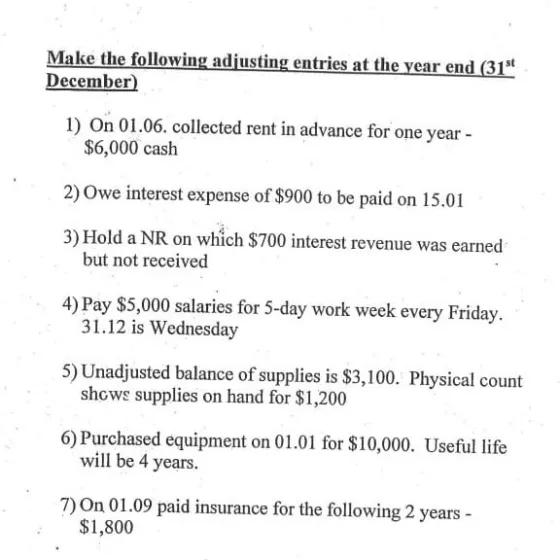

Question: Make the following adjusting entries at the year end (31 December) 1) On 01.06. collected rent in advance for one year - $6,000 cash

Make the following adjusting entries at the year end (31" December) 1) On 01.06. collected rent in advance for one year - $6,000 cash 2) Owe interest expense of $900 to be paid on 15.01 3) Hold a NR on which $700 interest revenue was earned but not received 4) Pay $5,000 salaries for 5-day work week every Friday. 31.12 is Wednesday 5) Unadjusted balance of supplies is $3,100. Physical count shows supplies on hand for $1,200 6) Purchased equipment on 01.01 for $10,000. Useful life will be 4 years. 7) On 01.09 paid insurance for the following 2 years - $1,800

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts