Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Major Case 1-Colonial Bank. Please answer the questions below and provide an explanation so I can better understand the case. I would really appreciate it

Major Case 1-Colonial Bank. Please answer the questions below and provide an explanation so I can better understand the case. I would really appreciate it if all the questions can be answered! :) Thank you!

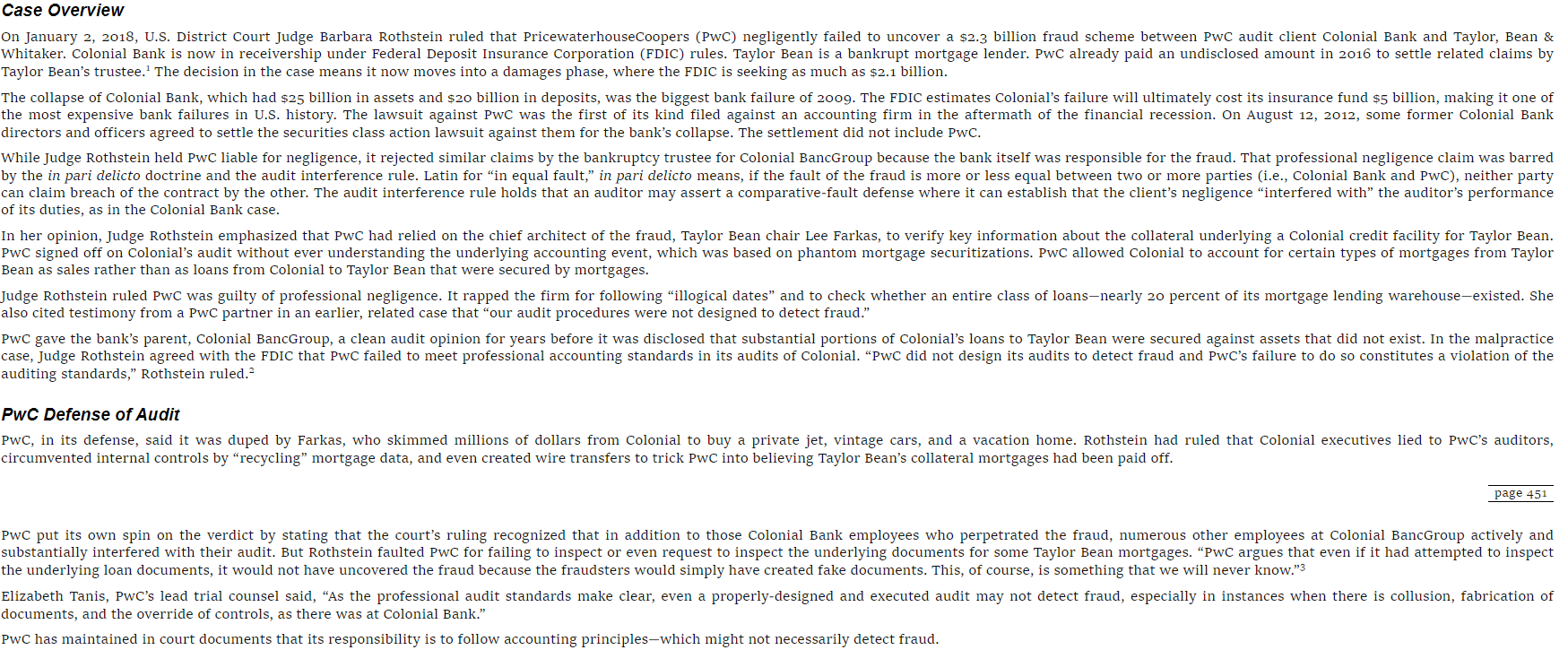

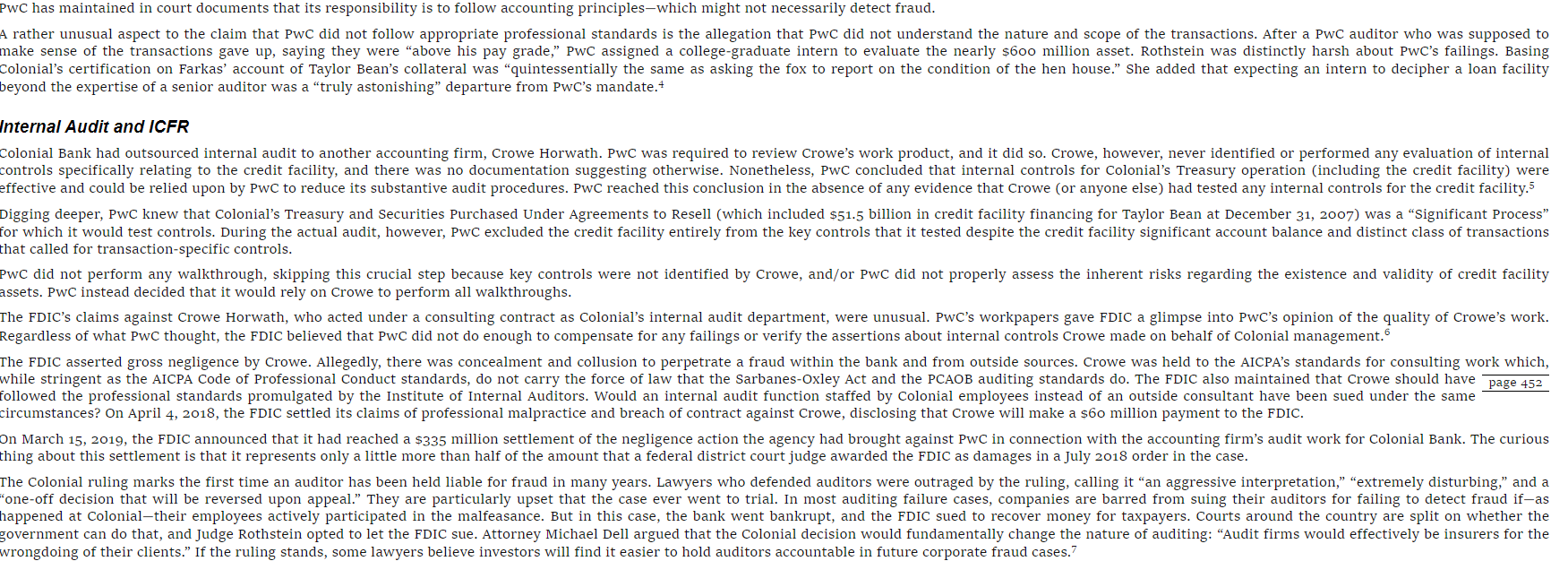

'aylor Bean's trustee. 1 The decision in the case means it now moves into a damages phase, where the FDIC is seeking as much as $2.1 billion. irectors and officers agreed to settle the securities class action lawsuit against them for the bank's collapse. The settlement did not include PwC. f its duties, as in the Colonial Bank case. ean as sales rather than as loans from Colonial to Taylor Bean that were secured by mortgages. lso cited testimony from a PWC partner in an earlier, related case that "our audit procedures were not designed to detect fraud." uditing standards," Rothstein ruled. 2 'wC Defense of Audit page 451 ocuments, and the override of controls, as there was at Colonial Bank." WC has maintained in court documents that its responsibility is to follow accounting principles-which might not necessarily detect fraud. eyond the expertise of a senior auditor was a "truly astonishing" departure from PwC's mandate. 4 nternal Audit and ICFR hat called for transaction-specific controls. ssets. PwC instead decided that it would rely on Crowe to perform all walkthroughs. ircumstances? On April 4, 2018, the FDIC settled its claims of professional malpractice and breach of contract against Crowe, disclosing that Crowe will make a $60 million payment to the FDIC. hing about this settlement is that it represents only a little more than half of the amount that a federal district court judge awarded the FDIC as damages in a July 2018 order in the case. rrongdoing of their clients." If the ruling stands, some lawyers believe investors will find it easier to hold auditors accountable in future corporate fraud cases. 7 1. Which rules of conduct in the AICPA Code of Professional Conduct were violated by PwC? Explain. 2. Which PCAOB auditing standards were violated by PwC? Explain why those violations occurred and whether PwC should be held responsible. anything wrong with holding auditors responsible for the wrongdoing of their clients when client employees actively participate in the malfeasance? Explain. have included in the audit report of Colonial Bank

'aylor Bean's trustee. 1 The decision in the case means it now moves into a damages phase, where the FDIC is seeking as much as $2.1 billion. irectors and officers agreed to settle the securities class action lawsuit against them for the bank's collapse. The settlement did not include PwC. f its duties, as in the Colonial Bank case. ean as sales rather than as loans from Colonial to Taylor Bean that were secured by mortgages. lso cited testimony from a PWC partner in an earlier, related case that "our audit procedures were not designed to detect fraud." uditing standards," Rothstein ruled. 2 'wC Defense of Audit page 451 ocuments, and the override of controls, as there was at Colonial Bank." WC has maintained in court documents that its responsibility is to follow accounting principles-which might not necessarily detect fraud. eyond the expertise of a senior auditor was a "truly astonishing" departure from PwC's mandate. 4 nternal Audit and ICFR hat called for transaction-specific controls. ssets. PwC instead decided that it would rely on Crowe to perform all walkthroughs. ircumstances? On April 4, 2018, the FDIC settled its claims of professional malpractice and breach of contract against Crowe, disclosing that Crowe will make a $60 million payment to the FDIC. hing about this settlement is that it represents only a little more than half of the amount that a federal district court judge awarded the FDIC as damages in a July 2018 order in the case. rrongdoing of their clients." If the ruling stands, some lawyers believe investors will find it easier to hold auditors accountable in future corporate fraud cases. 7 1. Which rules of conduct in the AICPA Code of Professional Conduct were violated by PwC? Explain. 2. Which PCAOB auditing standards were violated by PwC? Explain why those violations occurred and whether PwC should be held responsible. anything wrong with holding auditors responsible for the wrongdoing of their clients when client employees actively participate in the malfeasance? Explain. have included in the audit report of Colonial Bank Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started