Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maize's sales have been increasing, there seems to be a chance that demand for Maize's products will take off soon. Last year's sales generated net

Maize's sales have been increasing, there seems to be a chance that demand for Maize's products will take off soon. Last year's sales generated net cash flows after all costs and taxes of $ million. The consultants predict that sales will probably be at a level that will produce net cash flows of $ million per year for the next three years, but they also see a probability that sales could be high enough to generate net cash inflows of $ million per year. Meeting such an increase in demand presents a problem because of the advance contracting requirements for the new capacity. Unless Maize arranges for extra facilities now, there's a chance that the capacity won't be available if the increased demand materializes. An option arrangement is available with one of the large brewers under which it will hold capacity for Maize until the last minute for an immediate, nonrefundable payment of $ million. Maize's cost of capital is

Draw a decision tree showing Maize's cash flows for the next years without the option.

Calculate the expected NPV of operating cash flows without the option.Draw a decision tree showing

Maize's cash flows for the next years with the capacity option.What is the capacity option's value?

Should it be purchased? Why or why not?

Does the capacity option change your opinion if it should be purchased? Why or why not?

Submit your calculations in Excel format and the analysis of your calculations in a memo to your supervisor. Your to page document should include scholarly references to support your recommendations. Make sure your work is in APA format. A helpful resource for APA formatting can be found at this website: CSU Global Writing CenterLinks to an external site..

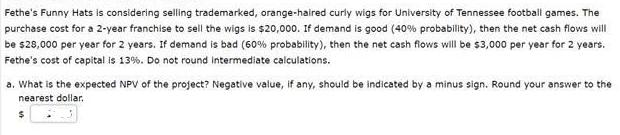

Fethe's Funny Hats is considering selling trademarked, orange-haired curly wigs for University of Tennessee football games. The purchase cost for a 2-year franchise to sell the wigs is $20,000. If demand is good (40% probability), then the net cash flows will be $28,000 per year for 2 years. If demand is bad (60% probability), then the net cash flows will be $3,000 per year for 2 years. Fethe's cost of capital is 13 %. Do not round intermediate calculations. a. What is the expected NPV of the project? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest dollar. $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Decision Tree Analysis for Maizes Capacity Expansion To Supervisor From Your Name Date 20230311 Subject Analysis of Capacity Option for Maize Introduction This memo analyzes Maizes decision regarding ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started