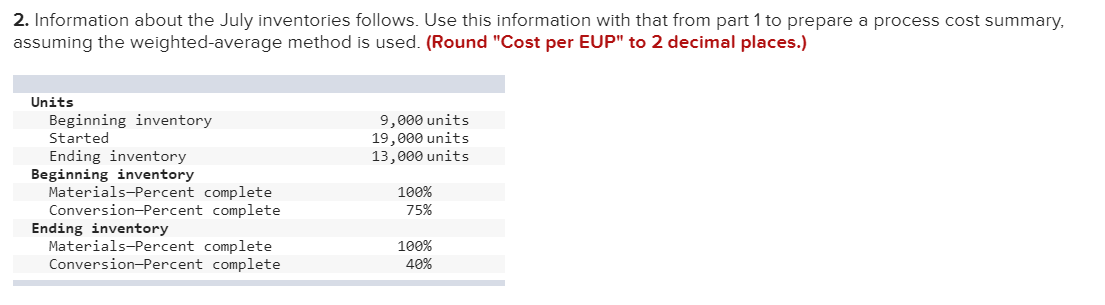

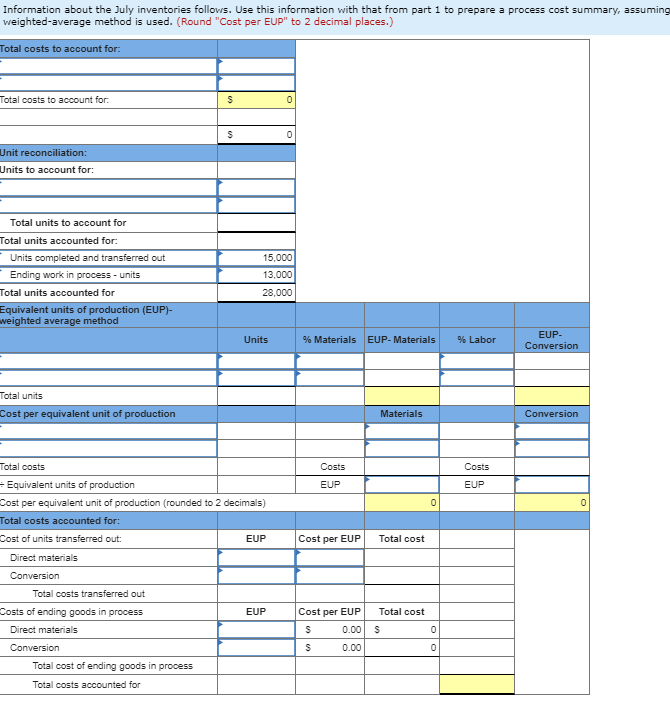

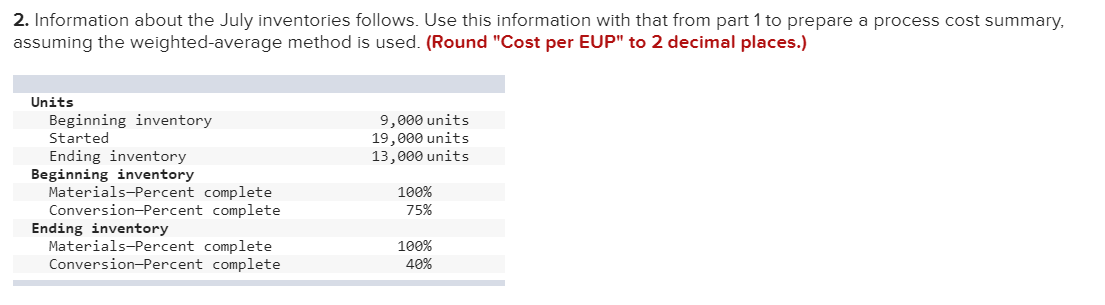

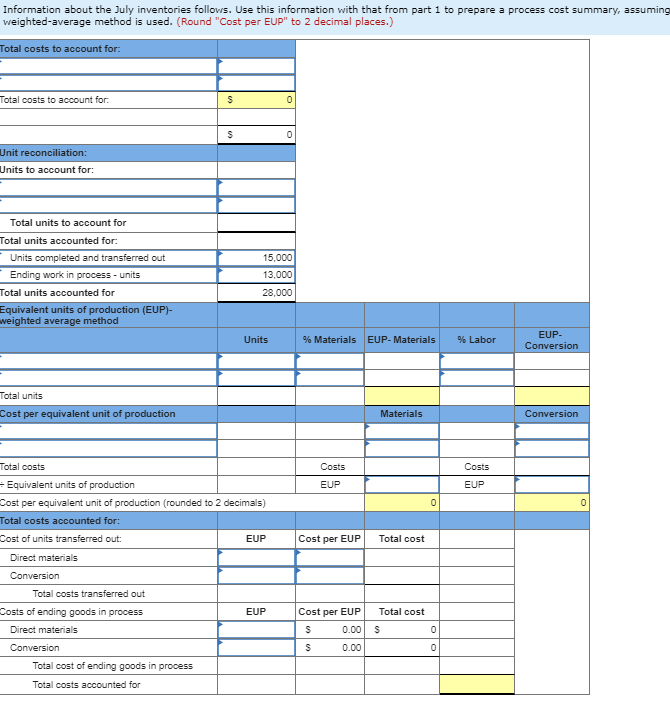

Major League Bat Company manufactures baseball bats. In addition to its work in process inventories, the company maintains inventories of raw materials and finished goods. It uses raw materials as direct materials in production and as indirect materials. Its factory payroll costs include direct labor for production and indirect labor. All materials are added at the beginning of the process, and conversion costs are applied uniformly throughout the production process. Required: You are to maintain records and produce measures of inventories to reflect the July events of this company. The June 30 balances: Raw Materials Inventory, $27,000; Work in Process Inventory, $7,885 ($3,060 of direct materials and $4,825 of conversion); Finished Goods Inventory, $190,000; Sales, $0; Cost of Goods Sold, $0; Factory Wages Payable, $0; and Factory Overhead, $0. 2. Information about the July inventories follows. Use this information with that from part 1 to prepare a process cost summary, assuming the weighted-average method is used. (Round "Cost per EUP" to 2 decimal places.) 9,000 units 19,000 units 13,000 units Units Beginning inventory Started Ending inventory Beginning inventory Materials-Percent complete Conversion-Percent complete Ending inventory Materials-Percent complete Conversion-Percent complete 100% 75% 100% 40% Information about the July inventories follows. Use this information with that from part 1 to prepare a process cost summary, assuming weighted-average method is used. (Round "Cost per EUP" to 2 decimal places.) Total costs to account for: Total costs to account for S 0 S 0 Unit reconciliation: Units to account for: Total units to account for Total units accounted for Units completed and transferred out Ending work in process - units Total units accounted for Equivalent units of production (EUP)- weighted average method 15,000 13,000 28,000 Units % Materials EUP-Materials % Labor EUP- Conversion Total units Cost per equivalent unit of production Materials Conversion Total costs Costs Costs EUP EUP 0 Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total costs accounted for: Cost of units transferred out: EUP Cost per EUP Total cost EUP Total cost Direct materials Conversion Total costs transferred out Costs of ending goods in process Direct materials Conversion Total cost of ending goods in process Total costs accounted for Cost per EUP S 0.00 S 0.00 S 0 0 Major League Bat Company manufactures baseball bats. In addition to its work in process inventories, the company maintains inventories of raw materials and finished goods. It uses raw materials as direct materials in production and as indirect materials. Its factory payroll costs include direct labor for production and indirect labor. All materials are added at the beginning of the process, and conversion costs are applied uniformly throughout the production process. Required: You are to maintain records and produce measures of inventories to reflect the July events of this company. The June 30 balances: Raw Materials Inventory, $27,000; Work in Process Inventory, $7,885 ($3,060 of direct materials and $4,825 of conversion); Finished Goods Inventory, $190,000; Sales, $0; Cost of Goods Sold, $0; Factory Wages Payable, $0; and Factory Overhead, $0. 2. Information about the July inventories follows. Use this information with that from part 1 to prepare a process cost summary, assuming the weighted-average method is used. (Round "Cost per EUP" to 2 decimal places.) 9,000 units 19,000 units 13,000 units Units Beginning inventory Started Ending inventory Beginning inventory Materials-Percent complete Conversion-Percent complete Ending inventory Materials-Percent complete Conversion-Percent complete 100% 75% 100% 40% Information about the July inventories follows. Use this information with that from part 1 to prepare a process cost summary, assuming weighted-average method is used. (Round "Cost per EUP" to 2 decimal places.) Total costs to account for: Total costs to account for S 0 S 0 Unit reconciliation: Units to account for: Total units to account for Total units accounted for Units completed and transferred out Ending work in process - units Total units accounted for Equivalent units of production (EUP)- weighted average method 15,000 13,000 28,000 Units % Materials EUP-Materials % Labor EUP- Conversion Total units Cost per equivalent unit of production Materials Conversion Total costs Costs Costs EUP EUP 0 Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Total costs accounted for: Cost of units transferred out: EUP Cost per EUP Total cost EUP Total cost Direct materials Conversion Total costs transferred out Costs of ending goods in process Direct materials Conversion Total cost of ending goods in process Total costs accounted for Cost per EUP S 0.00 S 0.00 S 0 0