Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Making a payslip which amounts fall under taxable and non-taxable? design a monthly payslip including the given amounts to show how much it's the nett

Making a payslip

which amounts fall under taxable and non-taxable? design a monthly payslip including the given amounts to show how much it's the nett monthly earning.

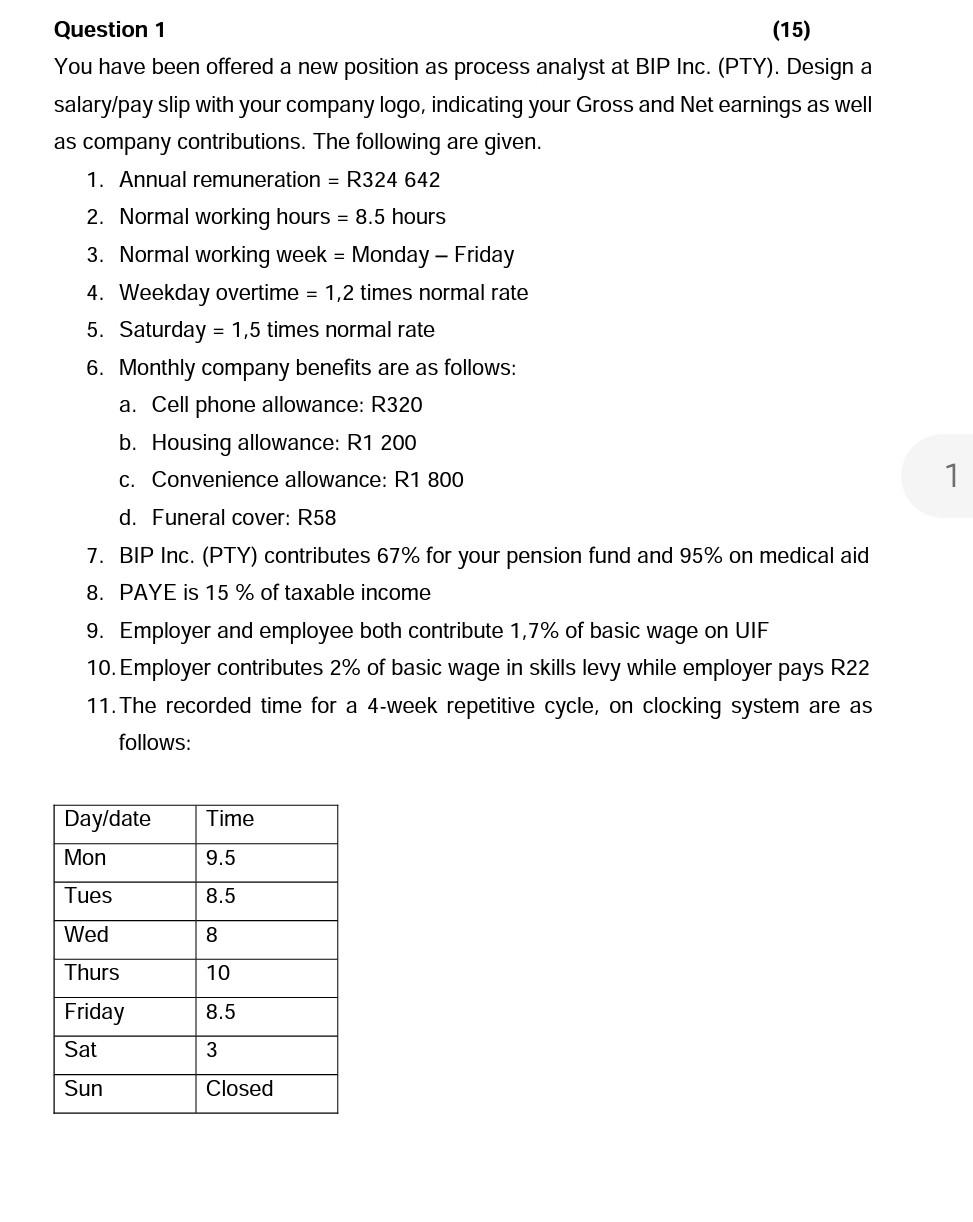

You have been offered a new position as process analyst at BIP Inc. (PTY). Design a salary/pay slip with your company logo, indicating your Gross and Net earnings as well as company contributions. The following are given. 1. Annual remuneration =R324642 2. Normal working hours =8.5 hours 3. Normal working week = Monday Friday 4. Weekday overtime =1,2 times normal rate 5. Saturday =1,5 times normal rate 6. Monthly company benefits are as follows: a. Cell phone allowance: R320 b. Housing allowance: R1 200 c. Convenience allowance: R1 800 d. Funeral cover: R58 7. BIP Inc. (PTY) contributes 67% for your pension fund and 95% on medical aid 8. PAYE is 15% of taxable income 9. Employer and employee both contribute 1,7\% of basic wage on UIF 10. Employer contributes 2% of basic wage in skills levy while employer pays R22 11. The recorded time for a 4-week repetitive cycle, on clocking system are as follows: You have been offered a new position as process analyst at BIP Inc. (PTY). Design a salary/pay slip with your company logo, indicating your Gross and Net earnings as well as company contributions. The following are given. 1. Annual remuneration =R324642 2. Normal working hours =8.5 hours 3. Normal working week = Monday Friday 4. Weekday overtime =1,2 times normal rate 5. Saturday =1,5 times normal rate 6. Monthly company benefits are as follows: a. Cell phone allowance: R320 b. Housing allowance: R1 200 c. Convenience allowance: R1 800 d. Funeral cover: R58 7. BIP Inc. (PTY) contributes 67% for your pension fund and 95% on medical aid 8. PAYE is 15% of taxable income 9. Employer and employee both contribute 1,7\% of basic wage on UIF 10. Employer contributes 2% of basic wage in skills levy while employer pays R22 11. The recorded time for a 4-week repetitive cycle, on clocking system are as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started