Make income statement as Excel spreadsheet, allowing you to calculate operating cashflows from the data provided below:

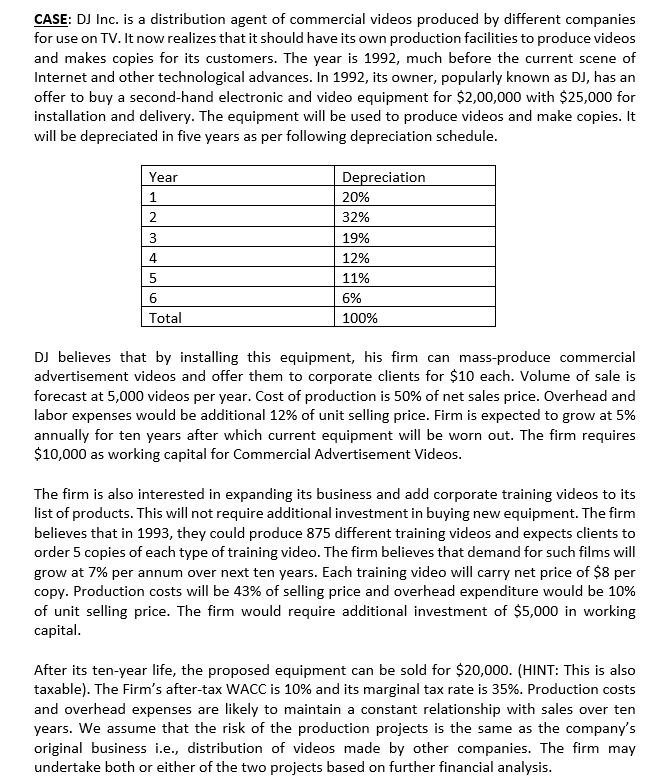

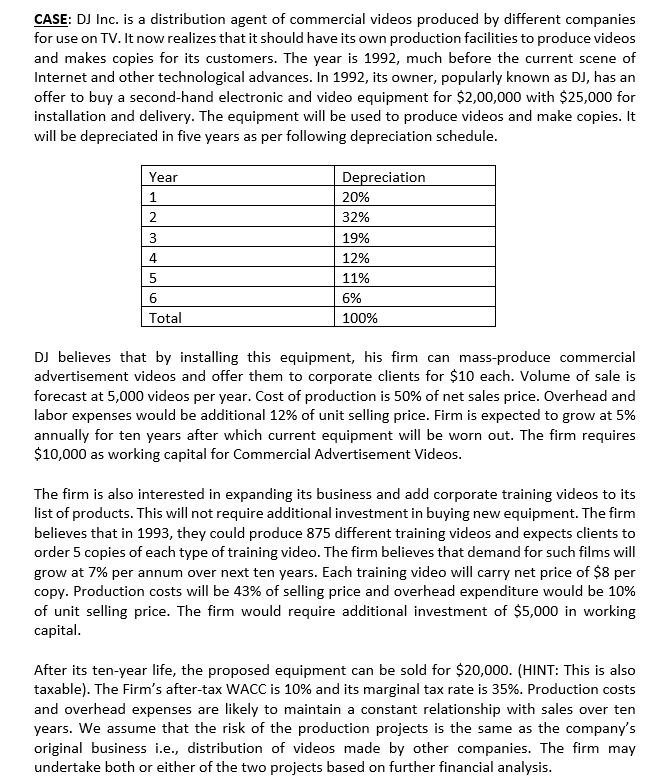

CASE: DJ Inc. is a distribution agent of commercial videos produced by different companies for use on TV. It now realizes that it should have its own production facilities to produce videos and makes copies for its customers. The year is 1992, much before the current scene of Internet and other technological advances. In 1992, its owner, popularly known as DJ, has an offer to buy a second-hand electronic and video equipment for $2,00,000 with $25,000 for installation and delivery. The equipment will be used to produce videos and make copies. It will be depreciated in five years as per following depreciation schedule. Year 1 2 3 Depreciation 20% 32% 19% 12% 11% 6% 100% 4 6 Total DJ believes that by installing this equipment, his firm can mass-produce commercial advertisement videos and offer them to corporate clients for $10 each. Volume of sale is forecast at 5,000 videos per year. Cost of production is 50% of net sales price. Overhead and labor expenses would be additional 12% of unit selling price. Firm is expected to grow at 5% annually for ten years after which current equipment will be worn out. The firm requires $10,000 as working capital for Commercial Advertisement Videos. The firm is also interested in expanding its business and add corporate training videos to its list of products. This will not require additional investment in buying new equipment. The firm believes that in 1993, they could produce 875 different training videos and expects clients to order 5 copies of each type of training video. The firm believes that demand for such films will grow at 7% per annum over next ten years. Each training video will carry net price of $8 per copy. Production costs will be 43% of selling price and overhead expenditure would be 10% of unit selling price. The firm would require additional investment of $5,000 in working capital. After its ten-year life, the proposed equipment can be sold for $20,000. (HINT: This is also taxable). The Firm's after-tax WACC is 10% and its marginal tax rate is 35%. Production costs and overhead expenses are likely to maintain a constant relationship with sales over ten years. We assume that the risk of the production projects is the same as the company's original business i.e., distribution of videos made by other companies. The firm may undertake both or either of the two projects based on further financial analysis