Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mainly need help with questions 3-7. REPORT 3: Consumers Cable Edna Black, CEO of Consumers Cable Ltd. (CCL) is looking at two capital project designed

Mainly need help with questions 3-7.

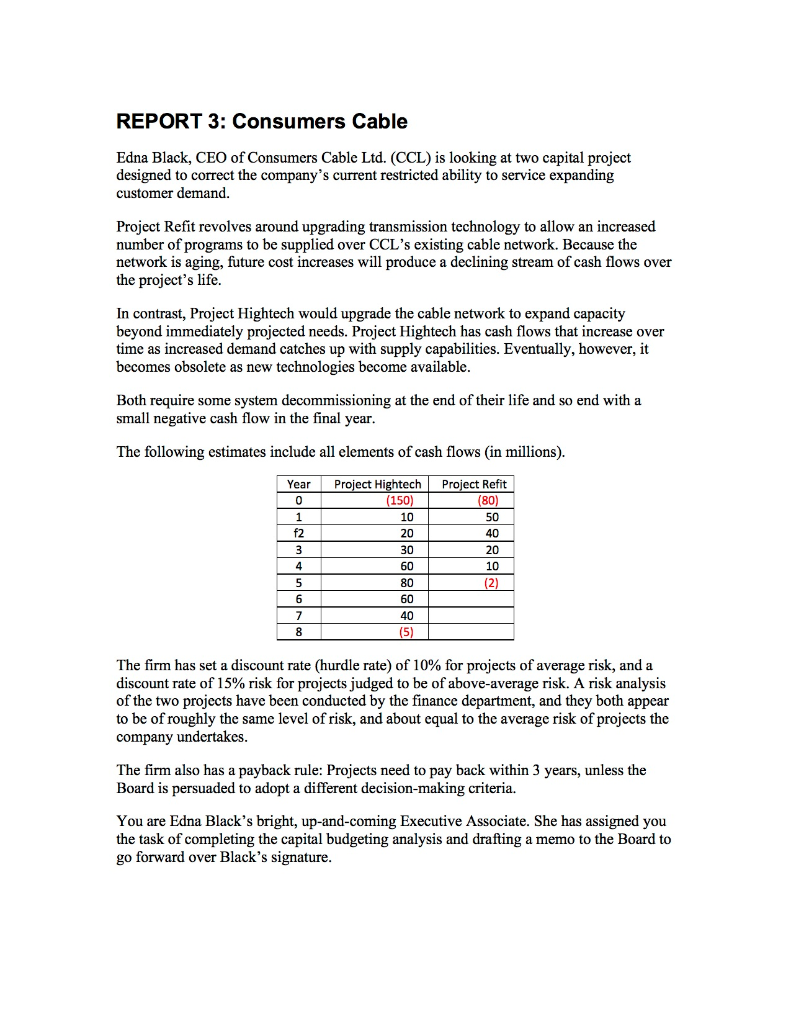

REPORT 3: Consumers Cable Edna Black, CEO of Consumers Cable Ltd. (CCL) is looking at two capital project designed to correct the company's current restricted ability to service expanding customer demand. Project Refit revolves around upgrading transmission technology to allow an increased number of programs to be supplied over CCL's existing cable network. Because the network is aging, future cost increases will produce a declining stream of cash flows over the project's life. In contrast, Project Hightech would upgrade the cable network to expand capacity beyond immediately projected needs. Project Hightech has cash flows that increase over time as increased demand catches up with supply capabilities. Eventually, however, it becomes obsolete as new technologies become available. Both require some system decommissioning at the end of their life and so end with a small negative cash flow in the final year. The following estimates include all elements of cash flows (in millions). Project Hightech (150) 10 20 Project Refit (80) 50 40 20 30 60 (2) 40 (5) The firm has set a discount rate (hurdle rate) of 10% for projects of average risk, and a discount rate of 15% risk for projects judged to be of above-average risk. A risk analysis of the two projects have been conducted by the finance department, and they both appear to be of roughly the same level of risk, and about equal to the average risk of projects the company undertakes. The firm also has a payback rule: Projects need to pay back within 3 years, unless the Board is persuaded to adopt a different decision-making criteria. You are Edna Black's bright, up-and-coming Executive Associate. She has assigned you the task of completing the capital budgeting analysis and drafting a memo to the Board to go forward over Black's signature. Prepare the memo according to the business memo format you've learnt in your Business Communications class. In the memo, address the following questions: 1. State the rationale for capital budgeting and how it links to the CEO's overall goal for all projects-maximizing the value of the firm. 2. Provide a rationale for why, in your view these projects are either independent or mutually exclusive. Could the company do both? As nearly as you can determine, should they? 3. Use the NPV method to analyze the two projects. Which project(s) should the firm undertake according to this method? 4. Use the IRR method to analyze the projects. Which project(s) should the firm undertake according to this method? 5. Calculate the payback period for each project. Which project(s) should the firm undertake according to this method? 6. Explain why each of these methods may (may not) provide good guidance in this instance. 7. Makeand justifya recommended course of action. 8. Explain why your recommendation would (or would not) be different if the CEO or the Board decide that both projects are of above-average risk. 9. Explain why your recommendation would (or would not) be different if the CEO or the Board decide that Project Hightech is above-average risk, while Project Retrofit is of average risk. You do not need to address these questions one by one. But you need to make sure your memo addresses all of them. As always, textbooks are available in the office. And, as always, put a Turabian/Chicago style cover page on top of the memo. 2020 Winter page 2 of 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started