Question

Make sure to solve everything completely and explain how it is done. Make sure to include the complete answers in the format of the attached

Make sure to solve everything completely and explain how it is done. Make sure to include the complete answers in the format of the attached images. Please have print if handwriting, typed also works but should be formatted properly. Make sure to completely answer the questions Problem 1 - Requirment A) Objective: To use the documents and calculations of a job order costing system.

Preparing:

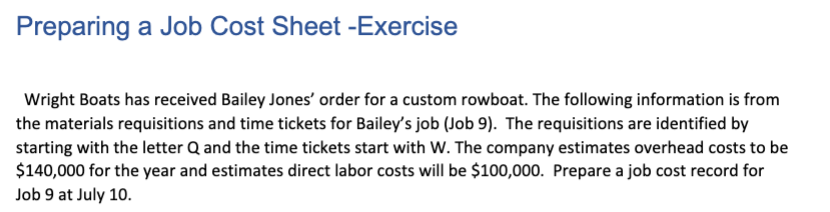

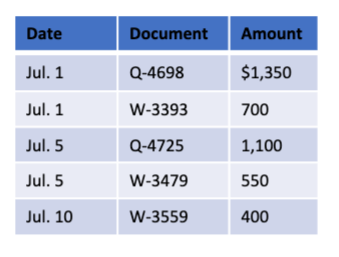

- You will be completing an exercise for Bailey Jones (attached below).

- This assignment addresses topics we covered in Topic 4.1 -4.2 of the textbook and lecture. So feel free to refer back to the book and lecture videosotes as needed.

Check Figures:

Let's make sure you are on the right track!

- You should get a total Direct Materials of $2,450.

- You should get a total Job Cost of $6,410

Bailey Jones:

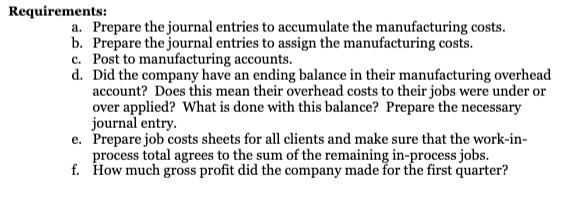

Problem 1 - Requirment B)

Objective: To use prepare entries and calculations for a manufacturer using a job order costing system.

Preparing:

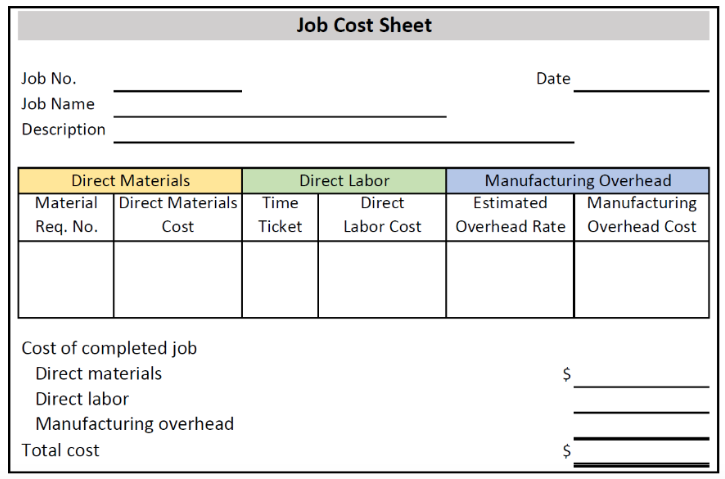

- You will be completing an exercise for Pinkie Pie Toys (attached below).

- Have your class examples of The Stacey Company from class handy to help you.

- This assignment addresses topics we covered in Topics 4.1 -4.3 of the textbook and lecture. So feel free to refer back to the book and lecture videosotes as needed.

Check Figures:

Let's make sure you are on the right track!

- For journal entry 5 you should have a debit to WIP of $160,320 credit to MOH of $165,380.

- For requirement (c) you should have an ending Raw Materials Balance of $28,530; Work in Process Balance of $66,313 and Finished Goods Balance of $0

- For requirement (d) the MOH account has an unadjusted (dr) balance of $6,879 before the adjusting entry is prepared. This means the MOH costs were under-applied for the period.

- For requirement (e) the job cost sheet for Celestia should be $66,313; for Luna $90,254

Pinkie Pie Toys:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started