Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Make adjusting entries with the following information below? Create adjusting entries with the information provided? make the adjusting entries with the information provided below? Adjusting

Make adjusting entries with the following information below?

Create adjusting entries with the information provided?

make the adjusting entries with the information provided below?

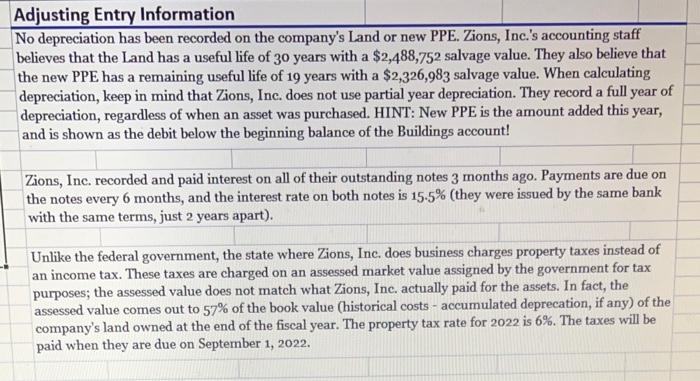

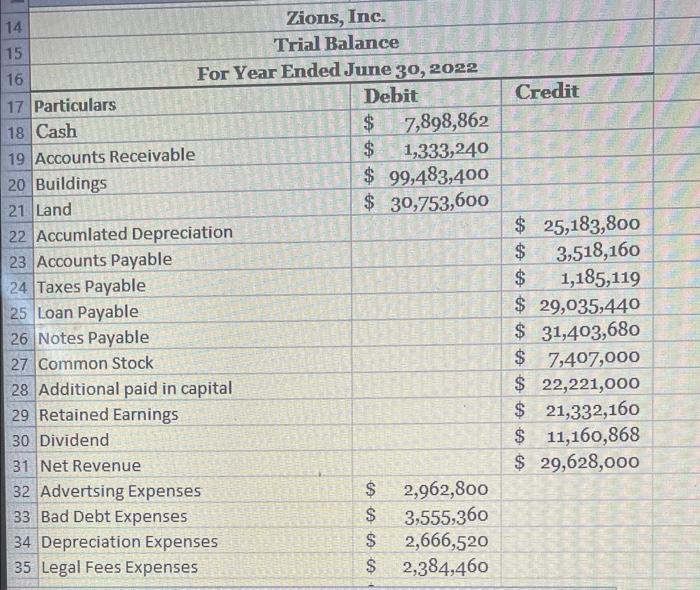

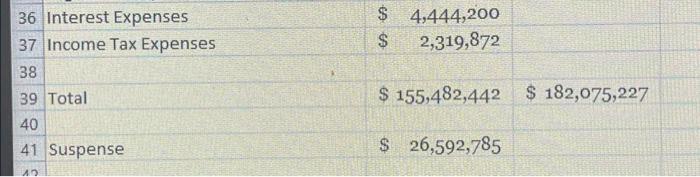

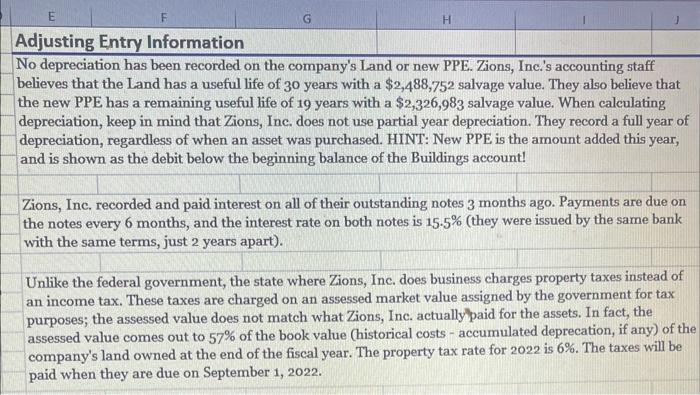

Adjusting Entry Information No depreciation has been recorded on the company's Land or new PPE. Zions, Inc.'s accounting staff believes that the Land has a useful life of 30 years with a $2,488,752 salvage value. They also believe that the new PPE has a remaining useful life of 19 years with a $2,326,983 salvage value. When calculating depreciation, keep in mind that Zions, Inc. does not use partial year depreciation. They record a full year of depreciation, regardless of when an asset was purchased. HINT: New PPE is the amount added this year, and is shown as the debit below the beginning balance of the Buildings account! Zions, Inc. recorded and paid interest on all of their outstanding notes 3 months ago. Payments are due on the notes every 6 months, and the interest rate on both notes is 15.5% (they were issued by the same bank with the same terms, just 2 years apart). Unlike the federal government, the state where Zions, Inc. does business charges property taxes instead of an income tax. These taxes are charged on an assessed market value assigned by the government for tax purposes; the assessed value does not match what Zions, Inc. actually paid for the assets. In fact, the assessed value comes out to 57% of the book value (historical costs accumulated deprecation, if any) of the company's land owned at the end of the fiscal year. The property tax rate for 2022 is 6%. The taxes will be paid when they are due on September 1, 2022.

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To make the adjusting entries for Zions Inc based on the information provided we need to account for depreciation on Land and new PPE interest on outs...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started