MAKE THE NECCESSARY JOURNAL ENTRIES FOR THE FOLLOWING TRANSACTIONS

Solve the questions sequentially

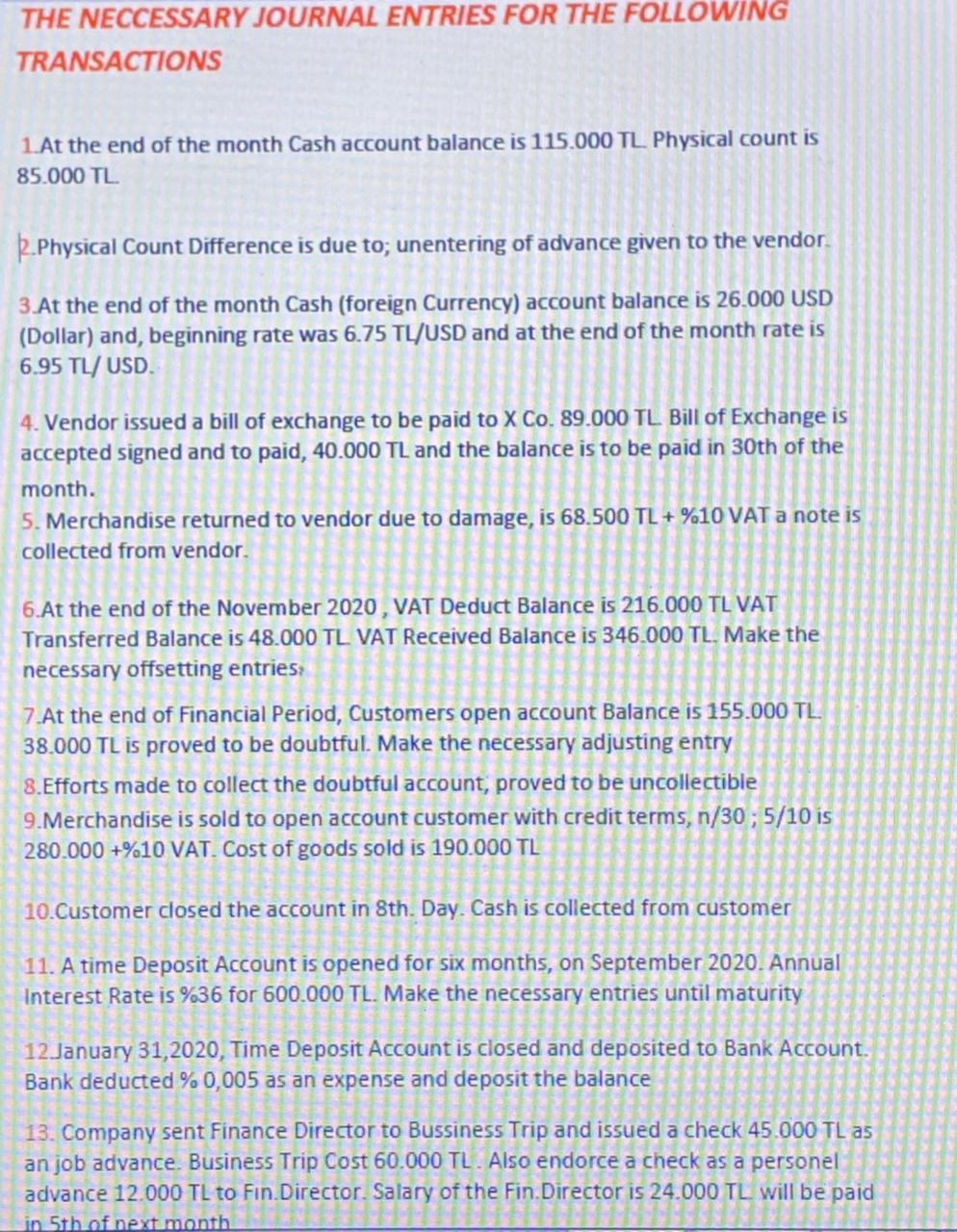

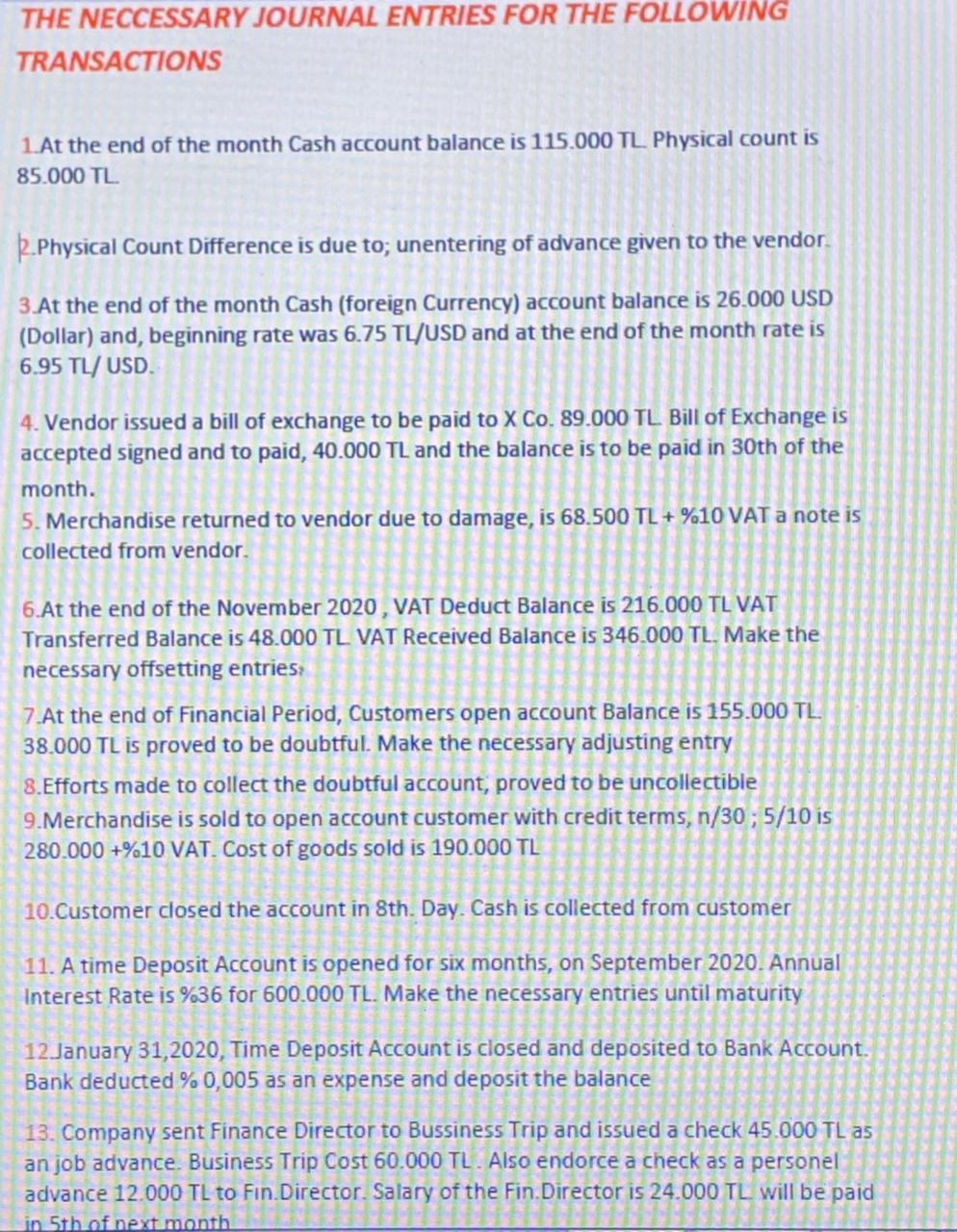

THE NECCESSARY JOURNAL ENTRIES FOR THE FOLLOWING TRANSACTIONS LAt the end of the month Cash account balance is 115.000 TL Physical count is 85.000 TL K.Physical Count Difference is due to; unentering of advance given to the vendor 3.At the end of the month Cash (foreign Currency) account balance is 26.000 USD (Dollar) and, beginning rate was 6.75 TL/USD and at the end of the month rate is 6.95 TL/USD. 4. Vendor issued a bill of exchange to be paid to X Co. 89.000 TL Bill of Exchange is accepted signed and to paid, 40.000 TL and the balance is to be paid in 30th of the month. 5. Merchandise returned to vendor due to damage, is 68.500 TL + %10 VAT a note is collected from vendor. 6.At the end of the November 2020, VAT Deduct Balance is 216.000 TL VAT Transferred Balance is 48.000 TL VAT Received Balance is 346.000 TL. Make the necessary offsetting entries 7 At the end of Financial Period, Customers open account Balance is 155.000 TL 38.000 TL is proved to be doubtful. Make the necessary adjusting entry 8.Efforts made to collect the doubtful account, proved to be uncollectible 9. Merchandise is sold to open account customer with credit terms, n/30 ; 5/10 is 280.000 +%10 VAT. Cost of goods sold is 190.000 TL 10. Customer closed the account in 8th. Day. Cash is collected from customer 11. A time Deposit Account is opened for six months, on September 2020. Annual Interest Rate is %36 for 600.000 TL. Make the necessary entries until maturity 12 January 31, 2020, Time Deposit Account is closed and deposited to Bank Account. Bank deducted %0,005 as an expense and deposit the balance 13. Company sent Finance Director to Bussiness Trip and issued a check 45.000 TL as an job advance, Business Trip Cost 60.000 TL. Also endorce a check as a personel advance 12.000 TL to Fin. Director. Salary of the Fin. Director is 24.000 TL will be paid in Sth of next month THE NECCESSARY JOURNAL ENTRIES FOR THE FOLLOWING TRANSACTIONS LAt the end of the month Cash account balance is 115.000 TL Physical count is 85.000 TL K.Physical Count Difference is due to; unentering of advance given to the vendor 3.At the end of the month Cash (foreign Currency) account balance is 26.000 USD (Dollar) and, beginning rate was 6.75 TL/USD and at the end of the month rate is 6.95 TL/USD. 4. Vendor issued a bill of exchange to be paid to X Co. 89.000 TL Bill of Exchange is accepted signed and to paid, 40.000 TL and the balance is to be paid in 30th of the month. 5. Merchandise returned to vendor due to damage, is 68.500 TL + %10 VAT a note is collected from vendor. 6.At the end of the November 2020, VAT Deduct Balance is 216.000 TL VAT Transferred Balance is 48.000 TL VAT Received Balance is 346.000 TL. Make the necessary offsetting entries 7 At the end of Financial Period, Customers open account Balance is 155.000 TL 38.000 TL is proved to be doubtful. Make the necessary adjusting entry 8.Efforts made to collect the doubtful account, proved to be uncollectible 9. Merchandise is sold to open account customer with credit terms, n/30 ; 5/10 is 280.000 +%10 VAT. Cost of goods sold is 190.000 TL 10. Customer closed the account in 8th. Day. Cash is collected from customer 11. A time Deposit Account is opened for six months, on September 2020. Annual Interest Rate is %36 for 600.000 TL. Make the necessary entries until maturity 12 January 31, 2020, Time Deposit Account is closed and deposited to Bank Account. Bank deducted %0,005 as an expense and deposit the balance 13. Company sent Finance Director to Bussiness Trip and issued a check 45.000 TL as an job advance, Business Trip Cost 60.000 TL. Also endorce a check as a personel advance 12.000 TL to Fin. Director. Salary of the Fin. Director is 24.000 TL will be paid in Sth of next month