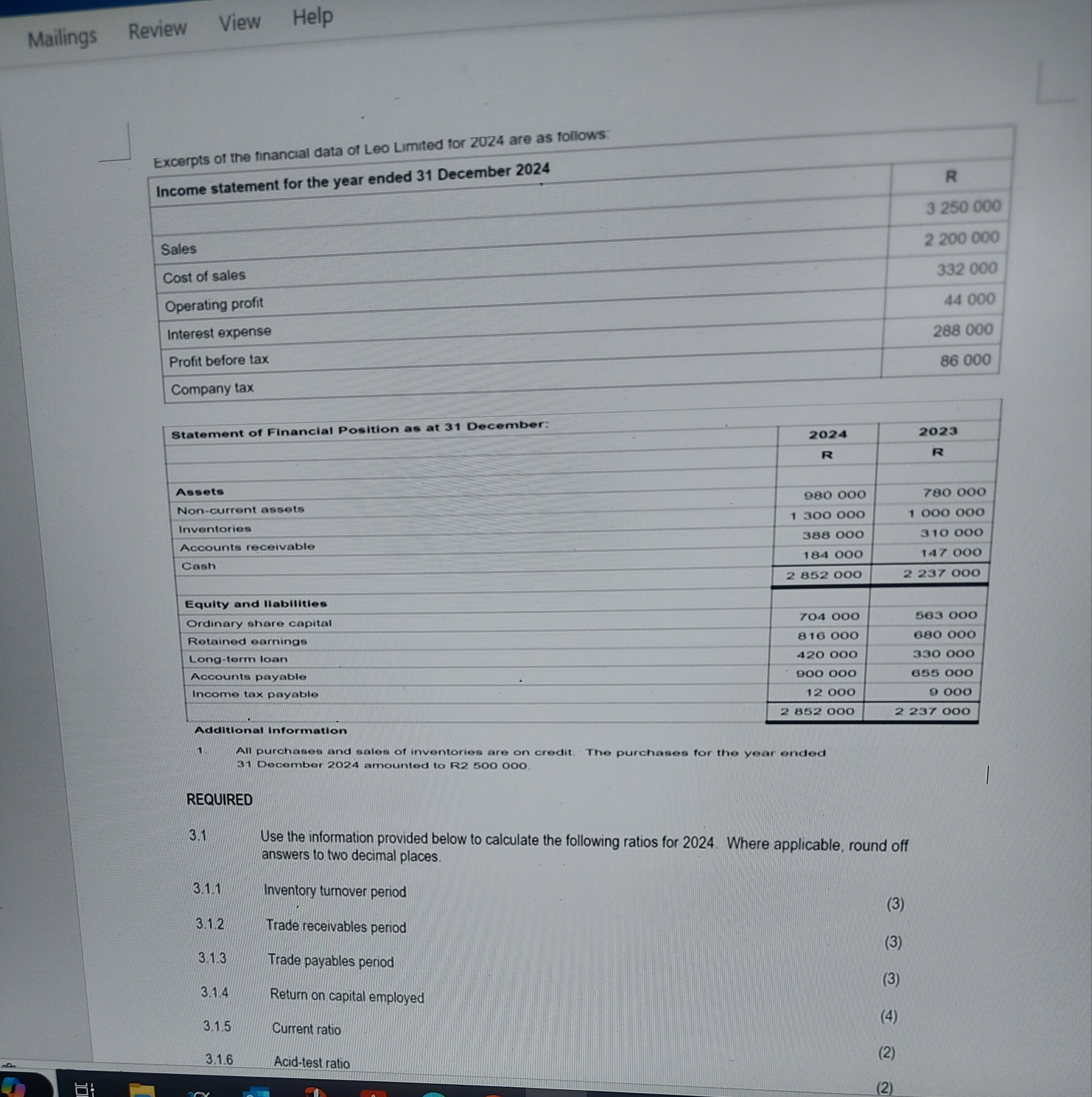

Mailings Review View Help Excerpts of the financial data of Leo Limited for 2024 are as follows. Income statement for the year ended 31

Mailings Review View Help Excerpts of the financial data of Leo Limited for 2024 are as follows. Income statement for the year ended 31 December 2024 Sales Cost of sales Operating profit Interest expense Profit before tax Company tax Statement of Financial Position as at 31 December: Assets Non-current assets Inventorios Accounts receivable Cash Equity and liabilities Ordinary share capital Retained earnings Long-term loan Accounts payable Income tax payable R 3 250 000 2 200 000 332 000 44.000 288 000 86 000 2024 R 2023 R 980 000 1 300 000 388 000 184 000 2 852 000 780 000 1 000 000 310 000 147 000 2 237 000 704 000 816 000 420 000 900 000 12 000 563 000 680 000 330 000 655 000 9.000 2 852 000 2 237 000 Additional Information All purchases and sales of inventories are on credit. The purchases for the year ended 31 December 2024 amounted to R2 500 000. REQUIRED 3.1 Use the information provided below to calculate the following ratios for 2024. Where applicable, round off answers to two decimal places. 3.1.1 Inventory turnover period 3.1.2 Trade receivables period 3.1.3 Trade payables period 3.1.4 Return on capital employed 3.1.5 Current ratio 3.1.6 Acid-test ratio (3) (3) (3) (4) (2) (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the ratios requested 311 Inventory turnover period Inventory turnover period Average In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started