Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Majestic Industries has one product. Information about the production and sales of that product for the past year follow. View the data. The company had

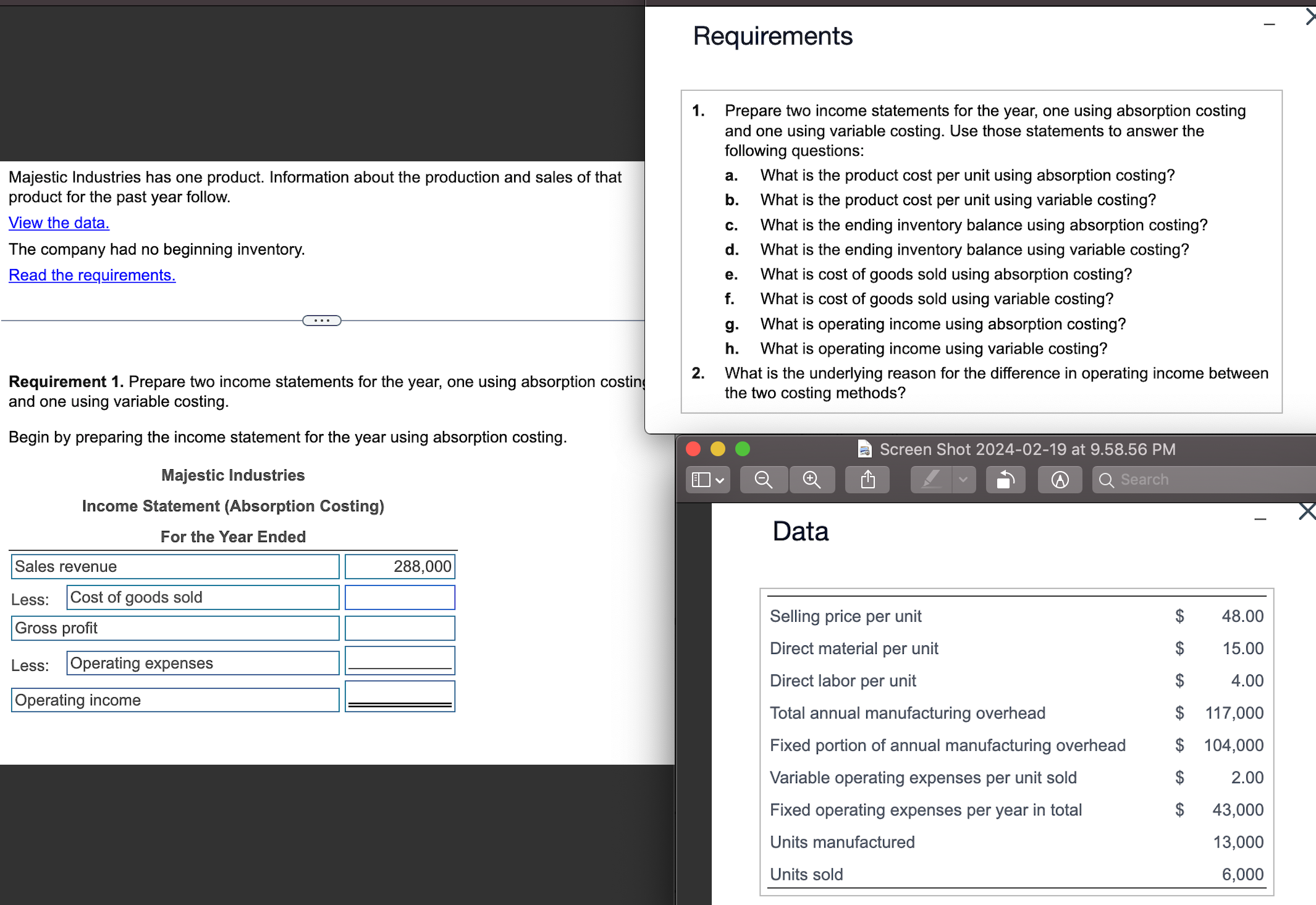

Majestic Industries has one product. Information about the production and sales of that

product for the past year follow.

View the data.

The company had no beginning inventory.

Read the requirements.

Requirement Prepare two income statements for the year, one using absorption costing

and one using variable costing.

Begin by preparing the income statement for the year using absorption costing.

Majestic Industries

Income Statement Absorption Costing

For the Year Ended

Less: Cost of goods sold

Gross profit

Less: Operating expensesMajestic Industries has one product. Information about the production and sales of that

product for the past year follow.

View the data.

The company had no beginning inventory.

Read the requirements.

Requirement Prepare two income statements for the year, one using absorption costin

and one using variable costing.

Begin by preparing the income statement for the year using absorption costing.

Majestic Industries

Income Statement Absorption Costing

For the Year Ended

Less: Cost of goods sold

Gross profit

Less:

following questions:

a What is the product cost per unit using absorption costing?

b What is the product cost per unit using variable costing?

c What is the ending inventory balance using absorption costing?

d What is the ending inventory balance using variable costing?

e What is cost of goods sold using absorption costing?

f What is cost of goods sold using variable costing?

g What is operating income using absorption costing?

h What is operating income using variable costing?

What is the underlying reason for the difference in operating income between

the two costing methods?

Operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started