Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MakeMeRich bank pays an average interest of 7% for its deposits and the bank receives 10% on average for its loans. Current size of

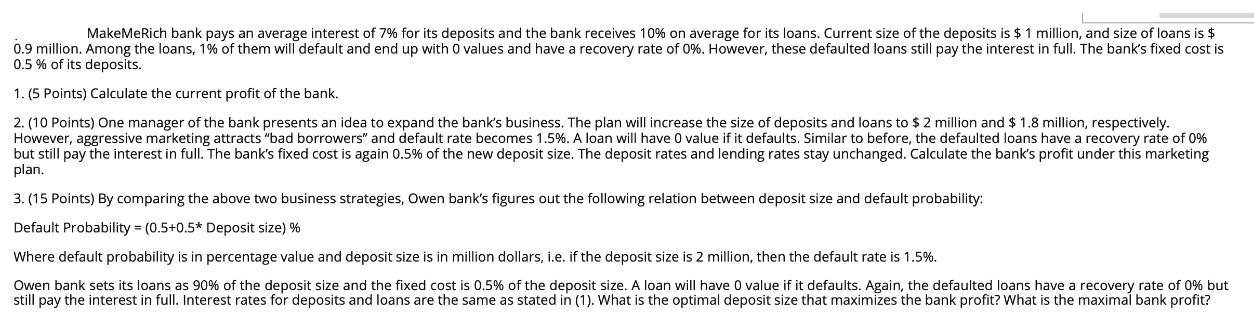

MakeMeRich bank pays an average interest of 7% for its deposits and the bank receives 10% on average for its loans. Current size of the deposits is $ 1 million, and size of loans is $ 0.9 million. Among the loans, 1% of them will default and end up with O values and have a recovery rate of 0%. However, these defaulted loans still pay the interest in full. The bank's fixed cost is 0.5% of its deposits. 1. (5 Points) Calculate the current profit of the bank. 2. (10 Points) One manager of the bank presents an idea to expand the bank's business. The plan will increase the size of deposits and loans to $ 2 million and $ 1.8 million, respectively. However, aggressive marketing attracts "bad borrowers" and default rate becomes 1.5%. A loan will have 0 value if it defaults. Similar to before, the defaulted loans have a recovery rate of 0% but still pay the interest in full. The bank's fixed cost is again 0.5% of the new deposit size. The deposit rates and lending rates stay unchanged. Calculate the bank's profit under this marketing plan. 3. (15 Points) By comparing the above two business strategies, Owen bank's figures out the following relation between deposit size and default probability: Default Probability = (0.5+0.5* Deposit size) % Where default probability is in percentage value and deposit size is in million dollars, i.e. if the deposit size is 2 million, then the default rate is 1.5%. Owen bank sets its loans as 90% of the deposit size and the fixed cost is 0.5% of the deposit size. A loan will have 0 value if it defaults. Again, the defaulted loans have a recovery rate of 0% but still pay the interest in full. Interest rates for deposits and loans are the same as stated in (1). What is the optimal deposit size that maximizes the bank profit? What is the maximal bank profit?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

MakeMeRich Bank Profit Analysis 1 Current Profit Interest earned on loans 10 09 million 90000 Intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started