Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maisie died on 11 September 2022. She had been married for many years to Bruce who had died on 5 March 2017. Bruce Under the

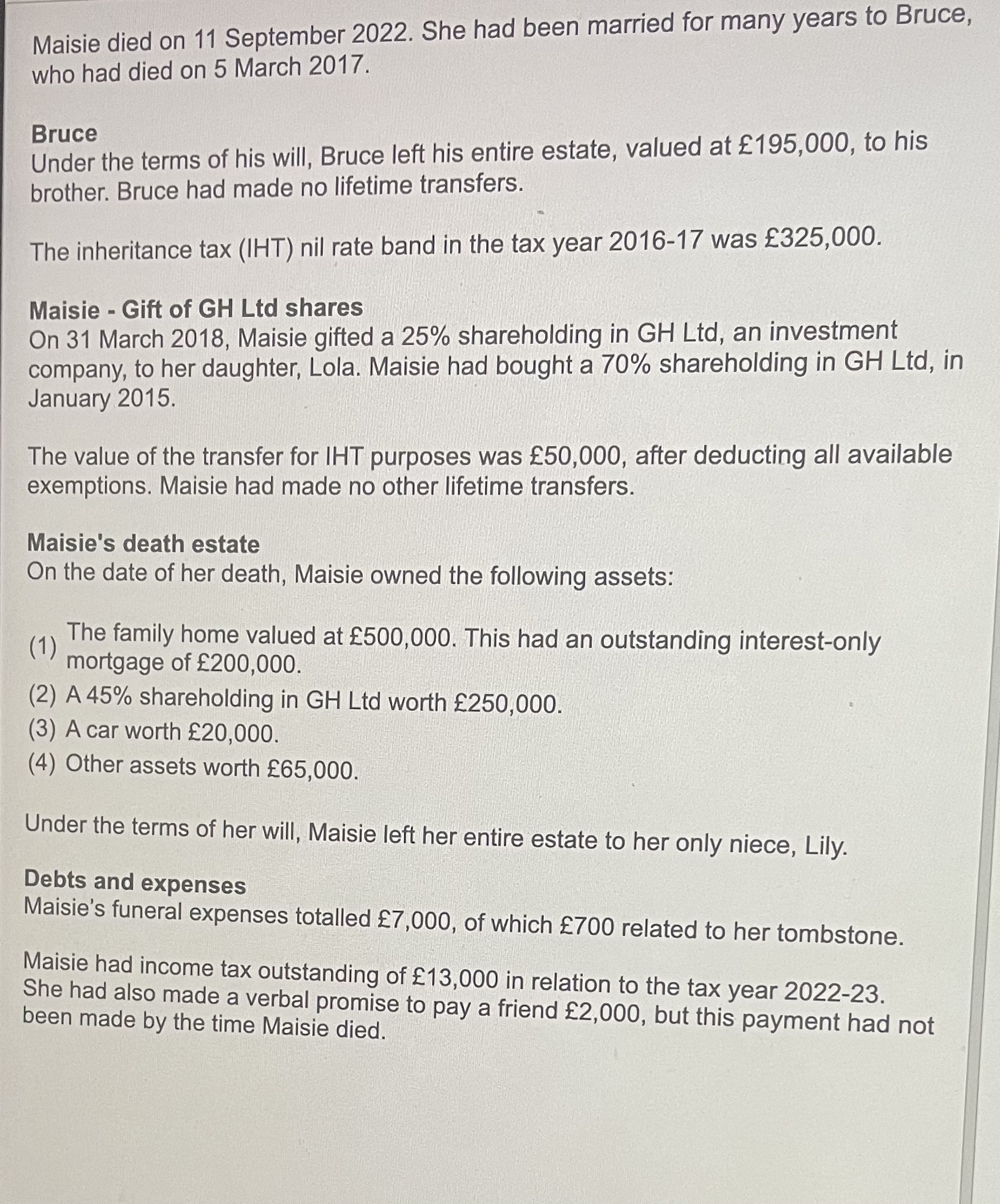

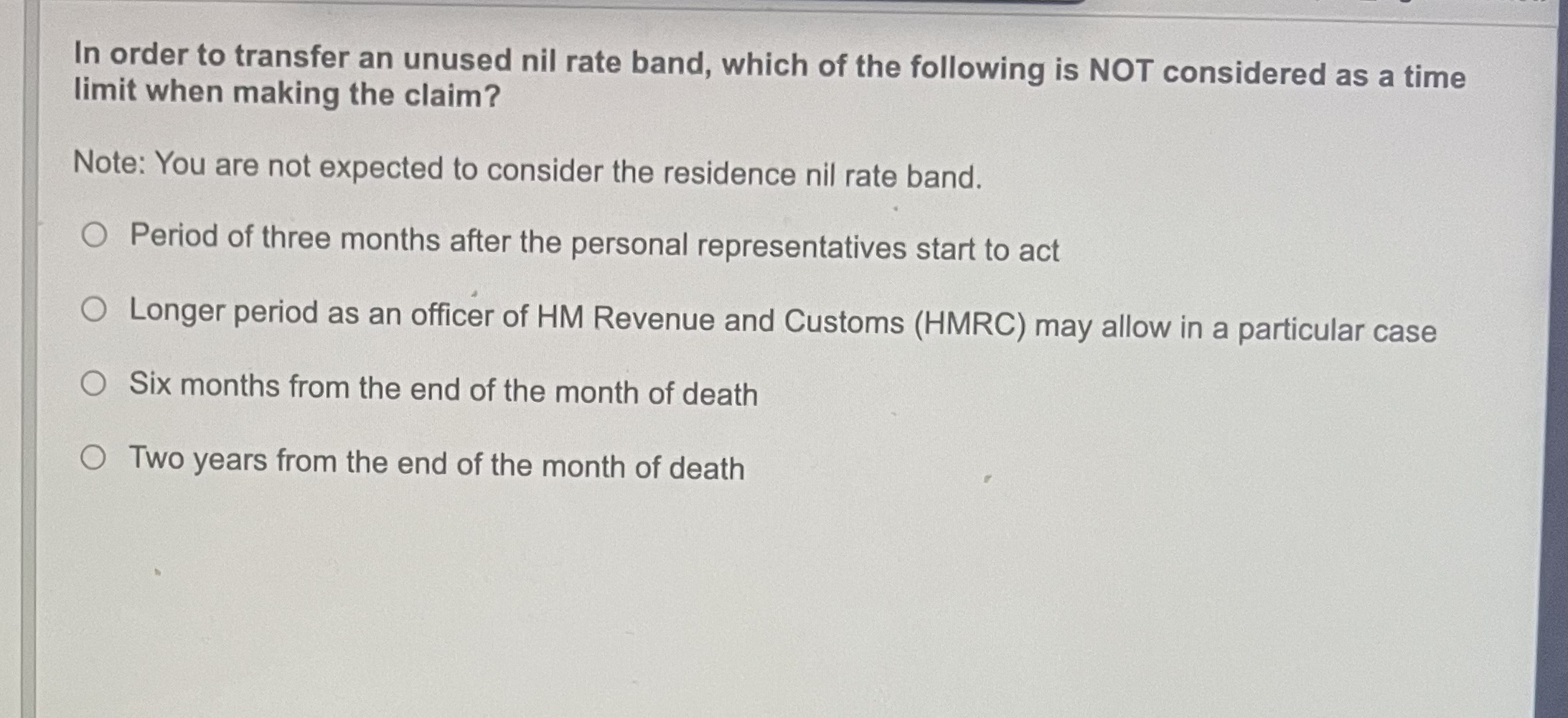

Maisie died on 11 September 2022. She had been married for many years to Bruce who had died on 5 March 2017. Bruce Under the terms of his will, Bruce left his entire estate, valued at 195,000, to his brother. Bruce had made no lifetime transfers. The inheritance tax (IHT) nil rate band in the tax year 2016-17 was 325,000. Maisie - Gift of GH Ltd shares On 31 March 2018, Maisie gifted a 25\% shareholding in GH Ltd, an investment company, to her daughter, Lola. Maisie had bought a 70% shareholding in GH Ltd, in January 2015. The value of the transfer for IHT purposes was 50,000, after deducting all available exemptions. Maisie had made no other lifetime transfers. Maisie's death estate On the date of her death, Maisie owned the following assets: (1) The family home valued at 500,000. This had an outstanding interest-only mortgage of 200,000. (2) A 45\% shareholding in GH Ltd worth 250,000. (3) A car worth 20,000. (4) Other assets worth 65,000. Under the terms of her will, Maisie left her entire estate to her only niece, Lily. Debts and expenses Maisie's funeral expenses totalled 7,000, of which 700 related to her tombstone. Maisie had income tax outstanding of 13,000 in relation to the tax year 2022-23. She had also made a verbal promise to pay a friend 2,000, but this payment had not been made by the time Maisie died. In order to transfer an unused nil rate band, which of the following is NOT considered as a time limit when making the claim? Note: You are not expected to consider the residence nil rate band. Period of three months after the personal representatives start to act Longer period as an officer of HM Revenue and Customs (HMRC) may allow in a particular case Six months from the end of the month of death Two years from the end of the month of death Maisie died on 11 September 2022. She had been married for many years to Bruce who had died on 5 March 2017. Bruce Under the terms of his will, Bruce left his entire estate, valued at 195,000, to his brother. Bruce had made no lifetime transfers. The inheritance tax (IHT) nil rate band in the tax year 2016-17 was 325,000. Maisie - Gift of GH Ltd shares On 31 March 2018, Maisie gifted a 25\% shareholding in GH Ltd, an investment company, to her daughter, Lola. Maisie had bought a 70% shareholding in GH Ltd, in January 2015. The value of the transfer for IHT purposes was 50,000, after deducting all available exemptions. Maisie had made no other lifetime transfers. Maisie's death estate On the date of her death, Maisie owned the following assets: (1) The family home valued at 500,000. This had an outstanding interest-only mortgage of 200,000. (2) A 45\% shareholding in GH Ltd worth 250,000. (3) A car worth 20,000. (4) Other assets worth 65,000. Under the terms of her will, Maisie left her entire estate to her only niece, Lily. Debts and expenses Maisie's funeral expenses totalled 7,000, of which 700 related to her tombstone. Maisie had income tax outstanding of 13,000 in relation to the tax year 2022-23. She had also made a verbal promise to pay a friend 2,000, but this payment had not been made by the time Maisie died. In order to transfer an unused nil rate band, which of the following is NOT considered as a time limit when making the claim? Note: You are not expected to consider the residence nil rate band. Period of three months after the personal representatives start to act Longer period as an officer of HM Revenue and Customs (HMRC) may allow in a particular case Six months from the end of the month of death Two years from the end of the month of death

Maisie died on 11 September 2022. She had been married for many years to Bruce who had died on 5 March 2017. Bruce Under the terms of his will, Bruce left his entire estate, valued at 195,000, to his brother. Bruce had made no lifetime transfers. The inheritance tax (IHT) nil rate band in the tax year 2016-17 was 325,000. Maisie - Gift of GH Ltd shares On 31 March 2018, Maisie gifted a 25\% shareholding in GH Ltd, an investment company, to her daughter, Lola. Maisie had bought a 70% shareholding in GH Ltd, in January 2015. The value of the transfer for IHT purposes was 50,000, after deducting all available exemptions. Maisie had made no other lifetime transfers. Maisie's death estate On the date of her death, Maisie owned the following assets: (1) The family home valued at 500,000. This had an outstanding interest-only mortgage of 200,000. (2) A 45\% shareholding in GH Ltd worth 250,000. (3) A car worth 20,000. (4) Other assets worth 65,000. Under the terms of her will, Maisie left her entire estate to her only niece, Lily. Debts and expenses Maisie's funeral expenses totalled 7,000, of which 700 related to her tombstone. Maisie had income tax outstanding of 13,000 in relation to the tax year 2022-23. She had also made a verbal promise to pay a friend 2,000, but this payment had not been made by the time Maisie died. In order to transfer an unused nil rate band, which of the following is NOT considered as a time limit when making the claim? Note: You are not expected to consider the residence nil rate band. Period of three months after the personal representatives start to act Longer period as an officer of HM Revenue and Customs (HMRC) may allow in a particular case Six months from the end of the month of death Two years from the end of the month of death Maisie died on 11 September 2022. She had been married for many years to Bruce who had died on 5 March 2017. Bruce Under the terms of his will, Bruce left his entire estate, valued at 195,000, to his brother. Bruce had made no lifetime transfers. The inheritance tax (IHT) nil rate band in the tax year 2016-17 was 325,000. Maisie - Gift of GH Ltd shares On 31 March 2018, Maisie gifted a 25\% shareholding in GH Ltd, an investment company, to her daughter, Lola. Maisie had bought a 70% shareholding in GH Ltd, in January 2015. The value of the transfer for IHT purposes was 50,000, after deducting all available exemptions. Maisie had made no other lifetime transfers. Maisie's death estate On the date of her death, Maisie owned the following assets: (1) The family home valued at 500,000. This had an outstanding interest-only mortgage of 200,000. (2) A 45\% shareholding in GH Ltd worth 250,000. (3) A car worth 20,000. (4) Other assets worth 65,000. Under the terms of her will, Maisie left her entire estate to her only niece, Lily. Debts and expenses Maisie's funeral expenses totalled 7,000, of which 700 related to her tombstone. Maisie had income tax outstanding of 13,000 in relation to the tax year 2022-23. She had also made a verbal promise to pay a friend 2,000, but this payment had not been made by the time Maisie died. In order to transfer an unused nil rate band, which of the following is NOT considered as a time limit when making the claim? Note: You are not expected to consider the residence nil rate band. Period of three months after the personal representatives start to act Longer period as an officer of HM Revenue and Customs (HMRC) may allow in a particular case Six months from the end of the month of death Two years from the end of the month of death Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started