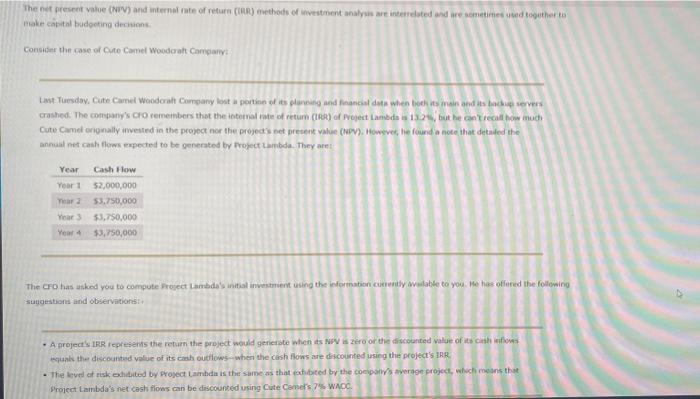

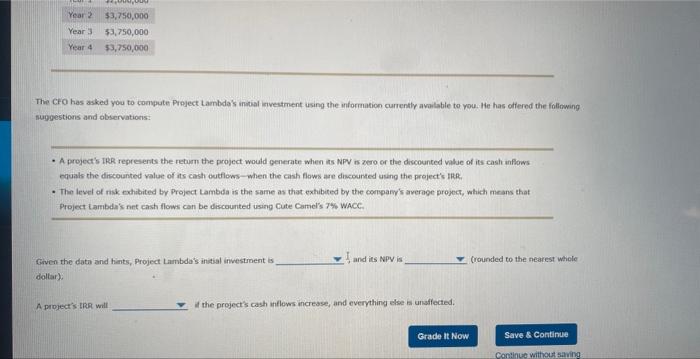

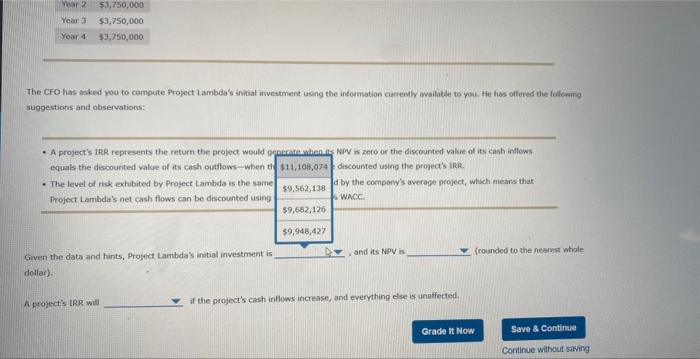

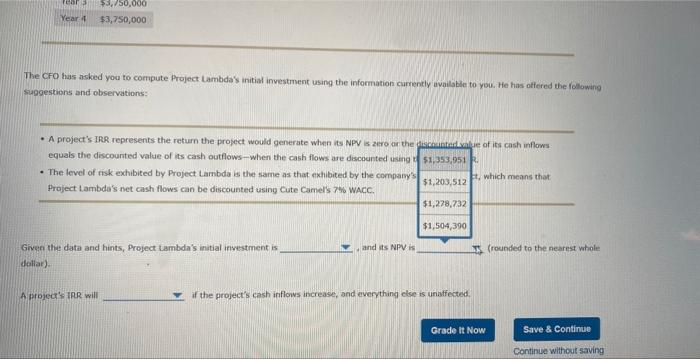

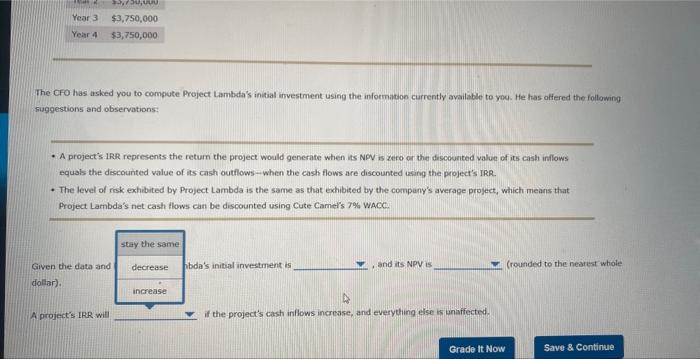

Make cabtal budoeting deciuons: Consuier the case of Cute Camel Woodoaht Campary? Cute Camet orignally imetied in the propect nor the projectis net pretent value (bev). Howeved, he found a note that detaded the annual met cakh fleces expeted to be generated by Fropect Larnbda. They are:s suygeistions and observintionsi i iniank the discountive valie of its cach outiows when the cash fows are chicouinted using the projectis IRR. The keved at risk eahdited by Proyect Lambda is the same as that rectubied by the cocipambs avorage project, whish mesins that Froject Lambala's net cest fiows an be dascounted using Cute Cemers 7 sh wncO. The Cro has asked you to coenpute Preject Lambda's initial investment using the information currently available to you. lie has offered the follifwing nuggestions and observations: - A project's tRR represents the return the project would generate when its NFV is zero or the dricounted value of its cash anflows equals the direcounted value of its carsh outfiows- when the cash flows are diacounted using the preject's fite. - The level of risk exhilaited by Project Lambda is the same as that exhibited by the congamy's average project, which means that Project iambda's net cash flonss can be discounted using Cute Carnel's 7\% WACC. Firven the dati and hants, Project Lambda's initial investrnent is and its NPY is frounded to the nearest whicle dollar). A project's tier will If the project's cash inflews increase, and everything else is unsfiected. The CFO has aiked you to compute Project Lambda's initial investment usang the information carrenth-availakle to you. Hfe has offered the folowing suggestions and observations: - A projectis IH equals the di - The level of r ieans that Project Lamb Given the data and hints, Proyect Lambda's initial investment is dollar). Aproject's LRR will if the project's ciesh inflows increase, and everything else is anaffected. The CFO has asked you to compute Project Lambda's initial investment using the information currently available to you. He has otiered the following sitaggestions and observations; Grvee the data and hints, Project Lambda's initial investment is , and its NPV if frounded to the nearest whole deilat). A. projects IPR will if the project's cash inflows increase, and everything else is unadfected. The OFO has asked you to compute Project Lambda's initial investment using the information currently available to you. He has affered the following fuggestions and observations: - A project's.1RR represents the return the project would generate when its NpV is zaro or the discounted value of its cash inflows equals the descounted value of its cash outflows-when the cash flows are discounted using the project's IRR. - The level of rosk exhibited by Project Lambda is the same as that exhibited by the company's average project, which mearis that Project Lambda's net cash Hlows can be discounted using Cute Camel's 7% WACC. Given the data and bda's initial investment is , and its NPV is (rounded to the nearest whole doliar). A project's IRR wil if the project's cash inflows increase, and everything else ins unafifected