Answered step by step

Verified Expert Solution

Question

1 Approved Answer

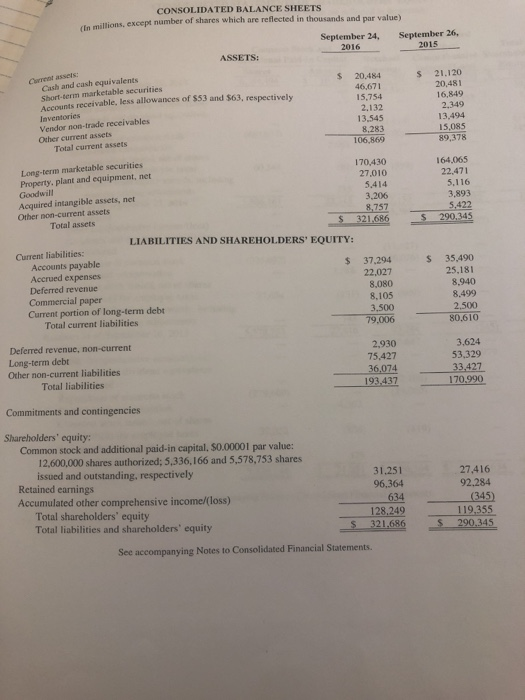

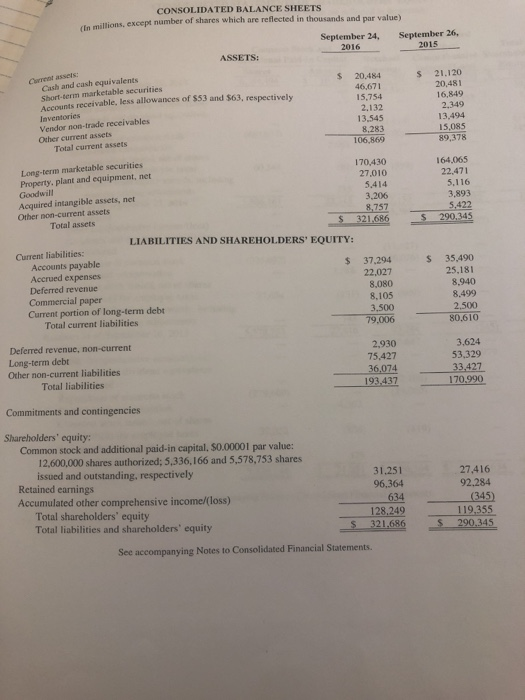

Make an analysis of the consolidated balance sheets. What do you see? The long-term debt has increased considerably...does that concern you? How is that explained

Make an analysis of the consolidated balance sheets. What do you see? The long-term debt has increased considerably...does that concern you? How is that explained in the notes to the financial statements? Consider the reasonableness of your answer.

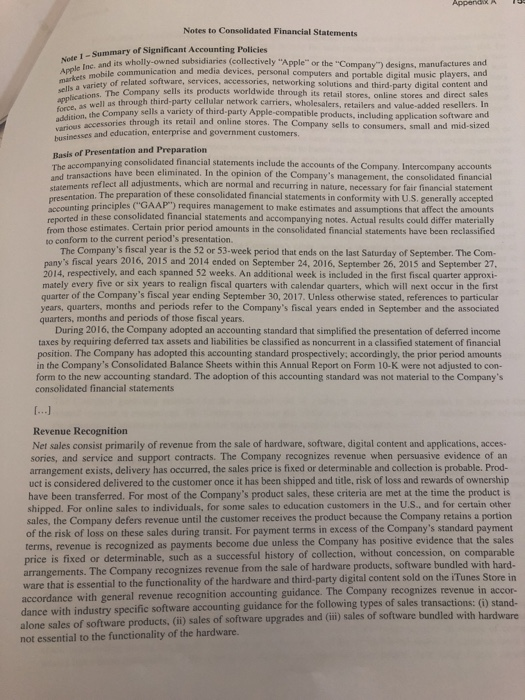

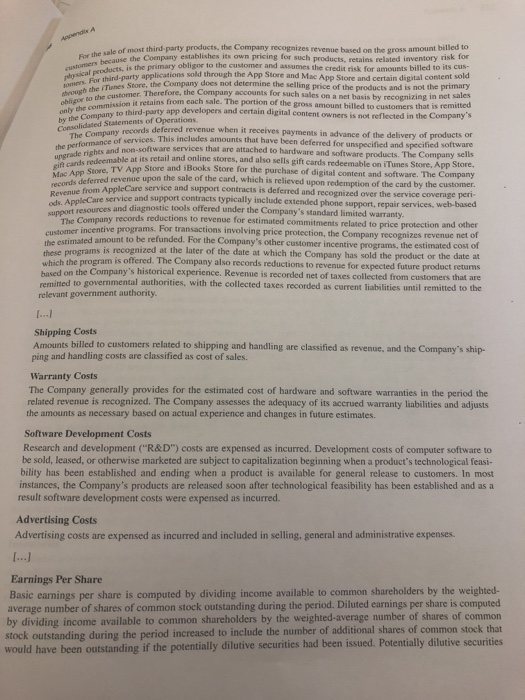

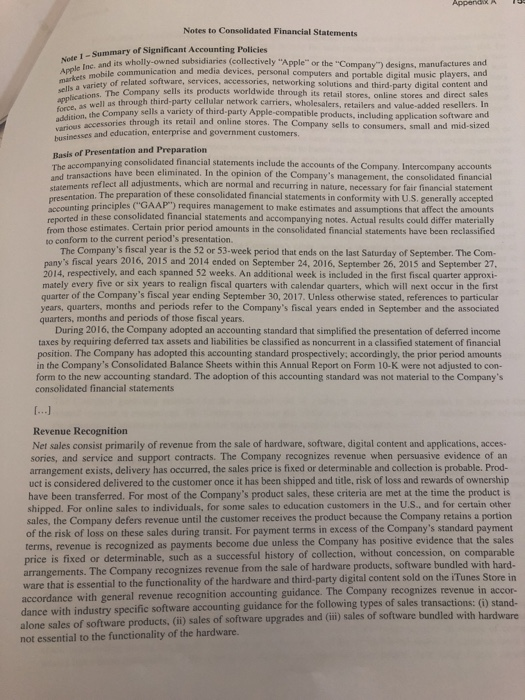

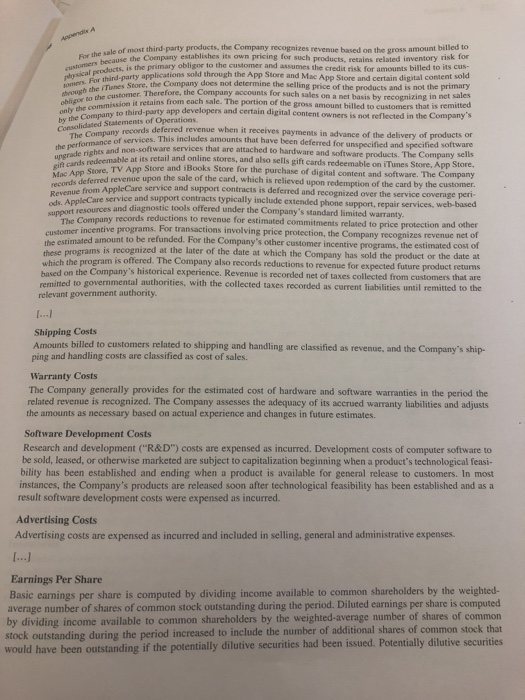

CONSOLIDATED BALANCE SHEETS millions, except number of shares which are reflected in thousands and par value) September 24 September 26, 2016 2015 ASSETS: $ $ Cash and cash equivalents Short-term marketable securities unts receivable, less allowances of $53 and 563, respectively Inventories Vendor non-trade receivables Other current assets Total current assets 20,484 46,671 15.754 2.132 13.545 8,283 106,869 21.120 20,481 16,849 2.349 13.494 15.085 89378 164,065 22.471 5.116 3,893 5.422 290.345 $ Long-term marketable securities 170,430 Property, plant and equipment, net 27.010 Goodwill 5.414 Acquired intangible assets, net 3,206 Other non-current assets 8,757 Total assets 321.686 LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable $ 37.294 Accrued expenses 22.027 Deferred revenue 8,080 Commercial paper 8,105 Current portion of long-term debt 3.500 Total current liabilities 79,006 $ 35,490 25,181 8.940 8,499 2.500 80.610 Deferred revenue, non-current Long-term debt Other non-current liabilities Total liabilities 2.930 75,427 36,074 3.624 53.329 33.427 170.990 193.437 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized: 5,336,166 and 5,578,753 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 31.251 96,364 634 128.249 321.686 27.416 92.284 (345) 119.355 290.345 $ See accompanying Notes to Consolidated Financial Statements. For the customer le of most third-party products, the Company recognizes revenue based on the gross amount billed to the Company establishes its own pricing for such products, retains related inventory risk is the primary obor to the customer and assumes the credit risk for amounts billed to its cus arty applications through the App Store and Mac App Store and certain digital content sota Store, the Company does not determine the selling price of the products and is not the primary Therefore, the Company Accounts for such sales on anthasis by m onizing in het sales i t retains from each sale. The portion of the gross amount billed to customers that is remitted a third-party app developers and certain digital content owners is not reflected in the Company's . For third through the Tunes St por to the customer only the commission it reta m by the Company to third-party app devel Consolidated Statements of Operations. the performance of services. This ineludes amounts grade rights and ne records deferred revenue when it receives payments in advance of the delivery of products or The compus services. This includes amounts that have been deferred for unspecified and specified software the perform and non-software services that are attached to hardware and software products. The Company sells mable at its retail and online stores, and also sells gift cards redeemable on iTunes Store, App Store, gift cards TV App Store and iBooks Store for the purchase of digital content and software. The Company Mac A Mac App Store, TV d revenue upon the sale of the card, which is relieved upon redemption of the card by the customer Revenue from from AppleCare service and support contracts is deferred and recognized over the service coverage peri- ods. Appleca Care service and support contracts typically include extended phone support, repair services, web-based C o urses and diagnostic tools offered under the Company's standard limited warranty. The Company records reductions to revenue for estimated commitments related to price protection and other incentive programs. For transactions involving price protection, the Company recognizes revenue net of estimated amount to be refunded. For the Company's other customer incentive programs, the estimated cost of these programs is recognized at the later of the date at which the Company has sold the product or the date at which the program is offered. The Company also records reductions to revenue for expected future product returns based on the Company's historical experience. Revenue is recorded net of taxes collected from customers that are remitted to governmental authorities, with the collected taxes recorded as current liabilities until remitted to the relevant government authority Shipping Costs Amounts billed to customers related to shipping and handling are classified as revenue, and the Company's ship- ping and handling costs are classified as cost of sales. Warranty Costs The Company generally provides for the estimated cost of hardware and software warranties in the period the related revenue is recognized. The Company assesses the adequacy of its accrued warranty liabilities and adjusts the amounts as necessary based on actual experience and changes in future estimates. Software Development Costs Research and development (R&D") costs are expensed as incurred. Development costs of computer software to be sold, leased, or otherwise marketed are subject to capitalization beginning when a product's technological feasi- bility has been established and ending when a product is available for general release to customers. In most instances, the Company's products are released soon after technological feasibility has been established and as a result software development costs were expensed as incurred. Advertising Costs Advertising costs are expensed as incurred and included in selling, general and administrative expenses. Earnings Per Share Basic earnings per share is computed by dividing income available to common shareholders by the weighted average number of shares of common stock outstanding during the period. Diluted earnings per share is computed by dividing income available to common shareholders by the weighted average number of shares of common stock outstanding during the period increased to include the number of additional shares of common stock that would have been outstanding if the potentially dilutive securities had been issued. Potentially dilutive securities Appendix A 757 utstanding stock options, shares to be purchased by employees under the Company's employee stock planunvested restricted stock and unvested RSUs. The dilutive effect of potentially dilutive securities is diluted earnings per share by application of the treasury stock method Under the treasury stock crease in the fair market value of the Company's common stock can result in a greater dilutive effect es podentally dilutive securities ing table shows the computation of basic and diluted earnings per share for 2016, 2015 and 2014 coin millions and shares in thousands) 2016 2015 2014 $ Nu Netcome 45,687 $ 53,394 $ 39,510 Weighted average shares outstanding Effect of dilutive securities Weighted average diluted shares 5,470.820 29,461 5.500.281 5.753.421 39.648 5.793.069 6,085.572 37.091 6,122,663 $ Basic earnings per share Diluted earnings per share 8.35 8.31 6.49 6.45 $ 0 $ Potentially dilutive securities whose effect would have been antidilutive are excluded from the computation of diluted earnings per share. ich habe appropriate classificaties have been claro purchase are Financial Instruments Cash Equivalents and Marketable Securities All highly liquid investments with maturities of three months or less at the date of purchase are classified as cash equivalents. The Company's marketable debt and equity securities have been classified and accounted for as avail able-for-sale, Management determines the appropriate classification of its investments at the time of purchase and reevaluates the classifications at each balance sheet date. The Company classifies its marketable debt securities as either short-term or long-term based on each instrument's underlying contractual maturity date. Marketable debt securities with maturities of 12 months or less are classified as short-term and marketable debt securities with maturities greater than 12 months are classified as long-term Marketable equity securities, including mutual funds are classified as either short-term or long-term based on the nature of each security and its availability for use in current operations. The Company's marketable debt and equity securities are carried at fair value, with unrealized gains and losses, net of taxes, reported as a component of accumulated other comprehensive income (AOCI") in shareholders' equity, with the exception of unrealized losses believed to be other than-temporary which are reported in earnings in the current period. The cost of securities sold is based upon the specific identification method Allowance for Doubtful Accounts The Company records its allowance for doubtful accounts based upon its assessment of various factors, including historical experience, age of the accounts receivable balances, credit quality of the Company's customers, current economic conditions and other factors that may affect the customers' abilities to pay Inventories Inventories are stated at the lower of cost, computed using the first-in, first-out method and net realizable value. Any adjustments to reduce the cost of inventories to their net realizable value are recognized in earnings in the cur rent period. As of September 24, 2016 and September 26, 2015, the Company's inventories consist primarily of finished goods Property. Plant and Equipment operty, plant and equipment are stated at cost. Depreciation is computed by use of the straight-line method over e estimated useful lives of the assets, which for buildings is the lesser of 30 years or the remaining life of the desting building between one to five years for machinery and equipment, including product tooling and manu. uring process equipment and the shorter of lease terms or useful life for leasehold improvements. The Com. capitalizes eligible costs to acquire or develop internal-use software that are incurred subsequent to the liminary project stage. Capitalized costs related to internal-use software are amortized using the straight line hed over the estimated useful lives of the assets, which range from three to five years. Depreciation and amor to expense on property and equipment was $8.3 billion, 59.2 billion and $6.9 billion during 2016, 2015 and 2014, respectively Long-Lived Assets Including Goodwill and Other Acquired Intangible Assets The Company reviews property, plant and equipment, inventory component prepayments and identifiable intangi bles, excluding goodwill and intangible assets with indefinite useful lives, for impairment. Long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate the carrying amount of an asset may not be recoverable. Recoverability of these assets is measured by comparison of their carrying amounts to future undiscounted cash flows the assets are expected to generate. Ir property, plant and equipment, inventory component prepayments and certain identifiable intangibles are considered to be impaired, the impairment to be recognized equals the amount by which the carrying value of the assets exceeds its fair value. The Company does not amortize goodwill and intangible assets with indefinite useful lives, rather such assets are required to be tested for impairment at least annually or sooner whenever events or changes in circumstances indicate that the assets may be impaired. The Company performs its goodwill and intangible asset impairment tests in the fourth quarter of each year. The Company did not recognize any impairment charges related to goodwill or indefinite lived intangible assets during 2016, 2015 and 2014. The Company amortizes its intangible assets with definite useful lives over their estimated useful lives and reviews these assets for impairment. The Company typically amortizes its acquired intangible assets with definite useful lives over periods from three to seven years. Fair Value Measurements The Company applies fair value accounting for all financial assets and liabilities and non-financial assets and lia- bilities that are recognized or disclosed at fair value in the financial statements on a recurring basis. The Company defines fair value as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value mea surements for assets and liabilities, which are required to be recorded at fair value, the Company considers the principal or most advantageous market in which the Company would transact and the market-based risk measure ments or assumptions that market participants would use to price the asset or liability, such as risks inherent in valuation techniques, transfer restrictions and credit risk. Fair value is estimated by applying the following hierar chy, which prioritizes the inputs used to measure fair value into three levels and bases the categorization within the hierarchy upon the lowest level of input that is available and significant to the fair value measurement: Level - Quoted prices in active markets for identical assets or liabilities Level 2 - Observable inputs other than quoted prices in active markets for identical assets and liabilities, quoted prices for identical or similar assets or liabilities in inactive markets, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Level 3 - Inputs that are generally unobservable and typically reflect management's estimate of assumptions that market participants would use in pricing the asset or liability. The Company's valuation techniques used to measure the fair value of money market funds and certain marketable equity securities were derived from quoted prices in active markets for identical assets or liabilities. The valuation echniques used to measure the fair value of the Company's debt instruments and all other financial instruments of which have counterparties with high credit ratings were valued based on quoted market prices or model criven valuations using significant inputs derived from or corroborated by observable market data -Financial Instruments Cash Cash Equivalents and Marketable Securities eing tables show the Company's cash and available for sale securities' adissted sost, gross unrealized oss unrealized losses and fair value by significant investment category recorded as cash and cash equiva- or short or long-term marketable securities as of September 24, 2016 (in millions Adjusted Unrealized Unrealized Cost Gains Losses S8601S - 2016 Cash and Short-Term Long-Term Fair Cash Marketable Marketable Value Equivalents Securities Securities 8,601 $ 8601 S Cash 3,666 Level 1: Money market funds Mutual funds Subtotal 3.666 1.407 5.073 (146) 3,666 1.261 4.927 1.261 1.261 126) 3.666 41.697 7.543 26,993 2.35 Level 2: U.S. Treasury securities U.S. agency securities Non-U.S. government securities Certificates of deposit and time deposits Commercial paper Corporate securities Municipal securities Mortgage- and asset hacked securities Subtotal 7,609 6,598 131,166 131.166 259 - 1.409 (27) - (206) 42.012 7,559 7,841 6.598 7.433 132,369 961 1.527 2.762 110 1,108 2.468 242 242 13.492 2.441 818 3.897 6912 1.59 112.52 7,433 4.965 132,369 19.59 956 167 19,134 222,136 178 2,186 (28) (265) 19,284 224,057 8,217 3.217 45.410 19.2 170,4 Total $ 235,810 $ 2,186 $ (411) $ 237,585 $ 20,484 $ 46,671 $ 1704 The Company considers the declines in market value of its marketable securities investment portfolio to be tempo. rary in nature. The Company typically invests in highly-rated securities, and its investment policy generally limits the amount of credit exposure to any one issuer. The policy generally requires investments to be investment grade, with the primary objective of minimizing the potential risk of principal loss. Fair values were determined for each individual security in the investment portfolio. When evaluating an investment for other than-temporary impair ment the Company reviews factors such as the length of time and extent to which fair value has been below its cost basis, the financial condition of the issuer and any changes thereto, changes in market interest rates and the Com pany's intent to sell, or whether it is more likely than not it will be required to sell the investment before recovery of the investment's cost basis. As of September 24, 2016, the Company does not consider any of its investments to be other than-temporarily impaired. [...] Accounts Receivable Trade Receivables The Company has considerable trade receivables outstanding with its third-party cellular network carriers, whole alers, retailers, value-added resellers, small and mid-sized businesses and education, enterprise and government mers. The Company Renerally does not require collateral from its customers; however, the Company will le collateral in certain instances to limit credit risk. In addition, when possible, the Company attempts to limit nk on trade receivables with credit insurance for certain customers or by requiring third-party financing and A leases to support credit exposure. These credit financine angements are directly be dy financing company and the end customer. As such, the Company venerally does not assume any risk sharing related to any of these arrangements As of September 24, 2016 and September 26, 2015, the Company had one customer that represente ellular network of total trade receivables, which accounted for 10% and 120 respectively. The Company's cellular net carriers accounted for 63% and 71% of trade receivables as of September 24, 2016 and September 20, Sare directly between the third- renerally does not assume any recourse or any had one customer that represented 10% or respectively .. Note 3 - Consolidated Financial Statement Details The following tables show the Company's consolidated financial statement details as of September 24, 2016 and September 26, 2015 in millions): Property, Plant and Equipment, Net S $ Land and buildings Machinery, equipment and internal-use software Leasehold improvements Gross property. plant and equipment Accumulated depreciation and amortization Total property, plant and equipment, net 2016 10.185 44,543 6,517 61.245 (34,235) 27.010 2015 6,956 37,038 5.263 49.257 (26,786) 22,471 $ Other Non-Current Liabilities $ 2015 24,062 2016 26,019 10,055 36,074 Deferred tax liabilities Other non-current liabilities Total other non-current liabilities 9.365 S $ 33,427 Other Income/(Expense), Net The following table shows the detail of other income/expense), net for 2016, 2015 and 2014 (in millions): $ $ $ Interest and dividend income Interest expense Other expense, net Total other income/(expense), net 2016 3.999 (1.456) (1,195) 1.348 2015 2,921 (733) (903) 1,285 2014 1.795 (384) (431) 980 $ $ [...] Appendix A 761 - Income Taxes The provision for incom sion for income taxes for 2016, 2015 and 2014, consisted of the following in millions 2016 2015 2014 Federal Current Deferred S 7.652 5,043 12.6195 11,730 3.408 15.138 ,624 3,183 11.807 State: Current Deferred 990 125 (220) 855 (178 677 852 1045 Foreign Current Deferred 2.105 4,744 (1806) 2.938 19,121 $ 2.147 (658) 1.489 13,973 Provision for income taxes 15.685 $ The foreign provision for income taxes is based on foreign puretaamines of 941.1 billion, 547.6 billion and $33.6 billion in 2016, 2015 and 2014, respectively. The Company's consolidated financial statements provide for any related tax liability on undistributed earnings that the Company does not intend to be indefinitely reinvested outside the U.S. Substantially all of the Company's undistributed international earnings intended to be indefinitely reinvested in operations outside the U.S. were generated by subsidiaries organized in Ireland, which has a statutory tax rate of 12.5%. As of September 24, 2016, U.S. income taxes have not been provided on a cumulative total of S109.8 billion of such earnings. The amount of unrecognized deferred tax liability related to these temporary dif ferences is estimated to be $35.9 billion. As of September 24, 2016 and September 26, 2015. S216.0 billion and S186.9 billion, respectively, of the Company's cash, cash equivalents and marketable securities were held by foreign subsidiaries and are generally based in US dollar-denominated holdings. Amounts held by foreign subsidiaries are generally subject to U.S. income taxation on repatriation to the U.S. A reconciliation of the provision for income taxes, with the amount computed by applying the statutory federal income tax rate (35% in 2016, 2015 and 2014) to income before provision for income taxes for 2016, 2015 and 2014, is as follows (dollars in millions): $ $ 2016 21,480 5 553 (5.582) (382) (371) Computed expected tax State taxes, net of federal effect Indefinitely invested earnings of foreign subsidiaries Domestic production activities deduction Research and development credit, net Other Provision for income taxes Effective tax rate 2015 25,380 680 (6,470) (426) (171) 128 19.121 26.456 2014 18,719 469 (4,744) (495) 15,685 S $ 112 13.973 26.19 Note 6 - Debt paper program for general corporate Commercial Paper The Company issues unsecured short-te ter promissory notes (Commercial Paner pursuant to a commercial r program. The Company uses net proceeds from the commercial paper program for genera ases, including dividends and share repurchases. As of September 24 2016 and September 26, 2013. 16. 2015, the many had $8.1 billion and $8.5 billion of Commercial para outstanding respectively, with maturities gener alls less than nine months. The weighted average interest rate of the Commy's Commercial Paper was 0.45% September 24, 2016 and 0.1496 as of September 26, 2015 The following table provides a summary of cash flows associated with the issuance and maturities of com mercial Paper for 2016 and 2015 (in millions 2016 2015 Maturities less than 90 days: Proceeds from (repayments of commercial paper, net (869) $ 5.293 Maturities greater than 90 days: Proceeds from commercial paper Repayments of commercial paper Maturities greater than 90 days, net Total change in commercial paper, net 3.632 (3.160) 472 (397) 3.851 (6,953) (3.102) 2.191 $ Long-Term Debt As of September 24, 2016, the Company had outstanding floating and fixed-rate notes with varying maturities for an aggregate principal amount of $78.4 billion (collectively the "Notes'). The Notes are senior unsecured obliga- tions, and interest is payable in arrears, quarterly for the U.S. dollar-denominated and Australian dollar-denomi- nated floating-rate notes, semi-annually for the U.S. dollar-denominated, Australian dollar-denominated, British pound-denominated and Japanese yen-denominated fixed-rate notes and annually for the euro-denominated and Swiss franc-denominated fixed-rate notes. owing table provides a sum Company's term debt as of Setember 24, 2016 and September 20. 2016 Amount Maturities (in millions) Effective Interest Rate 2015 Firective Amount interest (in millions) Rate $ 000 3.850 2018 2018-2043 notes 2.000 1 2.500 1.10165 _10155 3.000 0.519 1.109 14,000 051-3919 2017-2019 2017-2014 2,000 10.000 0.861-10946 0.85 4.489 2,000 10.000 0.375 0.37 0.6056 4.489 2017-2020 2017-2045 1,781 0.879 879 25,144 0.28% 4.5196 1.743 24,958 0.36%-1.87% 0.2894519 debe issuance of $17.0 billion: Floating-rate notes Fixed-rate 1.00093.8509 notes debe issuance of $12.0 billion: Floating-rate notes Fixed-rate 1.0505-4.45046 notes 2015 debt issuances of $27.3 billion Floating-rate notes Fixed-rate 0.350-4.3759 notes Second quarter 2016 debt issuance of SI5.5 billion Floating-rate notes Floating-rate notes Fixed-rate 1.30056 notes Fixed-rate 1.7006 notes Fixed-rate 2.250 notes Fixed-rate 2.8505 notes Fixed-rate 3.2509 notes Fixed-rate 4.500 notes Fixed-rate 4.650 notes 500 500 2019 2021 2018 2019 2021 2023 2026 2036 500 1.000 3,000 1.500 3.250 1.250 4,000 1.6456 1.959 1.32 1.7196 1.9196 2.5896 2.5196 4.5456 2046 4 5896 2020 2024 493 342 247 1.9296 2.619 2.84% 2026 Third quarter 2016 Australian dollar-denominated debt issuance of A$1.4 billion Fixed-rate 2.650 notes Fixed-rate 3.350 notes Fixed-rate 3.600% notes Third quarter 2016 debt issuance of $1.4 billion: Fixed-rate 4.150% notes Fourth quarter 2016 debt issuance of 57.0 billion: Floating-rate notes Fixed-rate 1009 notes Fixed-rate 1.550% notes Fixed-rate 2.450 notes Fixed-rate 3.850% notes Total term debt 2046 1,377 4.15% 2019 2019 2021 350 1.150 1.250 2.250 2,000 78,384 0.9196 1.13 1,4096 2.15% 3.865 2026 2046 55,701 (174) (248) Unamortized premium/(discount) and issuance costs, net Hedge accounting fair value adjustments Less: Current portion of long-term debt, net Total long-term debt 376 717 (3.500) 75.422 $ (2.500) 53,329 $ - Shareholders' Equity cany declared and paid cash dividends per share during the periods presented as follows The Company declared and Dividends Per Share Amount (in millions) 0.57 3 0.57 0.52 071 1.117 2,879 052 $ 2.18 2.98 11.065 $ 2016 Fourth quarter Third quarter Second quarter First quarter Total cash dividends declared and paid 2015: Fourth quarter Third quarter Second quarter First quarter Total cash dividends declared and paid $ 0.52 0.52 0.47 0.47 2.950 2.997 2.734 2.750 1.98 $ 11.431 Future dividends are subject to declaration by the Board of Directors. Share Repurchase Program In April 2016, the Company's Board of Directors increased the share repurchase authorization from $140 billion to $175 billion of the Company's common stock, of which $133 billion had been utilized as of September 24, 2016. The Company's share repurchase program does not obligate it to acquire any specific number of shares. Under the program, shares may be repurchased in privately negotiated and/or open market transactions, including under plans complying with Rule 1065.1 under the Securities Exchange Act of 1934, as amended (the "Exchange Act). Note 10 - Commitments and Contingencies Accrued Warranty and Indemnification The following table shows changes in the Company's accrued warranties and related costs for 2016, 2015 and 2014 (in millions): 5 Beginning accrued warranty and related costs Cost of warranty claims Accruals for product warranty Ending accrued warranty and related costs 2016 4,780 (4,663) 3.585 3.702 2015 4150 (4.401) 5,022 4,780 2014 2 (3.760) 4,952 4.159 $ $ S [...] The Company has entered into indemnification agreements with its directors and executive officers. Under these agreements, the Company has agreed to indemnify such individuals to the fullest extent permitted by law against liabilities that arise by reason of their status as directors or officers and to advance expenses incurred by such indi- viduals in connection with related legal proceedings. It is not possible to determine the maximum potential amount of payments the Company could be required to make under these agreements due to the limited history of prior indemnification claims and the unique facts and circumstances involved in each claim. However, the Company maintains directors and officers liability insurance coverage to reduce its exposure to such obligations Appendix A 765 walance Sheet Commitments Company la Sember 57.6 billion. The Co a s various equipement and facilities, including retail space, der cancelable operating lease The Company does not currently utilize any other off-balance sheet financing arrangements. As of em 2016, the Company's total future minimum lease payments under no cancelable operating leases The Company's retail store and other facility leaves are typically for terms not exceeding and generally contain multi-year renewal options under all operating leases, including both cancelled mangane se was 1939 mil million and $717 million in 2016, 2015 and 2014, respectively. Future simulease payments under aceable operating leases having remaining terms in excess of one year as of September 24, 2016, are as fol 10 5794 million Losin millions): 929 919 2017 2018 2019 2020 2021 Thereafter 915 889 836 2.139 Total $ 7,627 Contingencies The Company is subject to various legal proceedings and claims that have arisen in the ordinary course of business and that have not been fully adjudicated, as further discussed in Part 1 Item 1A of this Form 10-K under the head- ing "Risk Factors and in Part I. Item 3 of this Form 10-K under the heading "Legal Proceedings in the opinion of management, there was not at least a reasonable possibility the Company may have incurred a material loss, or a material loss in excess of a recorded accrual, with respect to loss contingencies for asserted legal and other claims. However, the outcome of litigation is inherently uncertain. Therefore, although management considers the likelihood of such an outcome to be remote, if one or more of these legal matters were resolved against the Com- pany in a reporting period for amounts in excess of management's expectations, the Company's consolidated financial statements for that reporting period could be materially adversely affected. Apple Inc, Samsung Electronics Co., Lid., et al. On August 24, 2012. a jury returned a verdict awarding the Company $1.05 billion in its lawsuit against Samsung Electronics Co., Ltd. and affiliated parties in the United States District Court, Northern District of California, San Jose Division. On March 6, 2014, the District Court entered final judgment in favor of the Company in the amount of approximately 5930 million. On May 18, 2015, the U.S. Court of Appeals for the Federal Circuit affirmed in part, and reversed in part, the decision of the District Court. As a result, the Court of Appeals ordered entry of final judgment on damages in the amount of approximately $548 million, with the District Court to determine supple- mental damages and interest, as well as damages owed for products subject to the reversal in part. Samsung paid $548 million to the Company in December 2015, which was included in net sales in the Condensed Consolidated Statement of Operations. Because the case remains subject to further proceedings, the Company has not recog- nized any further amounts in its results of operations. On October 11, 2016, the United States Supreme Court heard arguments in Samsung's request for appeal related to the $548 million in damages

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started