Answered step by step

Verified Expert Solution

Question

1 Approved Answer

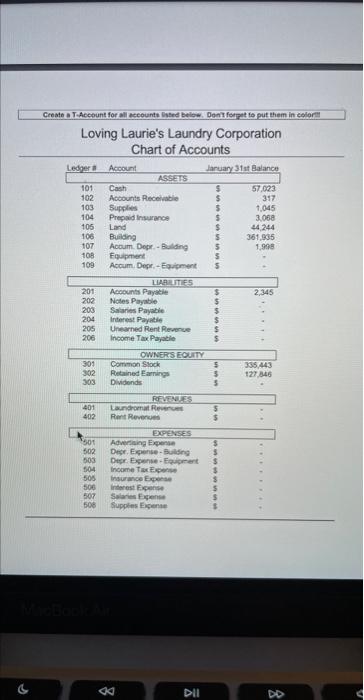

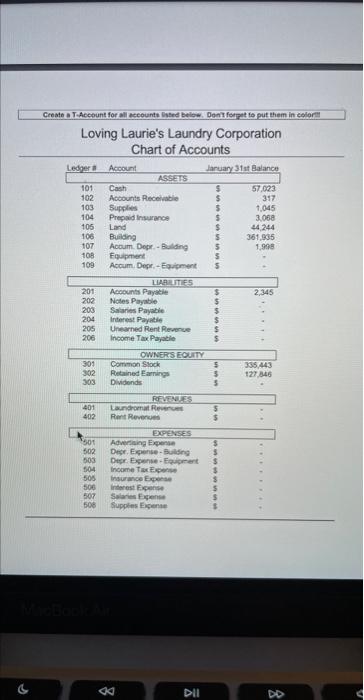

make t-accounts and do adjusting entrie for the accounts and transaction below. Loving Laurie's Laundry Corporation Chart of Accounts received 311,544 from Fippy Fienry for

make t-accounts and do adjusting entrie for the accounts and transaction below.

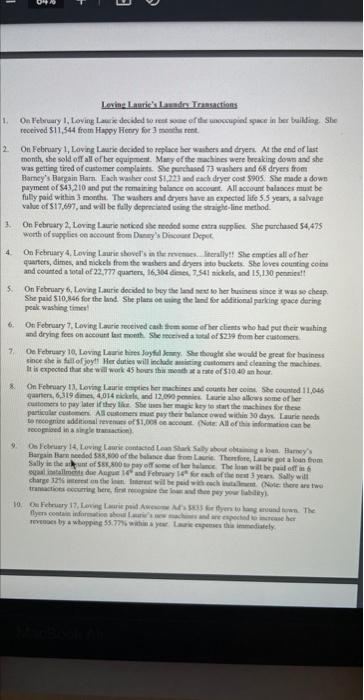

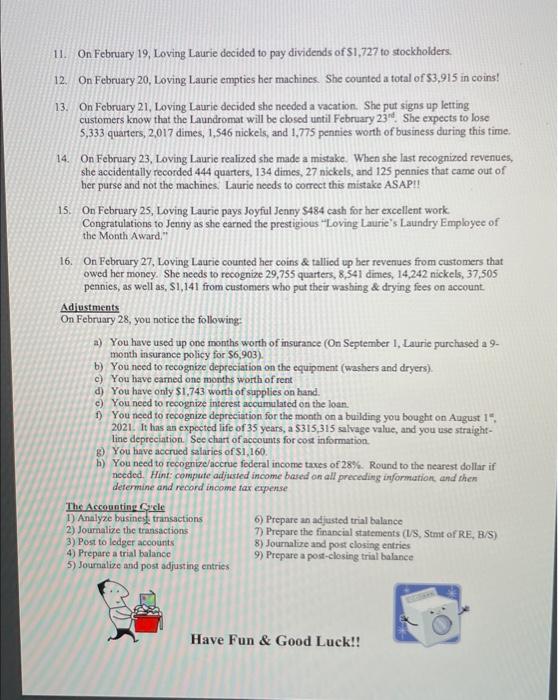

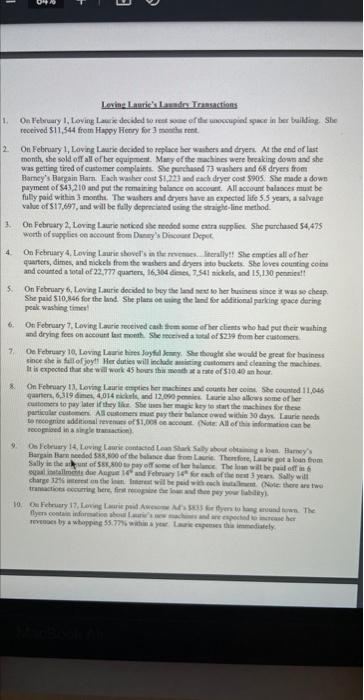

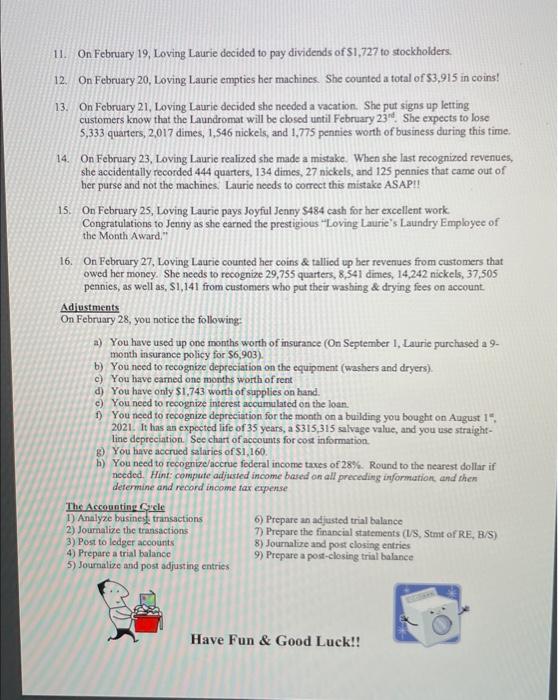

Loving Laurie's Laundry Corporation Chart of Accounts received 311,544 from Fippy Fienry for 3 mane rent. 2. On February 1, Loving Laure decided to seplace her waibers und dryers. At the end of last: month, she sold of all of ber equiproent. Mary of the machines were beeaking dows and she was getting tired of custemer osmplaints. She ferthasd 73 wasliers and 68 dryers from Bamey's Bargain Parm. Fach waster eost 51,223 aod zach dryer cost 5905 . She made a down payment of $43,210 and put the romaining balince ea acciouet. All acceunt halasces must be fulty paid within 3 monht. The waheri and dryers buve as expested life 5.5 yearm, a salvage value of $17,697, and will be fally deproiated weing the straiehe-line method. 3. On February 2 Lonizg laurie ngaked ake neodod some catra nuppliex. She parchased 54,475 woth of roggliet ee aceount from Dar ey's Dingore Depec. 4. On feceuary 4. Loving Larie skovel's at the mowack. Incrally!! She empties all of her quarters, Gimes, and nickels from the aashes and dyers ats beckets. 5 le loves countieg coins and courted a fotal of 22,707 quarters, 16,304 dienes, 7,541 aicheli, and 15,130 pennicu!t 5. On February .6. Lovint Lauric decided to bey the land nete to her business since it was as cheap. She paid 510,846 for the lind. Ste plara oe ining the lund for additional parking pace daring peak washine times! 6. On February 7, Loving larie rocelved cal fem some ef ber clients who had put their waihing 7. Oe Feleruagy 10. Laving Lane lirts loyfal knary. She thoughe se would be great for basiness fince the is A1 llof joyti Her duties will inchade antifing cautoment and cleaming the machines. It is cxpocted that ihe nill nork 45 horrs thir mods at a rite of 510.40 an hoer. tocoprioed in a sirgle tuansatsoe). reveoce by a whoppee 55.77 , wilhini yeas terie expemsers tha inmediately. 13. On February 21, Loving Laurie decided she needed a vacation. She put signs up letting customers know that the Laundromat will be closed until February 23nd. She expects to lose 5,333 quarters, 2,017 dimes, 1,546 nickels, and 1,775 pennies worth of business during this time. 14. On February 23, Loving Laurie realized she made a mistake. When she last recognized revenues, she accidentally recorded 444 quarters, 134 dimes, 27 nickels, and 125 pennies that came out of her purse and not the machines. Laurie needs to correct this mistake ASAPI!. 15. On February 25, Loving Laurie pays Joyful Jenny $484 cash for ber excellent work. Congratulations to Jenny as she earned the prestigious "Loving Laurie's Laundry Employec of the Month Award." 16. On February 27, Loving Laurie counted her coins \& tallied up her revenues from customers that owed her money. She needs to recognize 29,755 quarters, 8,541 dimes, 14,242 nickels, 37,505 pennies, as well as, $1,141 from customers who put their washing \& drying fees on account. Adjustments On February 28 , you notice the following: a) You have used up one months worth of insurance (On September I, Laurie purchased a 9 month insurance policy for $6,903). b) You need to recognize depreciation on the equipment (washers and dryers). c) You have carned one months worth of rent d) You have only $1,743 worth of supplies on hand. c) You need to recognize interest accumulated on the loan. 1) You need to recognize depreciation for the month on a building you bought on August 1=, 2021. It has an expected life of 35 years, a $315,315 salvage value, and you use straightline depreciation. See chart of accounts for cost information. 8) You have accrued salaries of $1,160. b) You need to recognize/accrue foderal income takes of 28\%. Round to the nearest dollar if needed. Hint compute adjieted income bared on all preceding information, and shen defermine and record income fax expense The Accounting racle 1) Analyze busines, transactions 6) Prepare an adjusted trial balance 2) Journalige the transactions 7) Prepare the financial statements (IS, Stmt of RE, B/S) 3) Post to ledger accounts. 8) Journalire and post closing entries 4) Prepare a trial balance 9) Prepare a post-closing trial balance 5) Journalize and post adjusting entries. Have Fun \& Good Luck

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started