make an income statement and balance sheet

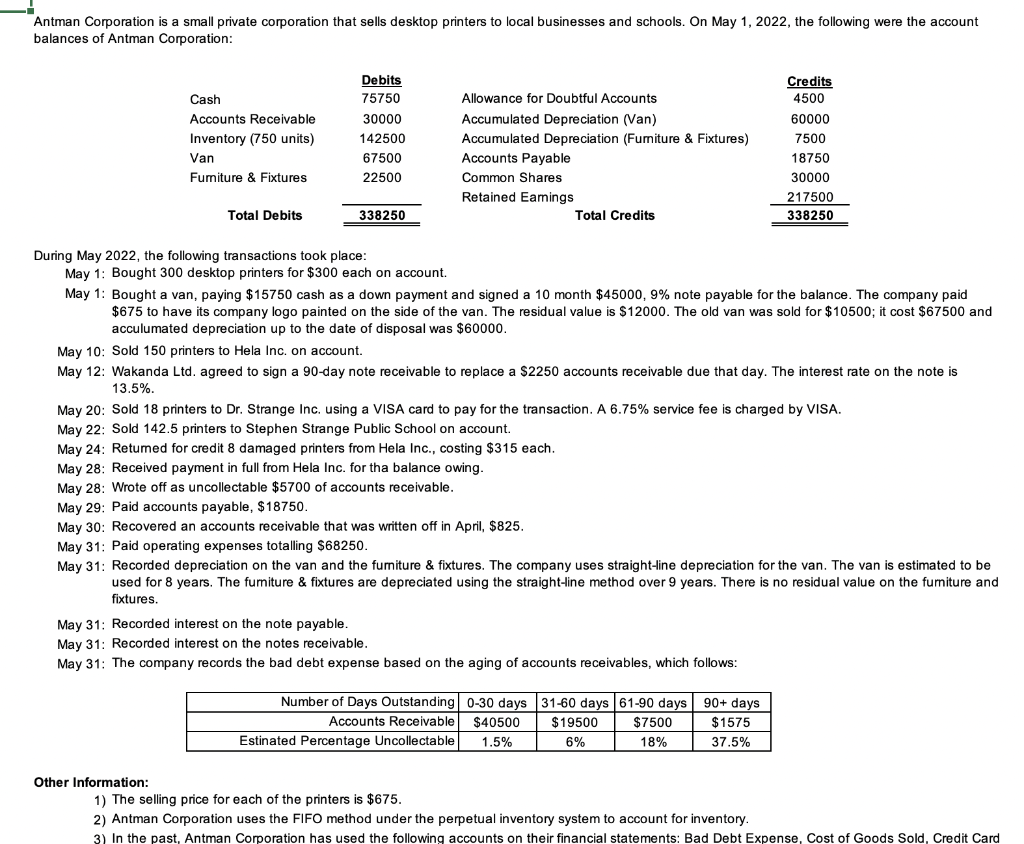

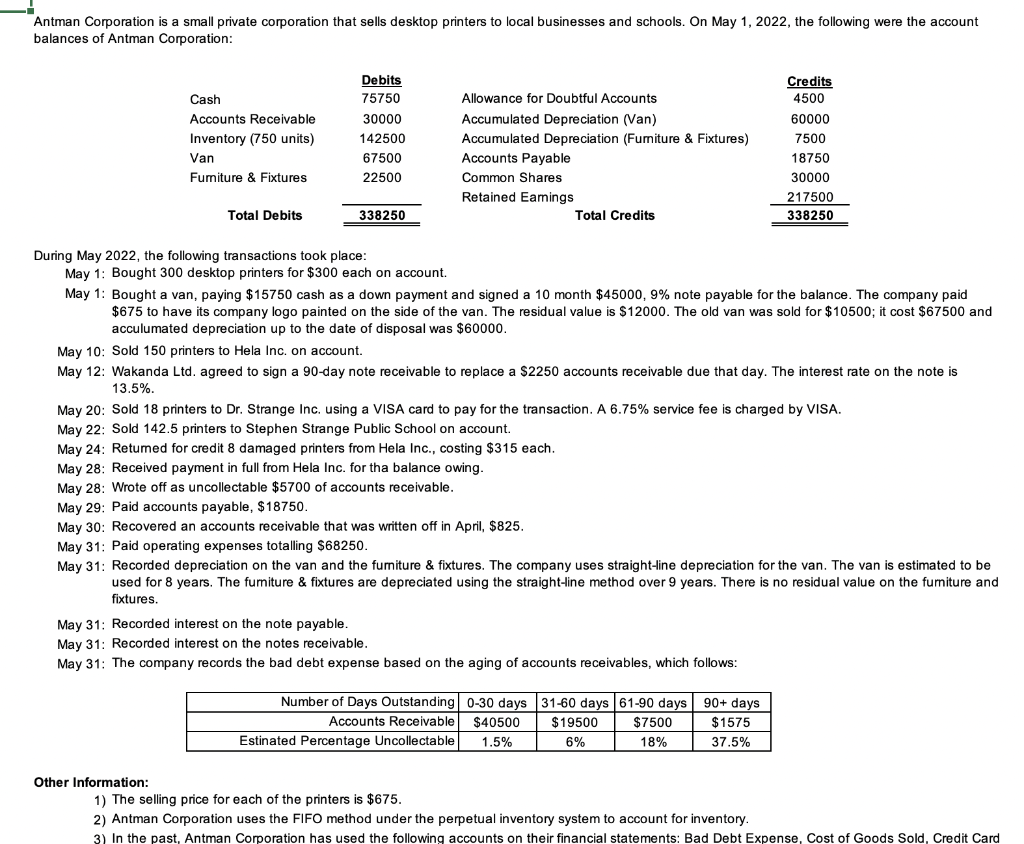

Antman Corporation is a small private corporation that sells desktop printers to local businesses and schools. On May 1, 2022, the following were the account balances of Antman Corporation: Cash Accounts Receivable Inventory (750 units) Van Furniture & Fixtures Debits 75750 30000 142500 67500 22500 Allowance for Doubtful Accounts Accumulated Depreciation (Van) Accumulated Depreciation (Fumiture & Fixtures) Accounts Payable Common Shares Retained Eamings Total Credits Credits 4500 60000 7500 18750 30000 217500 338250 Total Debits 338250 During May 2022, the following transactions took place: May 1: Bought 300 desktop printers for $300 each on account. May 1: Bought a van, paying $15750 cash as a down payment and signed a 10 month $45000, 9% note payable for the balance. The company paid $675 to have its company logo painted on the side of the van. The residual value is $12000. The old van was sold for $10500; it cost $67500 and acculumated depreciation up to the date of disposal was $60000. May 10: Sold 150 printers to Hela Inc, on account. May 12: Wakanda Ltd. agreed to sign a 90-day note receivable to replace a $2250 accounts receivable due that day. The interest rate on the note is 13.5%. May 20: Sold 18 printers to Dr. Strange Inc. using a VISA card to pay for the transaction. A 6.75% service fee is charged by VISA. May 22: Sold 142.5 printers to Stephen Strange Public School on account. May 24: Retumed for credit 8 damaged printers from Hela Inc., costing $315 each. May 28: Received payment in full from Hela Inc. for tha balance owing. May 28: Wrote off as uncollectable $5700 of accounts receivable. May 29: Paid accounts payable, $18750. May 30: Recovered an accounts receivable that was written off in April, $825. May 31: Paid operating expenses totalling $68250. May 31: Recorded depreciation on the van and the furniture & fixtures. The company uses straight-line depreciation for the van. The van is estimated to be used for 8 years. The fumiture & fixtures are depreciated using the straight-line method over 9 years. There is no residual value on the fumiture and fixtures. May 31: Recorded interest on the note payable. May 31: Recorded interest on the notes receivable. May 31: The company records the bad debt expense based on the aging of accounts receivables, which follows: Number of Days Outstanding 0-30 days 31-60 days 61-90 days 90+ days Accounts Receivable $40500 $19500 $7500 $1575 Estinated Percentage Uncollectable 1.5% 6% 18% 37.5% Other Information: 1) The selling price for each of the printers is $675. 2) Antman Corporation uses the FIFO method under the perpetual inventory system to account for inventory. 3) In the past, Antman Corporation has used the following accounts on their financial statements: Bad Debt Expense, Cost of Goods Sold, Credit Card Antman Corporation is a small private corporation that sells desktop printers to local businesses and schools. On May 1, 2022, the following were the account balances of Antman Corporation: Cash Accounts Receivable Inventory (750 units) Van Furniture & Fixtures Debits 75750 30000 142500 67500 22500 Allowance for Doubtful Accounts Accumulated Depreciation (Van) Accumulated Depreciation (Fumiture & Fixtures) Accounts Payable Common Shares Retained Eamings Total Credits Credits 4500 60000 7500 18750 30000 217500 338250 Total Debits 338250 During May 2022, the following transactions took place: May 1: Bought 300 desktop printers for $300 each on account. May 1: Bought a van, paying $15750 cash as a down payment and signed a 10 month $45000, 9% note payable for the balance. The company paid $675 to have its company logo painted on the side of the van. The residual value is $12000. The old van was sold for $10500; it cost $67500 and acculumated depreciation up to the date of disposal was $60000. May 10: Sold 150 printers to Hela Inc, on account. May 12: Wakanda Ltd. agreed to sign a 90-day note receivable to replace a $2250 accounts receivable due that day. The interest rate on the note is 13.5%. May 20: Sold 18 printers to Dr. Strange Inc. using a VISA card to pay for the transaction. A 6.75% service fee is charged by VISA. May 22: Sold 142.5 printers to Stephen Strange Public School on account. May 24: Retumed for credit 8 damaged printers from Hela Inc., costing $315 each. May 28: Received payment in full from Hela Inc. for tha balance owing. May 28: Wrote off as uncollectable $5700 of accounts receivable. May 29: Paid accounts payable, $18750. May 30: Recovered an accounts receivable that was written off in April, $825. May 31: Paid operating expenses totalling $68250. May 31: Recorded depreciation on the van and the furniture & fixtures. The company uses straight-line depreciation for the van. The van is estimated to be used for 8 years. The fumiture & fixtures are depreciated using the straight-line method over 9 years. There is no residual value on the fumiture and fixtures. May 31: Recorded interest on the note payable. May 31: Recorded interest on the notes receivable. May 31: The company records the bad debt expense based on the aging of accounts receivables, which follows: Number of Days Outstanding 0-30 days 31-60 days 61-90 days 90+ days Accounts Receivable $40500 $19500 $7500 $1575 Estinated Percentage Uncollectable 1.5% 6% 18% 37.5% Other Information: 1) The selling price for each of the printers is $675. 2) Antman Corporation uses the FIFO method under the perpetual inventory system to account for inventory. 3) In the past, Antman Corporation has used the following accounts on their financial statements: Bad Debt Expense, Cost of Goods Sold, Credit Card