Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mak Cun, a Malaysian citizen transferred a house in Penang as a gift to her daughter, Siti on 15 May 2015. Mak Cun bought

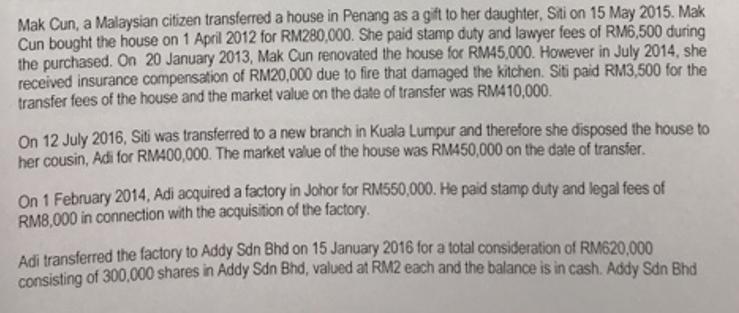

Mak Cun, a Malaysian citizen transferred a house in Penang as a gift to her daughter, Siti on 15 May 2015. Mak Cun bought the house on 1 April 2012 for RM280,000. She paid stamp duty and lawyer fees of RM6,500 during the purchased. On 20 January 2013, Mak Cun renovated the house for RM45,000. However in July 2014, she received insurance compensation of RM20,000 due to fire that damaged the kitchen. Siti paid RM3,500 for the transfer fees of the house and the market value on the date of transfer was RM410,000. On 12 July 2016, Siti was transferred to a new branch in Kuala Lumpur and therefore she disposed the house to her cousin, Adi for RM400,000. The market value of the house was RM450,000 on the date of transfer. On 1 February 2014, Adi acquired a factory in Johor for RM550,000. He paid stamp duty and legal fees of RM8,000 in connection with the acquisition of the factory. Adi transferred the factory to Addy Sdn Bhd on 15 January 2016 for a total consideration of RM620,000 consisting of 300,000 shares in Addy Sdn Bhd, valued at RM2 each and the balance is in cash. Addy Sdn Bhd was incorporated on 1 April 2012 with 3 shareholders, Adi and his siblings, Megat and Umar. The paid-up share capital held by the shareholders are as follows: Adi 150,000 units of shares 150,000 units of shares Megat Umar 100,000 units of shares Required: i. Determine the RPGT payable (if any) for the transfer of the house from: a) Mak Cun to Siti b) Siti to Adi ii. Discuss the tax implications of the: a) transfer of the factory by Adi to Addy Sdn Bhd b) disposal of 200,000 units share of Adi to Umar for RM400,000. From the shares disposed, 150,000 units are existing shares, while the balance is from the transfer of the factory.

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

i a No RPGT payable as the transfer is between mother and daughter b ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started