Answered step by step

Verified Expert Solution

Question

1 Approved Answer

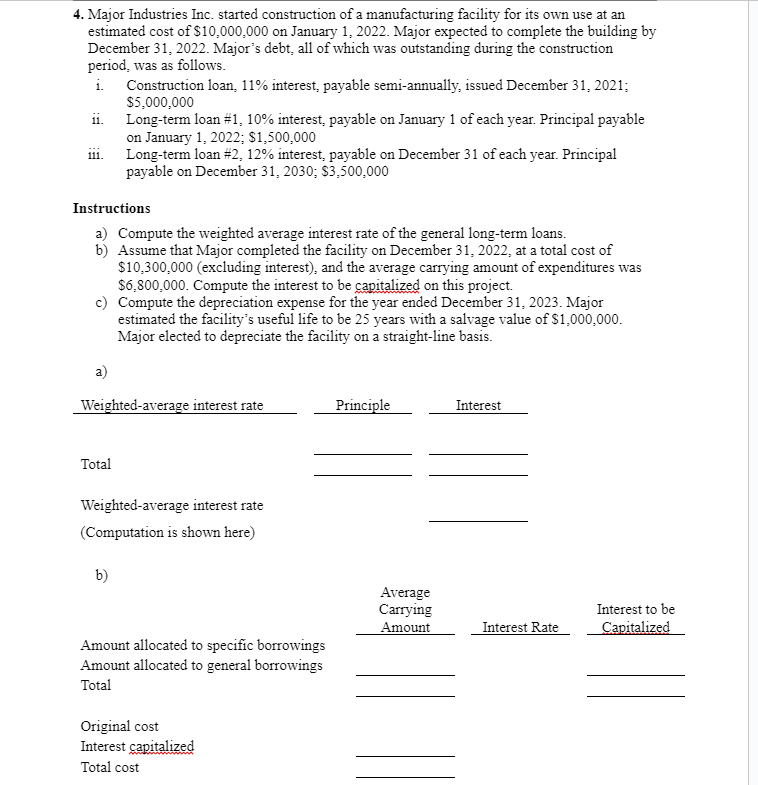

Major Industries Inc. started construction of a manufacturing facility for its own use at an estimated cost of $ 1 0 , 0 0 0

Major Industries Inc. started construction of a manufacturing facility for its own use at an

estimated cost of $ on January Major expected to complete the building by

December Major's debt, all of which was outstanding during the construction

period, was as follows.

i Construction loan, interest, payable semiannually, issued December ;

$

ii Longterm loan # interest, payable on January of each year. Principal payable

on January ;$

iii. Longterm loan # interest, payable on December of each year. Principal

payable on December ;$

Instructions

a Compute the weighted average interest rate of the general longterm loans.

b Assume that Major completed the facility on December at a total cost of

$excluding interest and the average carrying amount of expenditures was

$ Compute the interest to be capitalized on this project.

c Compute the depreciation expense for the year ended December Major

estimated the facility's useful life to be years with a salvage value of $

Major elected to depreciate the facility on a straightline basis.

a

Weightedaverage interest rate Principle Interest

Total

Total

Weightedaverage interest rate

Computation is shown here

b

Original cost

Interest capitalized

Total cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started