Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Make a list and briefly explain the critical criteria used in choosing a mutual fund, in order of importance. BULLETS! (10 points) We know

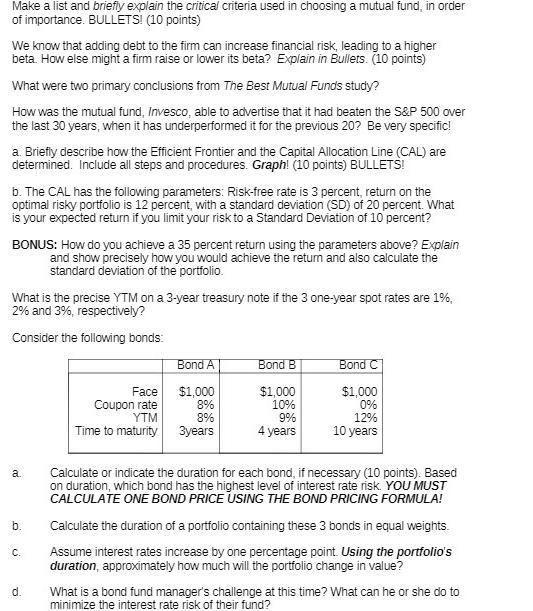

Make a list and briefly explain the critical criteria used in choosing a mutual fund, in order of importance. BULLETS! (10 points) We know that adding debt to the firm can increase financial risk, leading to a higher beta. How else might a firm raise or lower its beta? Explain in Bullets. (10 points) What were two primary conclusions from The Best Mutual Funds study? How was the mutual fund, Invesco, able to advertise that it had beaten the S&P 500 over the last 30 years, when it has underperformed it for the previous 20? Be very specific! a. Briefly describe how the Efficient Frontier and the Capital Allocation Line (CAL) are determined. Include all steps and procedures. Graph! (10 points) BULLETS! b. The CAL has the following parameters: Risk-free rate is 3 percent, return on the optimal risky portfolio is 12 percent, with a standard deviation (SD) of 20 percent. What is your expected return if you limit your risk to a Standard Deviation of 10 percent? BONUS: How do you achieve a 35 percent return using the parameters above? Explain and show precisely how you would achieve the return and also calculate the standard deviation of the portfolio. What is the precise YTM on a 3-year treasury note if the 3 one-year spot rates are 1%, 2% and 3%, respectively? Consider the following bonds: a. b. C. d. Face Coupon rate YTM Time to maturity Bond A $1,000 8% 8% 3years Bond B $1,000 10% 9% 4 years Bond C $1,000 0% 12% 10 years Calculate or indicate the duration for each bond, if necessary (10 points). Based on duration, which bond has the highest level of interest rate risk. YOU MUST CALCULATE ONE BOND PRICE USING THE BOND PRICING FORMULA! Calculate the duration of a portfolio containing these 3 bonds in equal weights. Assume interest rates increase by one percentage point. Using the portfolio's duration, approximately how much will the portfolio change in value? What is a bond fund manager's challenge at this time? What can he or she do to minimize the interest rate risk of their fund?

Step by Step Solution

★★★★★

3.26 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Here are the responses in bullet points as requested Past Performance Track record of consistent returns without excessive risk over several years Expenses The lower the expense ratio the better as hi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started