Question

Making a capital budgeting decision is one of the most important policy decisions that a firm makes. A firm that does not invest in long-term

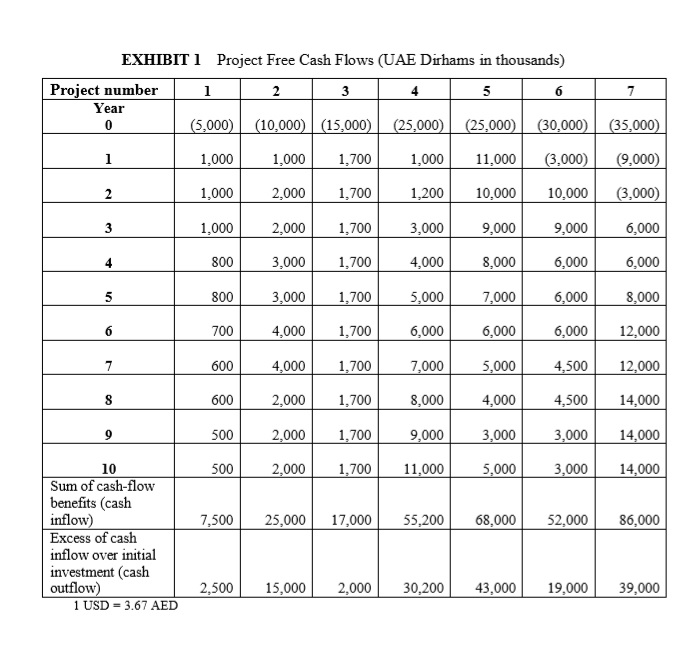

Making a capital budgeting decision is one of the most important policy decisions that a firm makes. A firm that does not invest in long-term investment projects does not maximize stakeholder wealth. Capital budgeting decisions determine the future of the company. An appropriate investment decision can yield spectacular returns. On the other hand, a misguided and incorrect decision can endanger the very survival of the firm. A few wrong decisions and the firm may be forced into bankruptcy. Capital budgeting decisions generally are either replacement decisions or expansion decisions. Replacement decisions are for purchasing of assets to replace existing assets that might be worn out, damaged or obsolete. Expansion decisions are made to add capital projects to the existing assets so as to produce either more of its existing products or entirely new products. Capital budgeting decisions are deciding which projects a firm should accept and which it should reject. Various capital budgeting techniques may be used to arrive at the most suitable decisions. A company in Dubai is considering investments in the seven projects listed in Exhibit 1. The company is approaching you asking you to rank the projects and recommend the three best that the company should accept. To keep it simple, you are required to consider only the quantitative factors for the selection of the projects. That is, no other project characteristics are relevant in the selection, except that management has determined that projects 4 and 5 are mutually exclusive. To guide your analysis, focus on the following questions:

a. Rank the projects simply by inspecting the cash flows (the excess of cash inflows over cash outflows).

b. Rank the projects using various quantitative methods. Assume that all projects are from the same risk class and the appropriate discount rate is 9%. Briefly explain the various methods, and specify which quantitative ranking methods are better and why?

c. Compare the ranking obtained by quantitative methods with the ranking obtained by simple inspection of the cash flows. Do they differ, explain the reasons for this?

d. Recommend the three best projects that the company should accept (Project 4 and Project 5 are mutually exclusive).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started