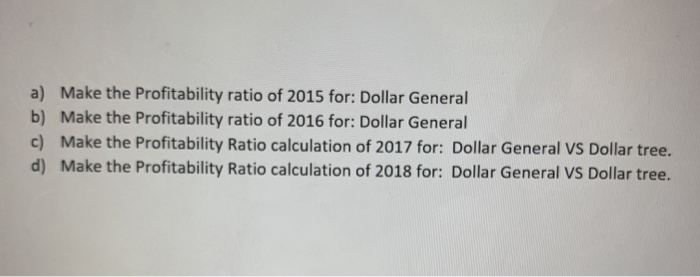

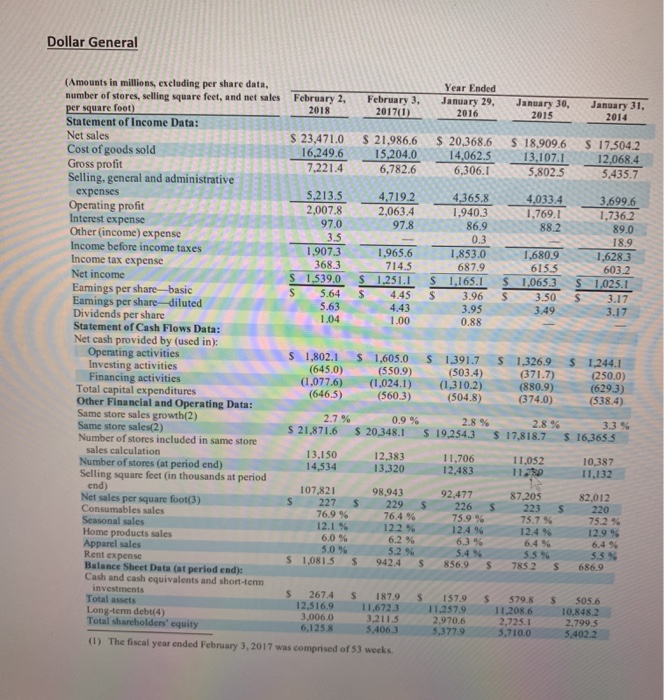

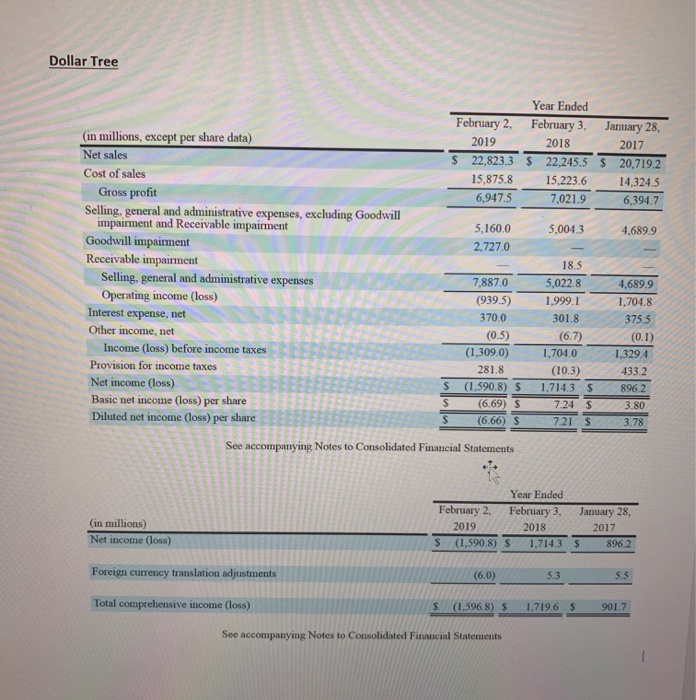

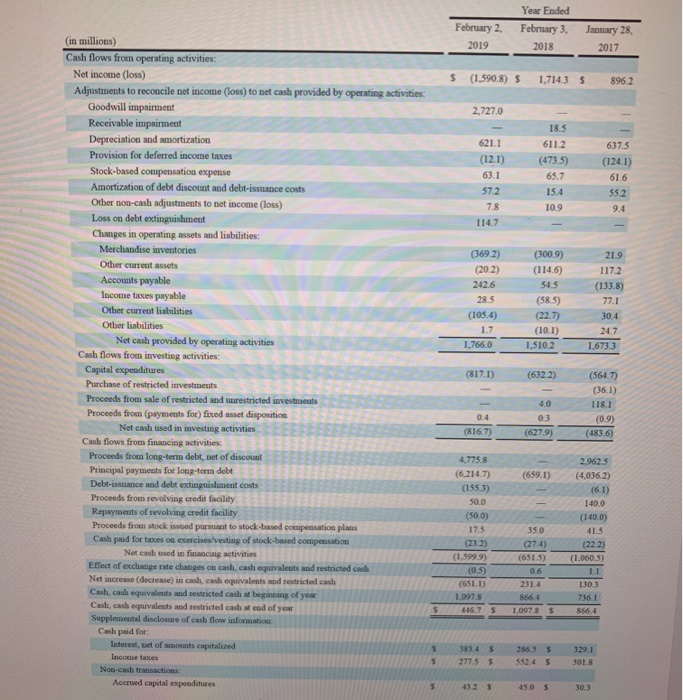

Make the Profitability ratio of 2015 for: Dollar General a) Make the Profitability ratio of 2016 for: Dollar General b) Make the Profitability Ratio calculation of 2017 for: Dollar General VS Dollar tree. c) Make the Profitability Ratio calculation of 2018 for: Dollar General vs Dollar tree. d) Dollar General (Amounts in millions, exclading per share data, Year Ended number of stores, selling square feet, and net sal les February 2 February 3, January 29, January 30, January 31. uare foot) 2018 Statement of Income Data: 23,471.0 S 21,986.6 $ 20.368.6S 18.909.6 $ 17,504.2 16.249.6 15.204.0 14,062.513.107112 068 7,221.4 Cost of goods sold Gross proft Selling, general and administrative 6,782.6 6.306.5 80212,068.4 5,213.5 2,007.8 97.0 4,719.2 4033.4 3.699.6 Operating profit Interest expense Other (income) expense Income before income taxes 2,063.4 1,736.2 1,907.3 1965.6 1,853.0 1,680.9 1,628.3 603.2 S 1,539.0 $ 1251.l $ 1,165.1 1,0653 s 10251 S 5.64 S 4.45 S3.96 S3.50 S 3.17 Income tax expense 368.3 687.9 Eamings per share-basic Eamings per share-diluted Dividends per share Statement of Cash Flows Data: Net cash provided by (used in): Operating activities Investing activities Financing activities Total capital expenditures Other Financial and Operating Data: Same store sales growth(2) Same store sales(2) Number of stores included in same store 4.43 s 1.802.1 s 1,605.0 s 1,391.7 S 1,3269 S 1244.1 (645.0) (550.9) 1.077.6) (1,024.1) (1,310.2) (560.3) (503.4) (250.0) (629.3) (538.4) (880.9) (374.0) (504.8) s 21,871.6 s 20348.1 S 19,2543 S 17,8187 s 16365.5 sales calculation Number of stores (at period end) Selling square feet (in thousands at period 11.706 11,052 10.387 14,534 13,320 107,821 s 227 S 229 S 226 S 223 S220 98,943 92,477 Net sales per square foot(3) Consumables sales 87.205 75.7 % 12.4 % 752 % 12.2 %)2.4 % Home products sales 12.9 % s 1,081.5$ 942.4 S 856.9 $ 7852 S 686.9 Balance Sheet Data (at period end): Cash and cash equivalents and short-term investments s 2674 $ 187.9 S 157.9 S 579.8 S s05.6 12,516.9 11,672.3 11,2579 11.208.6 3,006.0 Total assets Long-term debt(4) Total shareholders' equity 10,848.2 2970.6 6,125.8 5,406.3 The fiscal year ended February 3,2017 was comprised of 53 weeks 5,710.0 5.402.2 (1) Dollar Tree Year Ended February 2, February 3, January 28, (in millions, except per share data) 2019 2018 2017 Net sales s 22,823.3 22,245.5 20,7192 15,875.8 15,223.6 14,324.5 Cost of sales Gross proft Selling, general and administrative expenses, excluding Goodwill impairment and Receivable impairment Goodwill impairment 6,947.5 7.021.9 6,394.7 5,004.3 5,160.0 4,689.9 2,727.0 Receivable impairment Selling, general and administrative expenses Operating income (loss) 18.5 7,887.0 5,022.8 4,689.9 (939.5) 370.0 1,999.1 1,704.8 Interest expense, net 301.8 375.5 Other income, net (0.5) Income (loss) before income taxes ( i .3090) 1,704.0 1,329.4 Provision for income taxes 281.8 (10.3) 433.2 Net income (loss) S (1,590.8) S 1,714.3 896.2 Basic net income (loss) per share Diluted net income (loss) per share (6.69) S 7.24 $ 3.80 S(6.66) S 7.21 S See accompanying Notes to Consolidated Financial Statements Year Ended February 2, February 3, January 28, (in millions) 2018 2017 Net income (loss) s (1,590.8) S1,714.3 896.2 Foreign currency translation adjustments Total comprehensive income (loss) S (1.5968) S1,719.6 901.7 See accompanying Notes to Consolidated Financial Statements Year Ended February 2, February 3, January 28, (in millions) 2019 - 2018 2017 Cash flows from operating activities: Net income (loss) s (1.590.8) 1,7143 S896.2 Adjustments to reconcile net income (loss) to net cash provided by operating activities Goodwill impairment 2,727.0 18.5 Depreciation and amortization 621.1 611.2 637.5 Provision for deferred income taxes (12.1)(473.5) (124.1) Stock-based compensation expense 65.7 61.6 Amortization of debt discount and debt-issuance costs 57.2 15.4 55.2 Otber non-cash adjustments to net income (loss) 7.8 10.9 Loss on debt extinguishment Changes in operating assets and liabilities Merchandise nventories (369.2) 3009) (114.6) Other current assets (20.2) Accounts payable Income taxes payable 54.5 (133.8) 28.5 (58.5) (22.7) 30.4 Other current liabilities (105.4) Otber liabilities 24.7 Net cash provided by operating activities S102 1.766.0 1,673.3 Cash flows from investing activities: (817.) (6322) (564.7) Purchase of restricted investments Proceeds from sale of restricted and unrestricted investmeuts 4.0 118.1 Proceeds from (paymeuts for) fixed asset disposition (0.9) Net cash used in investing activities (816.7) (627.9) (483.6) Cash flows from financing activities Proceeds from long-term debt, net of discount Principal payments for long-terma debt Debt-issuance and debt extinguishment costs 4,775.8 (6214.7) (639.1) (4,036.2) Proceeds from revolving credit facility 50.0 140.0 Repayments of revolving credit facility Proceeds froem stock issbed parsuant to stock-based compensation plans Cash paid for taxes on exercises/vesting of stock-based compensation (50.0) (140.0) 17.5 35.0 41.5 (23.2) (274) (22.2) Net cash used in financing activities 1,399.9) (651.5) (1,060.5) Effect of exchange rate changes on cash, cash equivalents and restricted cash Net increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginsing of year Cash, cash equivalests and restricted cash at end of year (0.5) (651.1) 231.4 130.3 1097.8 36.1 866 4 4467 S1,097.8 $ 556.4 Cash paid for Interest, bet of amounts capitalized S 383 452865 $ 329.1 Income taxes 2775 55524 S 50L8 Noa-cash transactions Accrued capital expenditures S43 2 3450 S 30.3