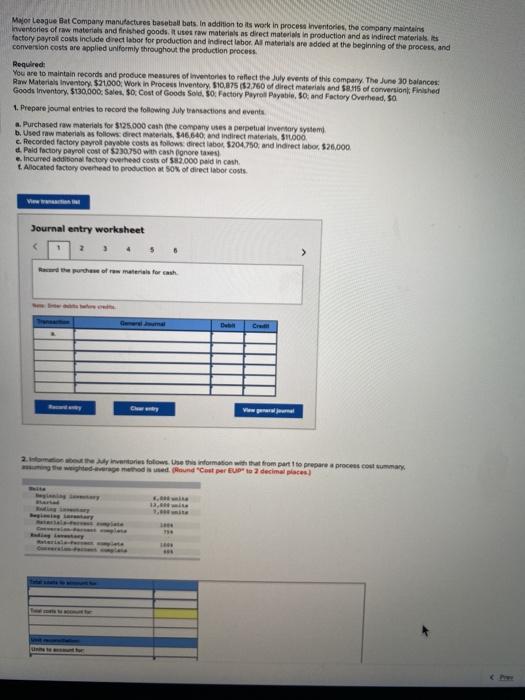

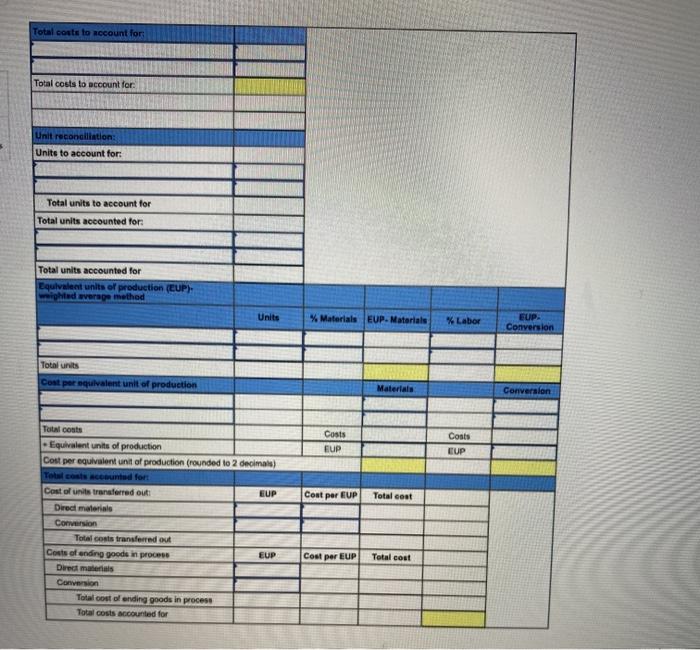

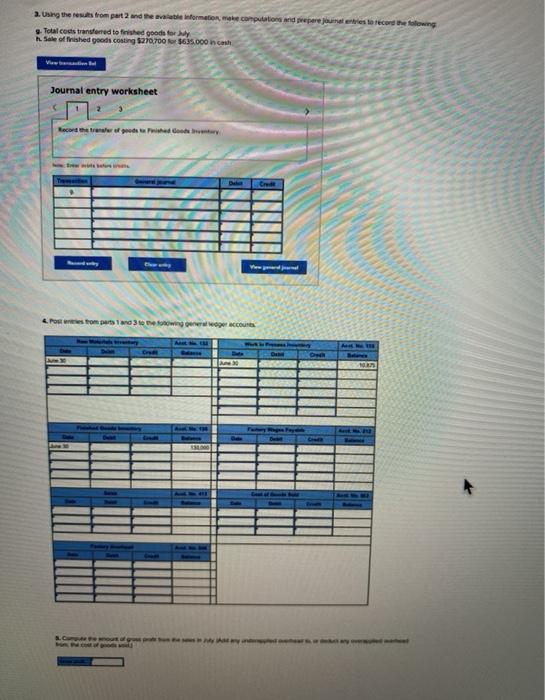

Major League Bat Company manufactures baseball bats. In addition to its work in process inventories, the company maintains Inventaries of raw materials and finished goods. It uses raw materials as direct materials production and as Indirect materiais factory payroll costs include direct labor for production and indirect labor. Al materials are added at the beginning of the process, and conversion costs are applied uniformly throughout the production process. Required You are to maintain records and produce measures of twentories to reflect the Julyvents of this company. The June 30 balances Raw Materials Inventory $21,000 Work in Process Inventory, 510,875 ($2.760 of direct materials and 58.116 of conversion Finished Goods Inventory, 5130.000: Sales, So: Cost of Goods Sold So Factory Payroll Payable, 50, and Factory Overhead, 50 1. Prepare jouma entries to record the following July transactions and events Purchased raw materials for $125.000 cash the company uses a perpetual inventory system Used raw materials as follows Grect materials, 46.640, and indirect materials, SL.000 c. Recorded factory payroll payable costs as follows direct labor 5204750, and indirect labor, 526,000 d. Pald factory payroll cost of $230.750 with cash ignore tanesi Incurred odional factory overhead costs of 532.000 paid in cash Allocated factory overhead to production at 50% of direct labor costs View Journal entry worksheet 2 5 6 purchase of raw materials for cash 2. My inwestors fotows. Use this information with that from part to prepare a process costuma wedd wedRound "Cost per EU to 7 decimal places) 1. Total costs to account for Total costs to account for Unit reconciliation: Units to account for: Total units to account for Total units accounted for Total units accounted for Equivalent units of production (EUP) pied average method Units % Materials EUP. Materials % Labor EUP Conversion Total units Cost per equivalent unit of production Materials Conversion Costs EUP Costs EUP Cost per EUP Total cost Total costs Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Tot ce counted for Cost of units transferred out: EUP Direct materials Conversion Total cost transferred out Costs of ending goods in process EUP Direct materials Conversion Total cost olending goods in process Total costs accounted for Cost per EUP Total cost 2. Using the results from part 2 and the variable information, make computation id prepere jaune entries to record the following Total cost transferred to finished goods for sy Sale of finished goods conting 270.00 $635.000 cash Journal entry worksheet Potom perind 3 sewing acco D 30 Major League Bat Company manufactures baseball bats. In addition to its work in process inventories, the company maintains Inventaries of raw materials and finished goods. It uses raw materials as direct materials production and as Indirect materiais factory payroll costs include direct labor for production and indirect labor. Al materials are added at the beginning of the process, and conversion costs are applied uniformly throughout the production process. Required You are to maintain records and produce measures of twentories to reflect the Julyvents of this company. The June 30 balances Raw Materials Inventory $21,000 Work in Process Inventory, 510,875 ($2.760 of direct materials and 58.116 of conversion Finished Goods Inventory, 5130.000: Sales, So: Cost of Goods Sold So Factory Payroll Payable, 50, and Factory Overhead, 50 1. Prepare jouma entries to record the following July transactions and events Purchased raw materials for $125.000 cash the company uses a perpetual inventory system Used raw materials as follows Grect materials, 46.640, and indirect materials, SL.000 c. Recorded factory payroll payable costs as follows direct labor 5204750, and indirect labor, 526,000 d. Pald factory payroll cost of $230.750 with cash ignore tanesi Incurred odional factory overhead costs of 532.000 paid in cash Allocated factory overhead to production at 50% of direct labor costs View Journal entry worksheet 2 5 6 purchase of raw materials for cash 2. My inwestors fotows. Use this information with that from part to prepare a process costuma wedd wedRound "Cost per EU to 7 decimal places) 1. Total costs to account for Total costs to account for Unit reconciliation: Units to account for: Total units to account for Total units accounted for Total units accounted for Equivalent units of production (EUP) pied average method Units % Materials EUP. Materials % Labor EUP Conversion Total units Cost per equivalent unit of production Materials Conversion Costs EUP Costs EUP Cost per EUP Total cost Total costs Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Tot ce counted for Cost of units transferred out: EUP Direct materials Conversion Total cost transferred out Costs of ending goods in process EUP Direct materials Conversion Total cost olending goods in process Total costs accounted for Cost per EUP Total cost 2. Using the results from part 2 and the variable information, make computation id prepere jaune entries to record the following Total cost transferred to finished goods for sy Sale of finished goods conting 270.00 $635.000 cash Journal entry worksheet Potom perind 3 sewing acco D 30