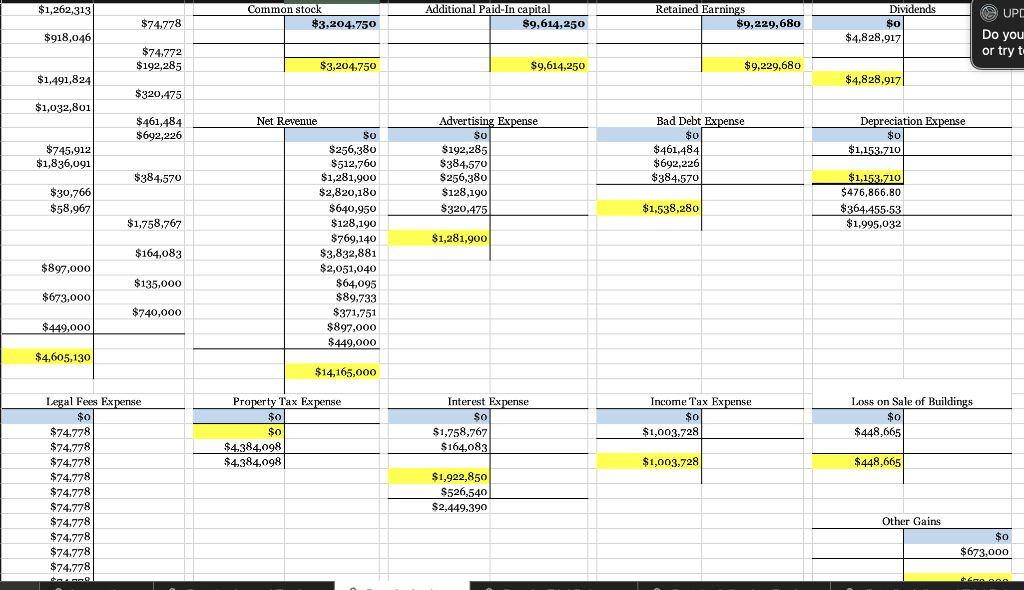

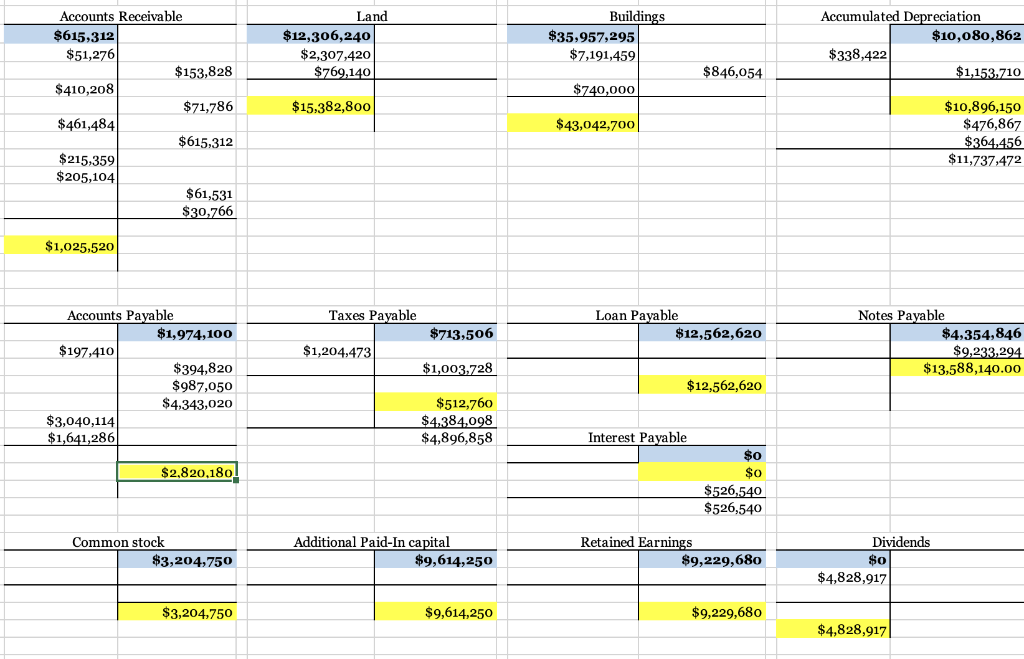

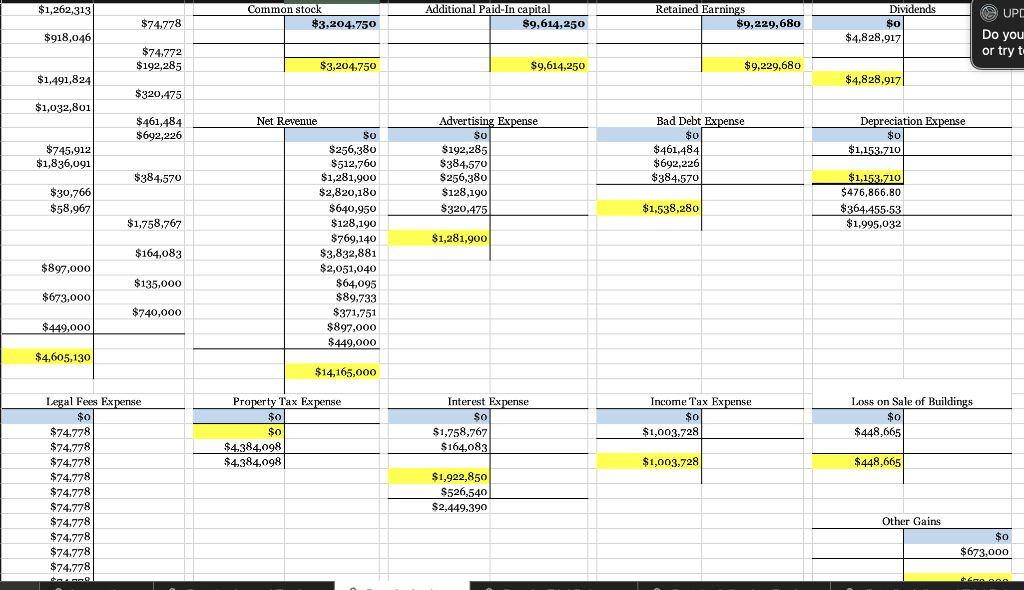

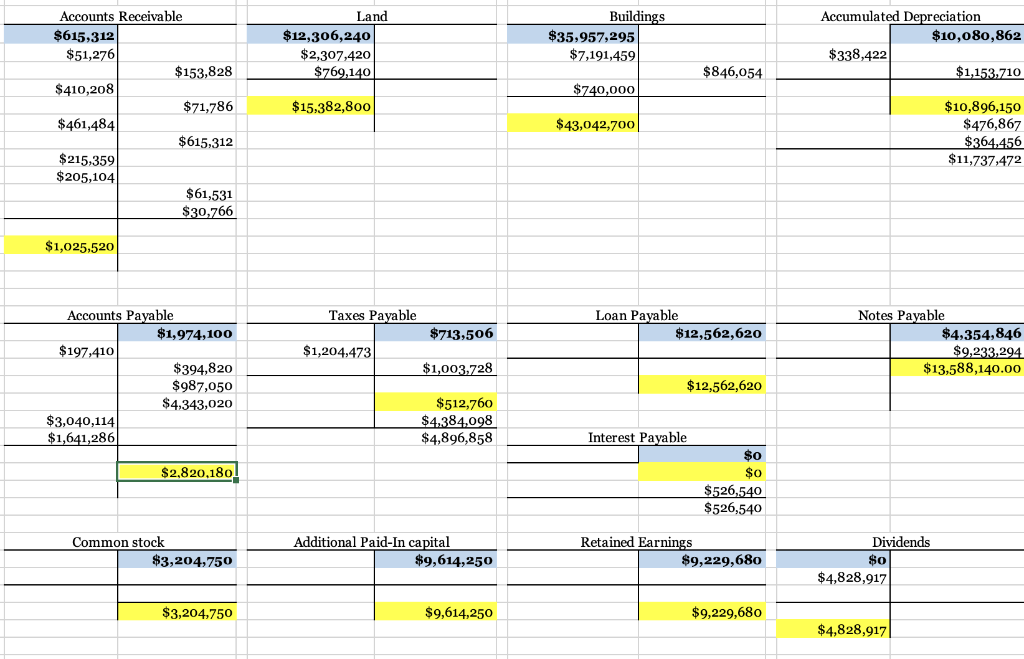

| Make the necessary adjusting entries to record the following information available at the end of the fiscal period. |

$1,262,313 Common stock $3,204,750 Additional Paid-In capital $9,614,250 $74,778 Retained Earnings $9,229,680 UPC Dividends $o $4,828,917 $918,046 Do you or try t $74,772 $192,285 $3,204,750 $9,614,250 $9,229,680 $1,491,824 $4,828,9171 $320,475 $1,032,801 $461,484 $692,226 Depreciation Expense $0 $1,153.710 $745.912 $1,836,091 Advertising Expense So $192,285 $384.570 $256,380 $128,190 $320,475 Bad Debt Expense $0 0 $461,484 $692,226 $384.570 $384.570 $30,766 $58,967 $1,538,280 $1,153,710 $476,866.80 $364,455.53 $1,995,032 $1,758,767 Net Revenue So $256,380 $512,760 $1,281,900 $2,820,180 $640,950 $128,190 $769,140 $3,832,881 $2,051,040 $64,095 $89.733 $371,751 $897,000 $449,000 $1,281,900 $164,083 $897,000 $135,000 $673,000 $740,000 $449,000 $4,605,130 $14,165,000 Property Tax Expense $o $0 $4,384,098 $4.384,098 Interest Expense $o $1,758,767 $164,083 Income Tax Expense $0 $1,003,728 Loss on Sale of Buildings $0 $448,665 $1,003,728 $448,665 Legal Fees Expense $0 $74.778 $74.778 $74.778 $74.778 $74.778 $74.778 $74.778 $74.778 $74,778 $74,778 $1,922,850 $526,540 $2,449,390 Other Gains $0 $673,000 Aanaan Land $12,306,240 $2,307,420 $769,140 Buildings $35,957,295 $7,191,459 Accumulated Depreciation $10,080,862 $338,422 $1,153,710 $846,054 $740,000 Accounts Receivable $615,312 $51,276 $153,828 $410,208 $71,786 $461,484 $615,312 $215,359 $ 205,104 $61,531 $30,766 $15,382,800 $43,042,700 $10,896,150 $476,867 $364,456 $11,737,472 $1,025,520 Taxes Payable $713,506 Loan Payable $12,562,620 Notes Payable $4,354,846 $9,233,294 $13,588,140.00 $1,204,473 $1,003,728 Accounts Payable $1,974,100 $197,410 $394,820 $987,050 $4,343,020 $3,040,114 $1,641,286 $12,562,620 $512,760 $4,384,098 $4,896,858 Interest Payable $2,820,180 $o $o $526,540 $526,540 Common stock $3,204,750 Additional Paid-In capital $9,614,250 Retained Earnings $9,229,680 Dividends $0 $4,828,917 $3,204,750 $9,614,250 $9,229,680 $4,828,917| $1,262,313 Common stock $3,204,750 Additional Paid-In capital $9,614,250 $74,778 Retained Earnings $9,229,680 UPC Dividends $o $4,828,917 $918,046 Do you or try t $74,772 $192,285 $3,204,750 $9,614,250 $9,229,680 $1,491,824 $4,828,9171 $320,475 $1,032,801 $461,484 $692,226 Depreciation Expense $0 $1,153.710 $745.912 $1,836,091 Advertising Expense So $192,285 $384.570 $256,380 $128,190 $320,475 Bad Debt Expense $0 0 $461,484 $692,226 $384.570 $384.570 $30,766 $58,967 $1,538,280 $1,153,710 $476,866.80 $364,455.53 $1,995,032 $1,758,767 Net Revenue So $256,380 $512,760 $1,281,900 $2,820,180 $640,950 $128,190 $769,140 $3,832,881 $2,051,040 $64,095 $89.733 $371,751 $897,000 $449,000 $1,281,900 $164,083 $897,000 $135,000 $673,000 $740,000 $449,000 $4,605,130 $14,165,000 Property Tax Expense $o $0 $4,384,098 $4.384,098 Interest Expense $o $1,758,767 $164,083 Income Tax Expense $0 $1,003,728 Loss on Sale of Buildings $0 $448,665 $1,003,728 $448,665 Legal Fees Expense $0 $74.778 $74.778 $74.778 $74.778 $74.778 $74.778 $74.778 $74.778 $74,778 $74,778 $1,922,850 $526,540 $2,449,390 Other Gains $0 $673,000 Aanaan Land $12,306,240 $2,307,420 $769,140 Buildings $35,957,295 $7,191,459 Accumulated Depreciation $10,080,862 $338,422 $1,153,710 $846,054 $740,000 Accounts Receivable $615,312 $51,276 $153,828 $410,208 $71,786 $461,484 $615,312 $215,359 $ 205,104 $61,531 $30,766 $15,382,800 $43,042,700 $10,896,150 $476,867 $364,456 $11,737,472 $1,025,520 Taxes Payable $713,506 Loan Payable $12,562,620 Notes Payable $4,354,846 $9,233,294 $13,588,140.00 $1,204,473 $1,003,728 Accounts Payable $1,974,100 $197,410 $394,820 $987,050 $4,343,020 $3,040,114 $1,641,286 $12,562,620 $512,760 $4,384,098 $4,896,858 Interest Payable $2,820,180 $o $o $526,540 $526,540 Common stock $3,204,750 Additional Paid-In capital $9,614,250 Retained Earnings $9,229,680 Dividends $0 $4,828,917 $3,204,750 $9,614,250 $9,229,680 $4,828,917|