Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Make an Economic Project Evaluation of Designing and Fabrication if Upper Body Auxiliary Support System using Aluminium (table sample attached). The list of project bill

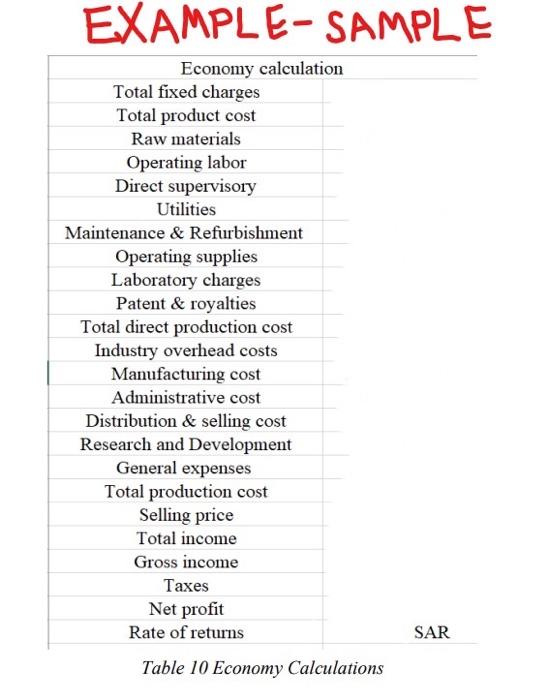

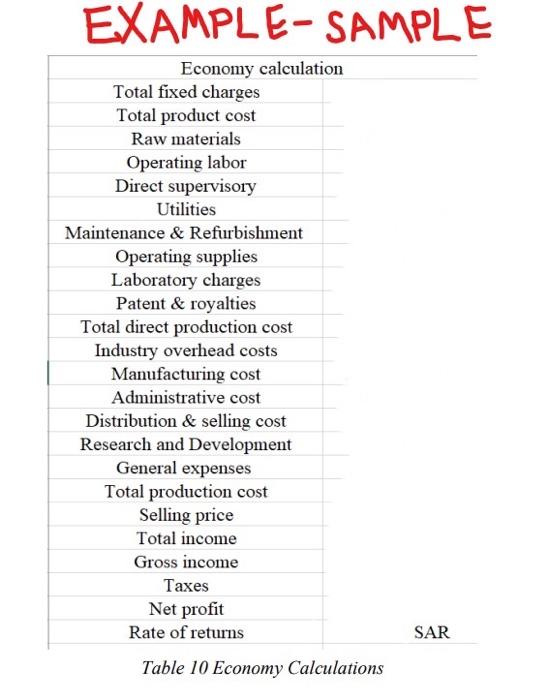

Make an Economic Project Evaluation of Designing and Fabrication if Upper Body Auxiliary Support System using Aluminium (table sample attached). The list of project bill of materials costs 3915.5 SAR, make an estimation of how much welding and cutting pipes costs and take in account of evaluation. To calculate how much interest rate of 50% will the project profit you in return. (Formula sheet and detailed explanations are attached).

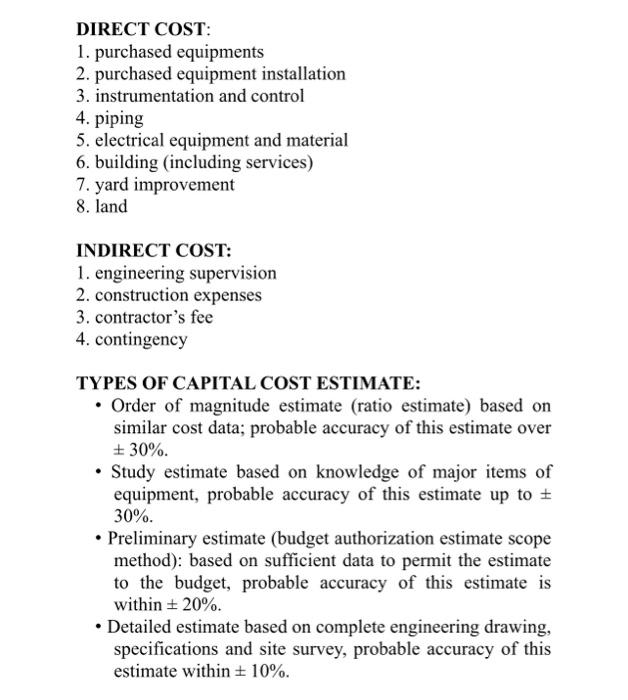

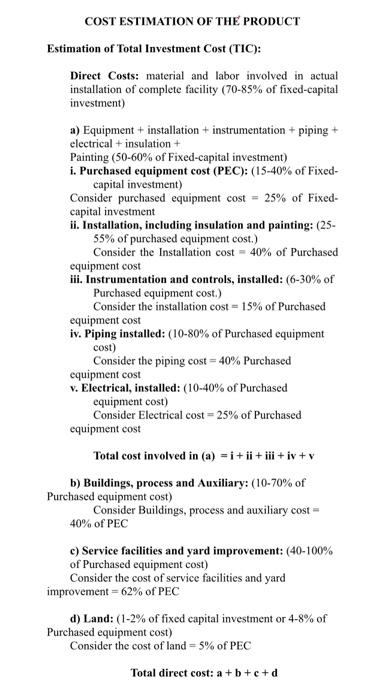

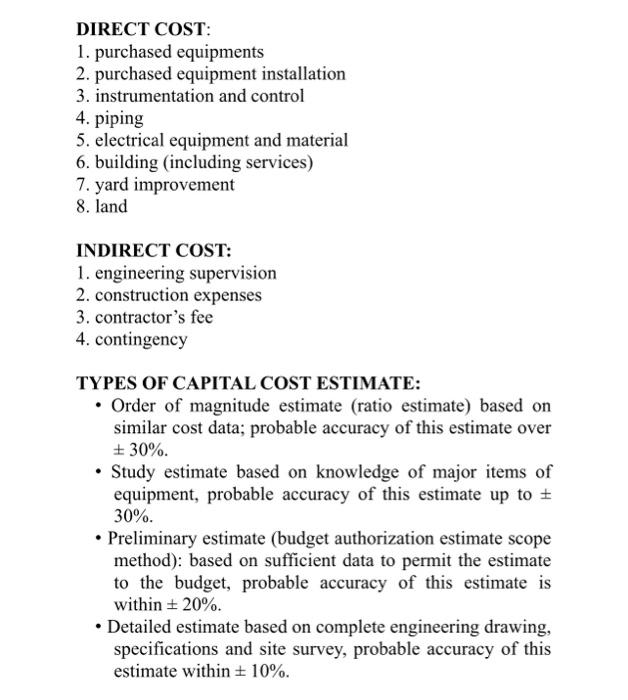

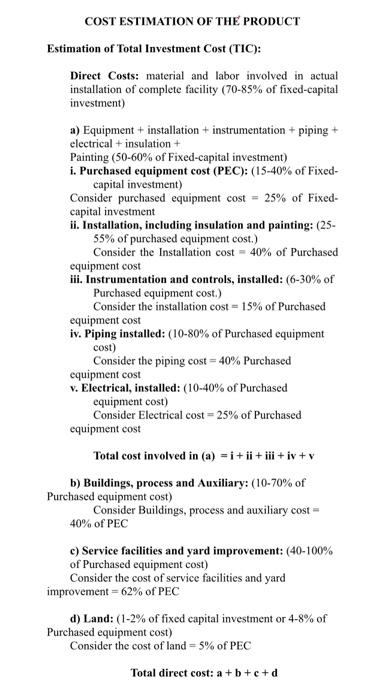

EXAMPLE-SAMPLE Table 10 Economy Calculations SAR DIRECT COST: 1. purchased equipments 2. purchased equipment installation 3. instrumentation and control 4. piping 5. electrical equipment and material 6. building (including services) 7. yard improvement 8. land INDIRECT COST: 1. engineering supervision 2. construction expenses 3. contractor's fee 4. contingency TYPES OF CAPITAL COST ESTIMATE: - Order of magnitude estimate (ratio estimate) based on similar cost data; probable accuracy of this estimate over 30%. - Study estimate based on knowledge of major items of equipment, probable accuracy of this estimate up to \pm 30%. - Preliminary estimate (budget authorization estimate scope method): based on sufficient data to permit the estimate to the budget, probable accuracy of this estimate is within 20%. - Detailed estimate based on complete engineering drawing, specifications and site survey, probable accuracy of this estimate within 10%. COST ESTIMATION OF THE PRODUCT Estimation of Total Investment Cost (TIC): Direct Costs: material and labor involved in actual installation of complete facility (7085% of fixed-capital investment) a) Equipment + installation + instrumentation + piping + electrical + insulation + Painting ( 5060% of Fixed-capital investment) i. Purchased equipment cost (PEC): (15-40\% of Fixedcapital investment) Consider purchased equipment cost =25% of Fixedcapital investment ii. Installation, including insulation and painting: (2555% of purchased equipment cost.) Consider the Installation cost =40% of Purchased equipment cost iii. Instrumentation and controls, installed: (630% of Purchased equipment cost.) Consider the installation cost=15% of Purchased equipment cost iv. Piping installed: ( 1080% of Purchased equipment cost) Consider the piping cost =40% Purchased equipment cost v. Electrical, installed: (1040% of Purchased equipment cost) Consider Electrical cost =25% of Purchased equipment cost Total cost involved in (a) =i+ii+iii+iv+v b) Buildings, process and Auxiliary: (10-70\% of Purchased equipment cost) Consider Buildings, process and auxiliary cost= 40% of PEC c) Service facilities and yard improvement: (40-100\% of Purchased equipment cost) Consider the cost of service facilities and yard improvement =62% of PEC d) Land: (1-2\% of fixed capital investment or 48% of Purchased equipment cost) Consider the cost of land =5% of PEC Total direct cost: a+b+c+d Indirect costs: expenses which are not directly involved with material and labour of actual installation of complete facility ( 1530% of Fixed-capital investment) a) Engineering and Supervision: (5-30\% of direct costs) Consider the cost of engineering and supervision = 15% of Direct costs b) Construction Expense and Contractor's fee: (630% of direct costs) Consider the construction expense and contractor's fee =10% of Direct costs c) Contingency: (5-15\% of Fixed-capital investment) Consider the contingency cost =10% of Fixedcapital investment Total Indirect cost: a+b+c Fixed Capital Investment (FCI) Fixed capital investment = Direct costs + Indirect costs Working Capital: (10-20\% of Fixed-capital investment) Consider the Working Capital =15% of Fixed-capital investment Total Capital Investment (TCI): Total capital investment = Fixed capital investment + Working capital Estimation of Total Product cost: 1. Manufacturing Cost = Direct production cost + Fixed charges + Industry overhead cost. A. Fixed Charges: (10-20\% total product cost) i. Depreciation: (depends on life period, salvage value and method of calculation-about 10% of FCl for machinery and equipment, and 2-3\% for Building Value for Buildings) Consider depreciation =10% of FCl for machinery and equipment, and 3% for Building value for Buildings) ii. Local Taxes: (1-4\% of fixed capital investment) Consider the local taxes =4% of fixed capital investment iii. Insurances: ( 0.41% of fixed capital investment) Consider the Insurance =0.6% of fixed capital investment iv. Rent: ( 812% fixed capital investment) Consider rent =10% of fixed capital investment Total Fixed Charges =i+ii+iii+iv B. Direct Production Cost: Now we have Fixed charges =1020% of total product charges - (given) Consider the Fixed charges =15% of total product cost Total product cost = fixed charges 15% i. Raw Materials: (10-50\% of total product cost) Consider the cost of raw materials =30% of total product cost ii. Operating Labor (OL): (10-20\% of total product cost) Consider the cost of operating labor =15% of total product cost iii. Direct Supervisory and Clerical Labor (DS \& CL): (10-25\% of OL) Consider the cost for Direct supervisory and clerical labor =12% of OL. iv. Utilities: (10-20\% of total product cost) Consider the cost of Utilities =15% of total product cost v. Maintenance and repairs (M \& R): (2-10\% of fixed capital investment) Consider the maintenance and repair cost =5% of fixed capital investment vi. Operating Supplies: (1020% of M&R or 0.51% of FCI) Consider the cost of Operating supplies =15% of M \& R vii. Laboratory Charges: (10-20\% of OL) Consider the Laboratory charges =15% of OL viii. Patent and Royalties: (2-6\% of total product cost) Consider the cost of Patent and royalties =5% of total product cost Total direct production cost =i+ii+ii+iv+v+vi+vii+ viii C. Industry overhead Costs (50-70\% of Operating labor, supervision, and maintenance or 515% of total product cost); includes for the following: general industry upkeep and overhead, payroll overhead, packaging, medical services, safety and protection, restaurants, recreation, salvage, laboratories, and storage facilities. Consider the plant overhead cost =60% of OL, DS \& CL, and M&R Manufacture cost = Direct production cost + Fixed charges + Industry overhead costs. General Expenses = Administrative costs + distribution and selling costs + research and development costs A. Administrative costs:(40-60\% of operating labor) Consider the Administrative costs =50% of operating labor B. Distribution and Selling costs: (220% of total product cost); Includes costs for sales offices, salesmen, shipping, and advertising. Consider the Distribution and selling costs =10% of total product cost C. Research and Development costs: (about 3% of total product cost) Consider the Research and development costs =3% of total product cost GeneralExpenses=A+B+C Total Production cost= Manufacture cost+ General Expenses Gross Earnings/Income: Wholesale Selling Price of the product =( Selling price need to fix) Total Income = Selling price * Quantity of product manufactured Gross income = Total Income - Total Production Cost Let the Tax rate be 45% (common) Taxes =45% of Gross income Note: if applicable tax need to include. Net Profit = Gross income - Taxes = Gross income* (1 Tax rate) Rate of Return: Rate of return = Net profit*100/Total Capital Investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started