Answered step by step

Verified Expert Solution

Question

1 Approved Answer

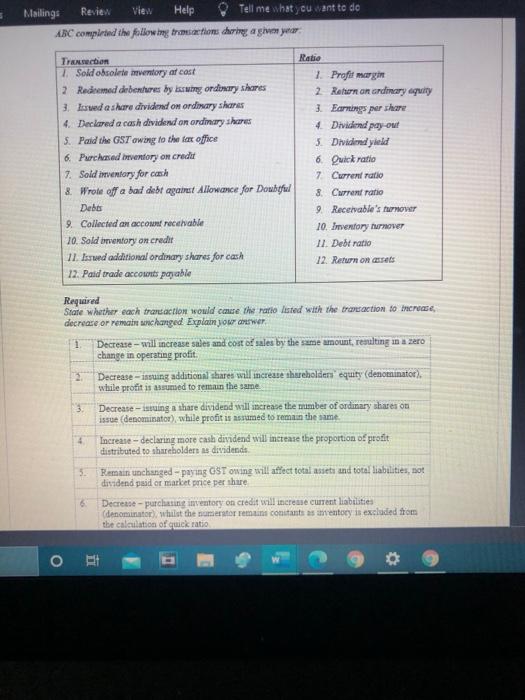

Mailings Review View Help Tell me what you want to do ABC completed the following fromation chering a give year Ratio Transaction 1 Sold obsolete

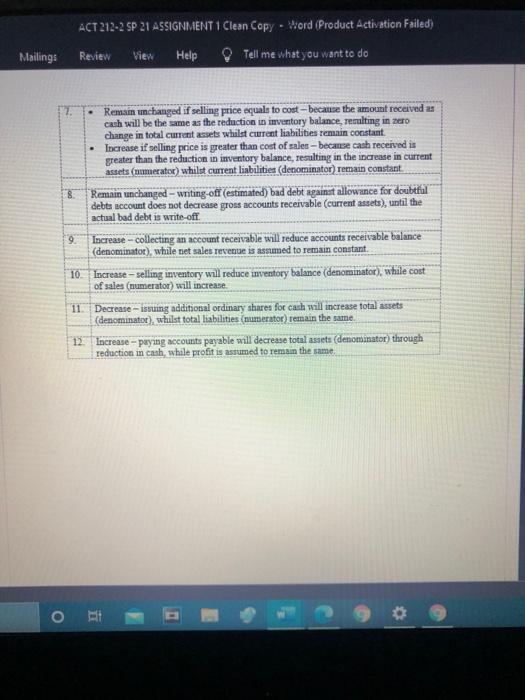

Mailings Review View Help Tell me what you want to do ABC completed the following fromation chering a give year Ratio Transaction 1 Sold obsolete twentory at cost 2 Redeemed drbentures by issuing ordinary Shares 3. Loud a share dividend on ordinary shares 4. Declared a casi dividend on ordinary shares 5. Pald the GST owing to the fac office 6. Purchased brventory on credit 7. Sold inventory for cash 8. Wrole off a bad debt against Allowance for Doubtful Debes 9. Collected an account recevable 10. Sold bnventory on credit 11 Issued additional ordinary shares for cash 12. Pald trade accounts payable 1. Profit margin 2. Return on ordinary equity 3. Earnings per share 4. Dividend pay out 5. Dividid yield 6 Quick ratio 7 Current ratio 8. Current ratio 9. Receivable's turno 10. Imentory turnover 11. Dedt ratio 12. Return on se Required State whether each transaction would cause the ratio listed with the transaction to increase decrease or remain unchanged Explan yow awer Decrease - will increase sules and cost of sales by the same amount, resulting in a zero change in operating prodit Decrease insuing additional shares will increase thareholders equity (denominator whuile profit is assumed to remain the same 3 Decreate isuing a share dividend will increase the mmber of ordinary shares on issue (denominator) while profit is assumed to remain the same 4 Increase - declaring more cash dividend will increase the proportion of profit distributed to shareholders as dividends 5. Pemain unchanged - paying GST owing will affect total assets and total liabilities, not dividend paid or market price per share 6 Decrease - purchasing inventory on credit will increase current liabilities (denominator, whilst the numerator remains constants as mentory is excluded from the calculation of cuck ratio o ACT 212-2 SP 21 ASSIGNMENT 1 Clean Copy - Word (Product Activation Failed) Mailings Review View Help Tell me what you want to do Remain unchanged if selling price equal to cost --because the amount received as cach will be the same as the reduction in inventory balance, resulting in zero change in total current assets whilst current liabilities remain constant Increase if selling price is greater than cost of sales - becanze cash received is greater than the reduction in inventory balance, resulting in the increase in current assets (numerator) whilst current liabilities (denominator) remain constant 8 Remain unchanged - writing-off (estimated) bad debt against allowance for doubtful debts account does not decrease gross accounts receivable (current assets), until the actual bad debt is write-off 9 Increase - collecting an account receivable will reduce accounts receivable balance (denominator) while net sales revenue is assumed to remain constant. 10 Increase selling inventory will reduce inventory balance (denominator), while cost of sales (mumerator) will increase 11 Decrease - issuing additional ordinary shares for cash will increase total assets (denominator), whilst total liabilities (numerator) remain the same 12. Increase - paying accounts payable will decrease total assets (denominator) through reduction in cash, while profit is assumed to remain the same O 7

Mailings Review View Help Tell me what you want to do ABC completed the following fromation chering a give year Ratio Transaction 1 Sold obsolete twentory at cost 2 Redeemed drbentures by issuing ordinary Shares 3. Loud a share dividend on ordinary shares 4. Declared a casi dividend on ordinary shares 5. Pald the GST owing to the fac office 6. Purchased brventory on credit 7. Sold inventory for cash 8. Wrole off a bad debt against Allowance for Doubtful Debes 9. Collected an account recevable 10. Sold bnventory on credit 11 Issued additional ordinary shares for cash 12. Pald trade accounts payable 1. Profit margin 2. Return on ordinary equity 3. Earnings per share 4. Dividend pay out 5. Dividid yield 6 Quick ratio 7 Current ratio 8. Current ratio 9. Receivable's turno 10. Imentory turnover 11. Dedt ratio 12. Return on se Required State whether each transaction would cause the ratio listed with the transaction to increase decrease or remain unchanged Explan yow awer Decrease - will increase sules and cost of sales by the same amount, resulting in a zero change in operating prodit Decrease insuing additional shares will increase thareholders equity (denominator whuile profit is assumed to remain the same 3 Decreate isuing a share dividend will increase the mmber of ordinary shares on issue (denominator) while profit is assumed to remain the same 4 Increase - declaring more cash dividend will increase the proportion of profit distributed to shareholders as dividends 5. Pemain unchanged - paying GST owing will affect total assets and total liabilities, not dividend paid or market price per share 6 Decrease - purchasing inventory on credit will increase current liabilities (denominator, whilst the numerator remains constants as mentory is excluded from the calculation of cuck ratio o ACT 212-2 SP 21 ASSIGNMENT 1 Clean Copy - Word (Product Activation Failed) Mailings Review View Help Tell me what you want to do Remain unchanged if selling price equal to cost --because the amount received as cach will be the same as the reduction in inventory balance, resulting in zero change in total current assets whilst current liabilities remain constant Increase if selling price is greater than cost of sales - becanze cash received is greater than the reduction in inventory balance, resulting in the increase in current assets (numerator) whilst current liabilities (denominator) remain constant 8 Remain unchanged - writing-off (estimated) bad debt against allowance for doubtful debts account does not decrease gross accounts receivable (current assets), until the actual bad debt is write-off 9 Increase - collecting an account receivable will reduce accounts receivable balance (denominator) while net sales revenue is assumed to remain constant. 10 Increase selling inventory will reduce inventory balance (denominator), while cost of sales (mumerator) will increase 11 Decrease - issuing additional ordinary shares for cash will increase total assets (denominator), whilst total liabilities (numerator) remain the same 12. Increase - paying accounts payable will decrease total assets (denominator) through reduction in cash, while profit is assumed to remain the same O 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started