Answered step by step

Verified Expert Solution

Question

1 Approved Answer

main subject is Taxation accounting 2. Mr. George is a boarding school teacher. His job requires him to live in a house within the school's

main subject is Taxation accounting

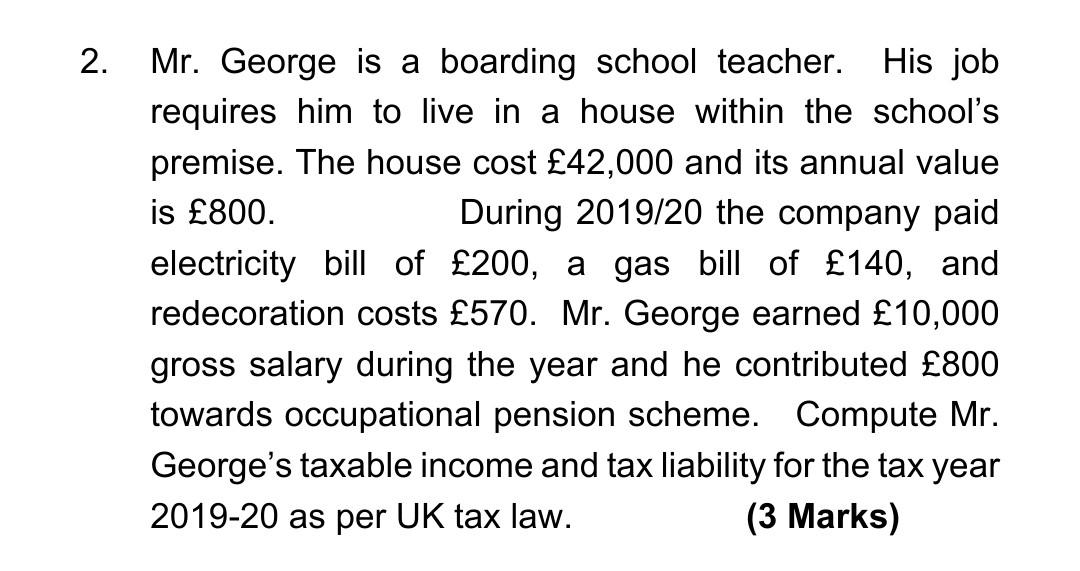

2. Mr. George is a boarding school teacher. His job requires him to live in a house within the school's premise. The house cost 42,000 and its annual value is 800. During 2019/20 the company paid electricity bill of 200, a gas bill of 140, and redecoration costs 570. Mr. George earned 10,000 gross salary during the year and he contributed 800 towards occupational pension scheme. Compute Mr. George's taxable income and tax liability for the tax year 2019-20 as per UK tax lawStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started